Rosetta Stone 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

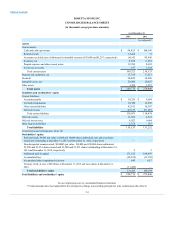

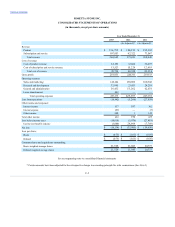

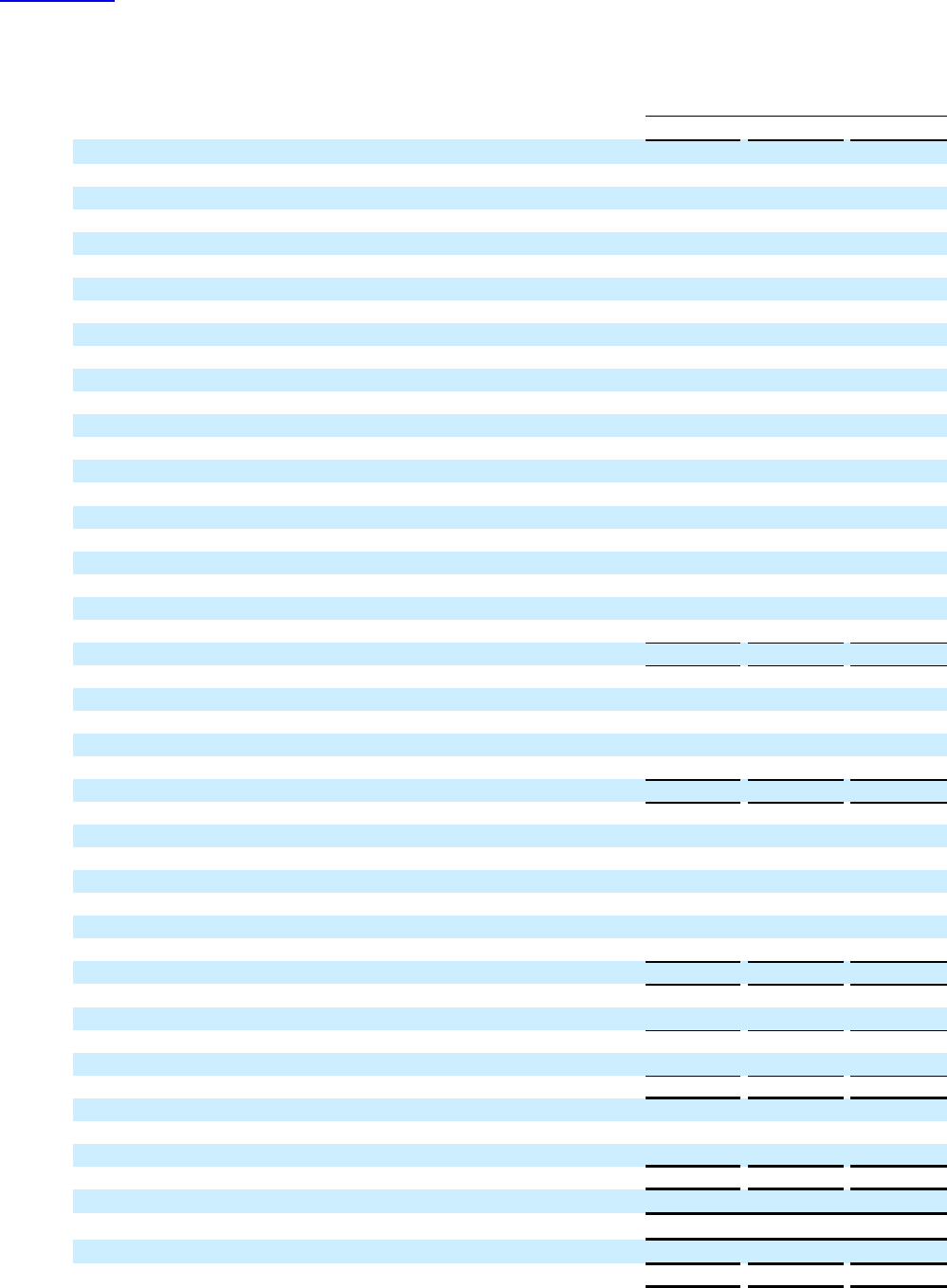

(As Adjusted)*

(As Adjusted)*

Net loss

$(16,134)

$(33,985)

$(19,650)

Adjustments to reconcile net loss to cash provided by operating activities:

Stock-based compensation expense

9,241

8,009

12,353

Bad debt expense

1,420

1,820

1,228

Depreciation and amortization

9,635

8,077

8,724

Deferred income tax (benefit) expense

(3,869)

25,953

(1,086)

Loss on disposal of equipment

278

783

318

Net change in:

Restricted cash

(37)

1

11

Accounts receivable

(9,477)

309

(5,058)

Inventory

(108)

185

3,168

Prepaid expenses and other current assets

(3,511)

1,165

110

Income tax receivable

827

6,515

(5,812)

Other assets

(1,680)

166

(25)

Accounts payable

3,702

(1,240)

(447)

Accrued compensation

(897)

5,093

1,200

Other current liabilities

4,250

635

3,979

Excess tax benefit from stock options exercised

—

—

(365)

Other long term liabilities

481

(99)

(52)

Deferred revenue

13,947

11,514

4,777

Net cash provided by operating activities

8,068

34,901

3,373

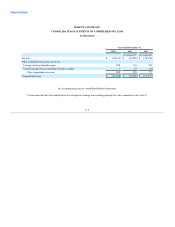

Purchases of property and equipment

(8,941)

(4,187)

(9,940)

Proceeds from sales (purchases) of available-for-sale securities

—

9,711

(3,301)

Increase in restricted cash related to Vivity Labs acquisition

(12,314)

—

—

Acquisitions, net of cash acquired

(25,675)

—

(75)

Net cash (used in) provided by investing activities

(46,930)

5,524

(13,316)

Proceeds from the exercise of stock options

2,457

862

800

Repurchase of shares from exercised stock options

(1,040)

—

—

Purchase of treasury stock

(11,435)

—

—

Tax benefit of stock options exercised

—

—

365

Proceeds from equity offering, net of issuance costs

(228)

—

—

Payments under capital lease obligations

(241)

(215)

(285)

Net cash (used in) provided by financing activities

(10,487)

647

880

(Decrease) increase in cash and cash equivalents

(49,349)

41,072

(9,063)

Effect of exchange rate changes in cash and cash equivalents

(16)

602

(177)

Net (decrease) increase in cash and cash equivalents

(49,365)

41,674

(9,240)

Cash and cash equivalents—beginning of year

148,190

106,516

115,756

Cash and cash equivalents—end of year

$98,825

$148,190

$106,516

Cash paid during the periods for:

Interest

$18

$—

$5

Income taxes

$3,290

$ 4,040

$1,683

Noncash financing and investing activities:

Accrued purchase price of business acquisition

$3,375

$—

$—

Accrued liability for purchase of property and equipment

$192

$1,228

$204

Equipment acquired under capital lease

$702

$—

$ 16

See accompanying notes to consolidated financial statements

* Certain amounts have been adjusted for the retrospective change in accounting principle for sales commissions (See Note 3)