Rosetta Stone 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

mobile. We also intend to restructure operations to optimize research and development initiatives. As a result of these initiatives, we expect an increase in

research and development expense in 2013.

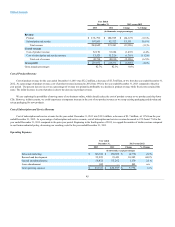

General and Administrative Expenses

General and administrative expenses for the year ended December 31, 2012 were $55.3 million, a decrease of $6.8 million, or 11%, from the year ended

December 31, 2011. As a percentage of revenue, general and administrative expenses decreased to 20% for the year ended December 31, 2012 compared to 23%

for year ended December 31, 2011. The dollar and percentage decreases were primarily attributable to a $4.2 million decrease in consulting expenses, a

$2.7 million decrease in personnel-related expenses, $0.9 million decrease in hardware and software upgrades, hosting, and telephone expenses related to

investment in our technology infrastructure and cost realignment initiatives during the prior year period and a $0.9 million decrease in depreciation expense

related to certain fixed assets being fully depreciated early in the second quarter of 2012. These decreases were partially offset by a $1.3 million increase in

outside legal expenses in connection with our Google lawsuit and a $0.7 million increase in VAT expenses. During 2012, we took additional steps to reduce

certain general and administrative expenses as well as realign our cost structure to help fund investments in areas of growth. We expect there to be increases in

general and administrative expenses to support our expansion into international markets in 2013.

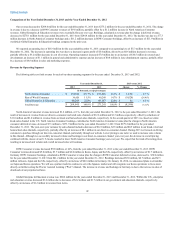

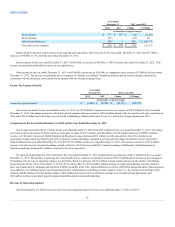

Stock-Based Compensation

As a result of the loss of the incentive and retentive value of the Long Term Incentive Plan ("LTIP"), on November 30, 2011 the board of directors

cancelled the LTIP resulting in the recognition of a non-cash charge of $4.9 million, which is included in each of the respective operating expense lines for the

year ended December 31, 2011 as follows, $0.8 million in sales and marketing, $1.1 million in research and development, and $4.0 million in general and

administrative. There were no shares issued from the LTIP to any executive prior to its cancellation. Total stock-based compensation by expense line item is as

follows:

Cost of revenue

$ 288

$55

$233

424 %

Sales and marketing

1,185

1,932

(747)

(39)%

Research and development

1,547

2,448

(901)

(37)%

General and administrative

4,989

7,918

(2,929)

(37)%

Total

$ 8,009

$ 12,353

$(4,344)

(35)%

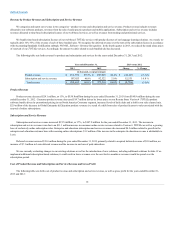

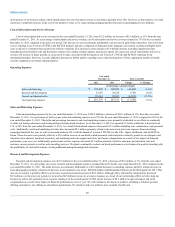

Interest and Other Income (Expense)

Interest Income

$ 187

$302

$(115)

(38.1)%

Interest Expense

—

(5)

5

100.0 %

Other Income (Expense)

3

142

(139)

(97.9)%

Total other income (expense)

$ 190

$439

$(249)

(56.7)%

Interest income represents interest earned on our cash, cash equivalents, and short-term investments. Interest income for the year ended December 31,

2012 was $187,000, a decrease of $115,000, or 38%, from the year ended December 31, 2011.

Interest expense is primarily related to our capital leases. Interest expense for the year ended December 31, 2012 was zero, a decrease of $5,000 or 100%,

from the year ended December 31, 2011. We expect interest expense to be minimal in future periods as we allowed the revolving line of credit with Wells Fargo

to expire on January 17, 2011.

Other income for the year ended December 31, 2012 was $3,000 as compared to other income of $142,000 for the year ended December 30, 2011, a

decrease of $139,000 or 98%. The decrease was primarily due to foreign exchange losses partially offset by an increase in legal settlements in connection with

our anti-piracy enforcement efforts.

51