Rosetta Stone 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

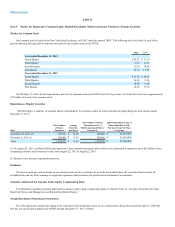

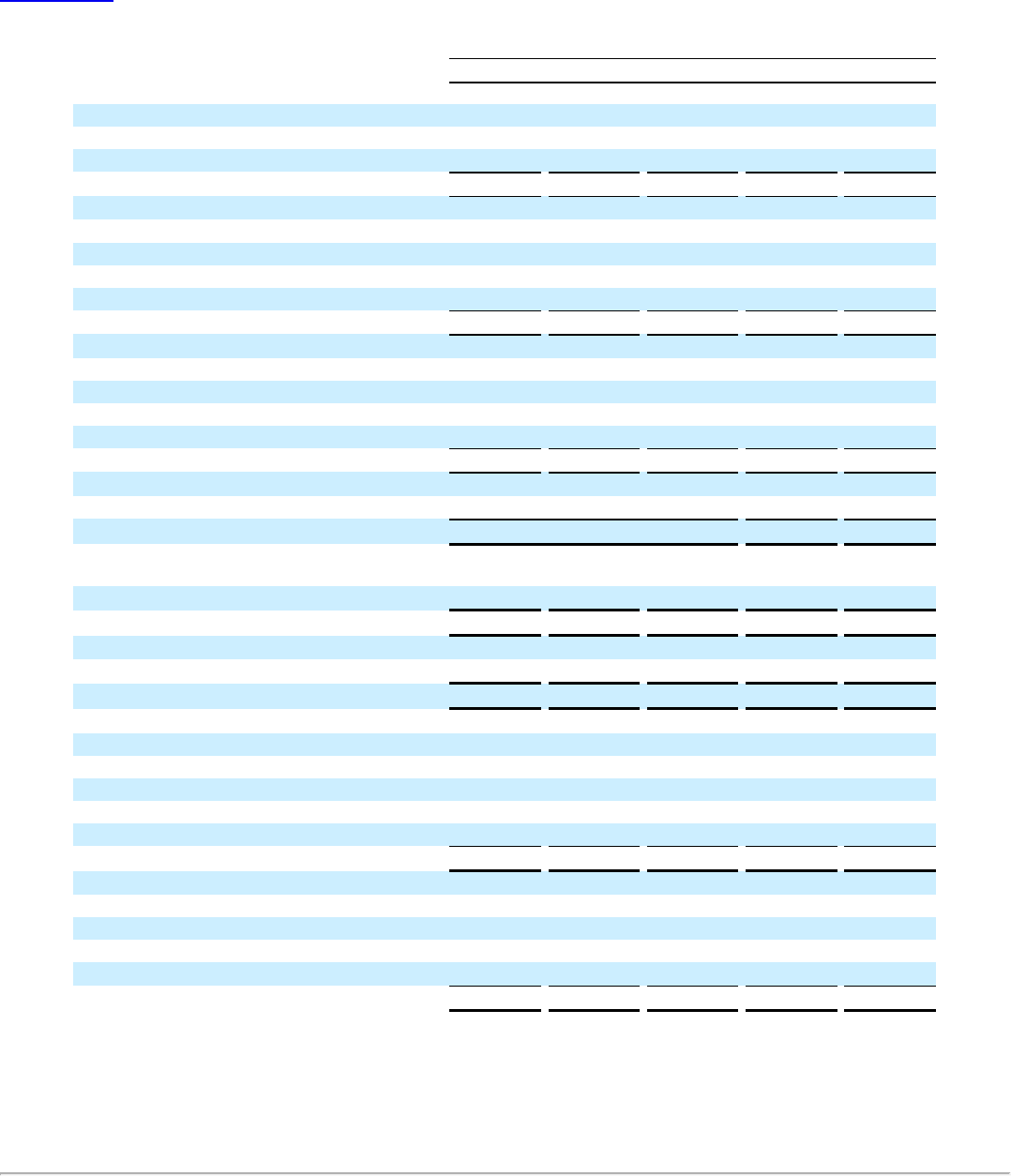

Revenue

$264,645

$273,241

$268,449

258,868

$252,271

Cost of revenue

45,714

48,910

49,116

38,999

33,427

Gross profit

218,931

224,331

219,333

219,869

218,844

Operating expenses:

Sales and marketing

146,104

150,882

160,942

130,335

115,108

Research and development

33,995

23,453

24,218

23,437

26,239

General and administrative

56,432

55,262

62,031

53,239

57,182

Lease abandonment

842

—

—

(583)

(8)

Total operating expenses

237,373

229,597

247,191

206,428

198,521

Income (loss) from operations

(18,442)

(5,266)

(27,858)

13,441

20,323

Other income and expense:

Interest income

117

187

302

262

159

Interest expense

(61)

—

(5)

(66)

(356)

Other (expense) income

368

3

142

(220)

112

Interest and other income (expense), net

424

190

439

(24)

(85)

Income (loss) before income taxes

(18,018)

(5,076)

(27,419)

13,417

20,238

Income tax expense (benefit)

(1,884)

28,909

(7,769)

(178)

7,010

Income (loss) attributable to common stockholders

(16,134)

(33,985)

(19,650)

13,595

$ 13,228

Income (loss) per share attributable to common

stockholders:

Basic

$(0.75)

$ (1.61)

$ (0.95)

0.67

$0.88

Diluted

$(0.75)

$ (1.61)

$ (0.95)

0.64

$0.66

Common shares and equivalents outstanding:

Basic weighted average shares

21,528

21,045

20,773

20,439

14,990

Diluted weighted average shares

21,528

21,045

20,773

21,187

19,930

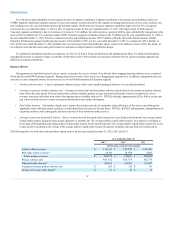

Cost of revenue

$175

$ 288

$55

$ 39

$34

Sales and marketing

1,840

1,185

1,932

774

999

Research and development

1,460

1,547

2,448

1,181

5,959

General and administrative

5,766

4,989

7,918

2,393

15,158

Total stock-based compensation expense

$9,241

$ 8,009

$ 12,353

$4,387

$22,150

Cost of revenue

$244

$ —

$ —

$ —

$ —

Sales and marketing

1,028

—

45

58

42

Research and development

550

40

40

—

—

General and administrative

—

—

—

—

—

Total intangible amortization expense

$1,822

$40

$85

$58

$42

_______________________________________________________________________________

(1) As discussed in Note 5, the Company acquired Livemocha, Inc. on April 1, 2013 and acquired Lexia Learning Systems, Inc. on August 1, 2013.

The results of operations from these entities have been included from the acquisition date.

(2) As discussed in Note 15, the Company established a full valuation allowance to reduce the deferred tax assets of the Korea, Brazil, and Japan

subsidiaries and the U.S.

30