Rosetta Stone 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

year ended December 31, 2013 was primarily due to the purchase of our own common stock as treasury stock of $11.4 million, and net cash provided of

$1.4 million from the exercise and repurchase of shares from exercised stock options.

We believe our current cash and cash equivalents, short term investments and funds generated from our operations will be sufficient to meet our

working capital and capital expenditure requirements through the foreseeable future, including at least the next 12 months. Thereafter, we may need to raise

additional funds through public or private financings or borrowings to develop or enhance products, to fund expansion, to respond to competitive pressures or

to acquire complementary products, businesses or technologies. If required, additional financing may not be available on terms that are favorable to us, if at

all. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders will be reduced and

these securities might have rights, preferences and privileges senior to those of our current stockholders. No assurance can be given that additional financing

will be available or that, if available, such financing can be obtained on terms favorable to our stockholders and us.

During the last three years, inflation has not had a material effect on our business and we do not expect that inflation or changing prices will materially

affect our business in the foreseeable future.

Off-Balance Sheet Arrangements

We do not engage in any off-balance sheet financing arrangements. We do not have any interest in entities referred to as variable interest entities, which

include special purpose entities and other structured finance entities.

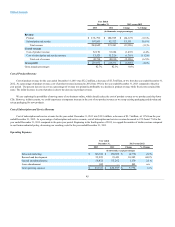

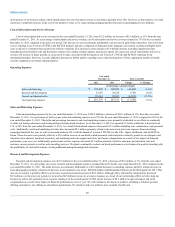

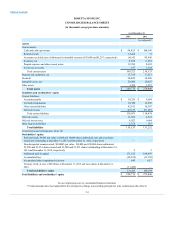

Contractual Obligations

The following table summarizes our contractual obligations at December 31, 2013 and the effect such obligations are expected to have on our liquidity

and cash flow in future periods.

Contractual obligations

$23,896

$ 6,342

$9,488

$8,066

$ —

The operating lease obligations reflected in the table above include our corporate office leases.

Recent Accounting Pronouncements

In July 2012, the Financial Accounting Standards Board (“FASB”) issued new guidance on the impairment testing of indefinite-lived intangible assets

(Accounting Standards Update (“ASU”) 2012-02, (Topic 350): Testing Indefinite-Lived Intangible Assets for

Impairment), effective for calendar years beginning after September 15, 2012. Early adoption is permitted. The objective of this standard update is to simplify

how an entity tests indefinite-lived intangible assets for impairment. The amendments in this standard will allow an entity to first assess qualitative factors to

determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform the

quantitative impairment test. Only if an entity determines, based on qualitative assessment, that it is more likely than not that the indefinite-lived intangible

asset is impaired will it be required to determine the fair value of the indefinite-lived intangible asset and perform the quantitative impairment test. The

Company adopted this guidance beginning in fiscal year 2013, and the adoption of such guidance did not have a material impact on the Company’s reported

results of operations or financial position.

In February 2013, the FASB issued ASU No. 2013-02,

(“ASU 2013-02”), which requires disclosure of significant amounts reclassified out of accumulated other comprehensive

income by component and their corresponding effect on the respective line items of net income. The Company adopted this guidance beginning in fiscal year

2013, and the adoption of such guidance did not have a material impact on the presentation of the Company’s reported results of operations or financial

position.

In July 2013, the FASB issued ASU No. 2013-11

(“ASU 2013-11”), which requires that an unrecognized tax benefit be

presented in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward,

except for a situation in which some or all of such net operating loss carryforward, a similar loss, or a tax credit carryforward is not available at the reporting

date under the tax law of the applicable tax jurisdiction to settle any additional income taxes that would result from the disallowance of a tax position or the tax

law of the applicable jurisdiction does not require the entity to use, and the entity does not intend to use, the

53