Rosetta Stone 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

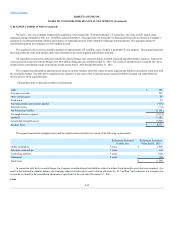

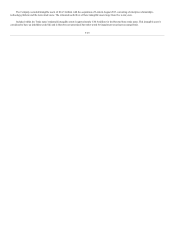

In the third quarter of 2013, the Company voluntarily changed its accounting policy for sales commissions related to non-cancellable Software-as-a-

Service (“SaaS”) contracts, from recording an expense when incurred, to deferral of the sales commission in proportion to the consideration allocated to each of

the elements in the arrangement and in, or over, the same period the revenue is recognized for each of the elements in the arrangement (i.e. over the non-

cancellable term of the contract for the SaaS deliverable). The Company is anticipating a significant increase in contracts with multi-year subscriptions and a

corresponding increase in sales commissions due, among other reasons, to its acquisition of Lexia Learning Systems, Inc. (“Lexia”) in August 2013. Lexia

provides services using a SaaS model and has historically had long-term arrangements with material sales commissions paid to its network of resellers and

has applied a sales commission deferral and amortization policy.

The Company believes the deferral method described above is preferable primarily because (i) the sales commission charges are so closely related to

obtaining the revenue from the non-cancellable contracts that they should be deferred and charged to expense over the same period that the related revenue is

recognized; and (ii) it provides a single accounting policy, consistent with that used by Lexia, that makes it easier for financial statement users to understand.

Deferred commission amounts are recoverable through the future revenue streams under the non-cancellable arrangements.

Short-term deferred commissions are included in prepaid expenses and other current assets, while long-term deferred commissions are included in other

assets in the accompanying consolidated balance sheets. The amortization of deferred commissions is included in sales and marketing expense in the

accompanying consolidated statements of operations.

The accompanying consolidated financial statements and related notes have been adjusted to reflect the impact of this change and the associated deferred

tax impact retrospectively to all prior periods. Under the as previously reported basis, there was no book / tax basis difference related to commission expense.

Under the as adjusted basis, the deferred commission asset creates a deferred tax liability related to commissions expense which has been deducted for tax

purposes.

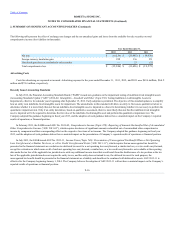

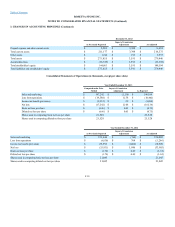

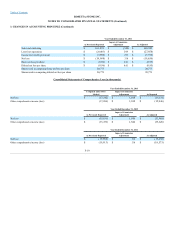

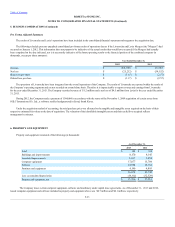

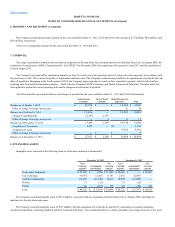

The following tables present the effects of the retrospective application of the voluntary change in accounting principle for sales commissions related to

non-cancellable SaaS contracts for all periods presented, effective as of January 1, 2011 (in thousands):

Prepaid expense and other current assets $ 7,707

$4,587

$12,294

Total current assets $ 186,134

$4,587

$190,721

Other assets $3,111

$113

$3,224

Total assets $286,076

$4,700

290,776

Accumulated loss $ (33,992)

$4,700

$(29,292)

Total stockholders' equity $126,543

$4,700

$131,243

Total liabilities and stockholders' equity $286,076

$4,700

$290,776

F-17