Rosetta Stone 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

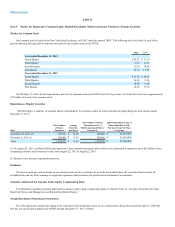

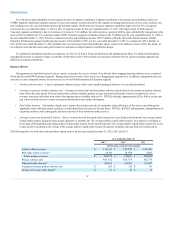

(3) As discussed in Note 11, on January 4, 2011 the Company's Board of Directors approved the Rosetta Stone Inc. Long Term Incentive Program

("LTIP") and then subsequently cancelled the LTIP on November 30, 2011, resulting in $4.9 million additional operating expense.

(4) In April 2009 shares of common stock were awarded to key employees as part of the IPO resulting in $18.8 million of additional operating expense.

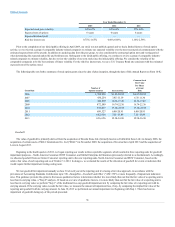

Cash and cash equivalents

$98,825

$ 148,190

$106,516

$115,756

$95,188

Total assets

290,776

279,446

280,059

278,804

227,228

Deferred revenue

78,857

63,416

51,895

47,158

26,106

Notes payable and capital lease obligation

242

5

12

—

—

Total stockholders' equity

$131,243

$ 148,194

$172,951

$179,724

$157,531

Rosetta Stone Inc. (“Rosetta Stone,” “the Company,” “we” or “us”) is dedicated to changing the way the world learns. Our innovative, technology-driven

language-learning solutions have been purchased by millions of individuals and used by thousands of schools, businesses, and government organizations

around the world. Founded in 1992, Rosetta Stone pioneered the use of interactive software to accelerate language learning. Today we offer courses in 30

languages across a broad range of formats, including online subscriptions, digital downloads, mobile apps, and perpetual CD-Rom packages. Rosetta Stone

has invested more in language learning and expanded beyond language learning and deeper into education-technology with its acquisitions of Livemocha Inc.

("Livemocha") and Lexia Learning Systems Inc, ("Lexia") in 2013 and Vivity Labs, Inc. ("Vivity""), and Tell Me More S.A. ("Tell Me More") in January

2014.

We derive our revenues from sales to both individual consumers and organizations. Our global consumer distribution model comprises a mix of our call

centers, websites, third party e-commerce websites such as Digital River and Apple iTunes, select retail resellers, such as Amazon.com, Barnes & Noble,

Target, Best Buy, Books-a-Million, Staples, Costco, daily deal partners such as Groupon, home shopping networks such as GS Home Shopping in Korea

and consignment distributors such as Speed Commerce and third-party resellers of Lexia solutions. Our Global Enterprise & Education distribution model is

focused on targeted sales activity primarily through a direct sales force in five markets: K-12 schools; colleges and universities; federal government agencies;

corporations; and not-for-profit organizations.

Rosetta Stone’s management team has communicated a strategic business plan designed to guide the Company through 2015. The key areas of focus

are:

1. leveraging the brand;

2. innovating the platform; and

3. expanding distribution.

In pursuing these priorities, we plan to grow the business by continuing to invest in research and development of new products while focusing on

maintaining costs and margins at appropriate levels.

During 2012, we instituted a change in our chief operating decision maker ("CODM"), which led to a fourth quarter change to what our CODM uses to

measure profitability and allocate resources. Accordingly, beginning with the fourth quarter of 2012, we have three operating segments, North America

Consumer, Rest of World ("ROW") Consumer and Global Enterprise & Education. From the first quarter of 2011 through the third quarter of 2012, we had

two operating segments, Consumer and Global Enterprise & Education. Prior to 2011 we operated as a single segment.

31