Rosetta Stone 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

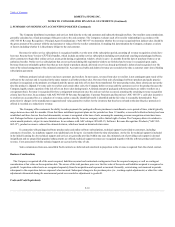

Rosetta Stone Inc. and its subsidiaries ("Rosetta Stone," or the "Company") develop, market and support a suite of language and reading learning

solutions consisting of software products, online services, audio practice tools and mobile applications under the Rosetta Stone, Livemocha and Lexia brand

names. The Company's software products are sold on a direct basis and through select retailers. The Company provides its software applications to customers

through the sale of packaged software and online subscriptions, domestically and in certain international markets. Following the Company's acquisitions in

January 2014, of Vivity Labs, Inc. and Tell Me More S.A. (see Footnote 20, Subsequent Events), the Company also sells Vivity's brain fitness mobile

applications and Tell Me More language learning solutions.

The accompanying consolidated financial statements include the accounts of Rosetta Stone Inc. and its wholly owned subsidiaries. All intercompany

accounts and transactions have been eliminated in consolidation. Certain numbers in the prior period consolidated financial statements have been reclassified

to conform to the current period presentation.

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires that

management make certain estimates and assumptions. Significant estimates and assumptions have been made regarding the allowance for doubtful accounts,

estimated sales returns, stock-based compensation, fair value of intangibles and goodwill, inventory reserve, disclosure of contingent assets and liabilities,

disclosure of contingent litigation, and allowance for valuation of deferred tax assets. Actual results may differ from these estimates.

The Company's primary sources of revenue are online subscriptions, software and bundles of software and online subscriptions. The Company

also generates revenue from the sale of audio practice products and training and implementation services. Revenue is recognized when all of the following

criteria are met: there is persuasive evidence of an arrangement; the product has been delivered or services have been rendered; the fee is fixed or determinable;

and collectability is reasonably assured. Revenues are recorded net of discounts.

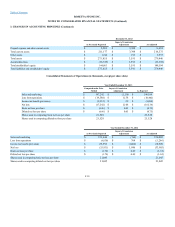

The Company identifies the units of accounting contained within our sales arrangements in accordance with ASC 605-25 Revenue Recognition -

Multiple Element Arrangements (“ASC 605-25”). In doing so, the Company evaluates a variety of factors including whether the undelivered element(s) have

value to the customer on a stand-alone basis or if the undelivered element(s) could be sold by another vendor on a stand-alone basis.

For multiple element arrangements that contain software products and related services, the Company allocates the total arrangement consideration to

all deliverables based on vendor-specific objective evidence of fair value, or VSOE, in accordance with ASC subtopic 985-605-25 Software: Revenue

Recognition-Multiple-Element Arrangements ("ASC 985-605-25"). The Company generates a substantial portion of its consumer revenue from Rosetta Stone

Version 4 which is a multi-element arrangement that includes perpetual software bundled with the subscription and conversational coaching

components of the Company's online service. The Company has identified two deliverables generally contained in Rosetta Stone V4

software arrangements. The first deliverable is the perpetual software, which is delivered at the time of sale, and the second deliverable is the subscription

service. The Company allocates revenue between these two deliverables using the residual method based on the existence of VSOE of the subscription service.

In the U.S., the Company offers consumers who purchase packaged software and audio practice products directly from the Company a 30-day,

unconditional, full money-back refund. The Company also permits some of our retailers and distributors to return packaged products, subject to certain

limitations. The Company establishes revenue reserves for packaged product returns based on historical experience, estimated channel inventory levels, the

timing of new product introductions and other factors.

For non-software multiple element arrangements the Company allocates revenue to all deliverables based on their relative selling prices.

F-9