Rosetta Stone 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

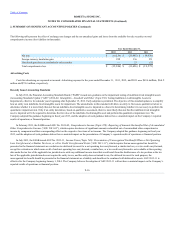

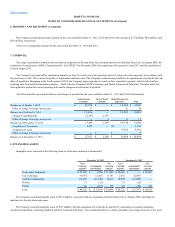

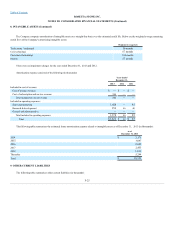

The Company recorded depreciation expense for the years ended December 31, 2013, 2012 and 2011 in the amount of $7.8 million, $8.0 million, and

$8.6 million, respectively.

There were no impairment charges for the years ended December 31, 2013 and 2012.

The value of goodwill is primarily derived from the acquisition of Rosetta Stone Ltd. (formerly known as Fairfield & Sons, Ltd.) in January 2006, the

acquisition of certain assets of SGLC International Co. Ltd ("SGLC") in November 2009, the acquisition of Livemocha in April 2013 and the acquisition of

Lexia in August 2013.

The Company tests goodwill for impairment annually on June 30 of each year at the reporting unit level using a fair value approach, in accordance with

the provisions of ASC 350, or more frequently, if impairment indicators arise. The Company's annual testing resulted in no impairments of goodwill since the

dates of acquisition. Beginning in the fourth quarter of 2012, the Company began reporting its results in three reportable segments, which resulted in three

reporting units for goodwill impairment purposes—North America Consumer, ROW Consumer, and Global Enterprise & Education. The table below has

been updated to present the current reporting units and the change in the allocation of goodwill.

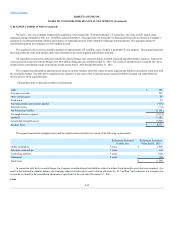

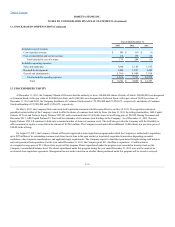

The following table represents the balance and changes in goodwill for the years ended December 31, 2013 and 2012 (in thousands):

Balance as of January 1, 2012

$15,679

$ —

$19,162

$34,841

Effect of change in foreign currency rate

17

—

23

40

Balance as of October 30, 2012

15,696

—

19,185

34,881

Change in reporting units

(2,197)

2,197

—

—

Effect of change in foreign currency rate

—

2

13

15

Balance as of December 31, 2012

13,499

2,199

19,198

34,896

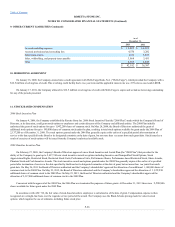

Acquisition of Livemocha

4,472

—

720

5,192

Acquisition of Lexia

—

—

9,962

9,962

Effect of change in foreign currency rate

—

1

8

9

Balance as of December 31, 2013

$17,971

$2,200

$29,888

$50,059

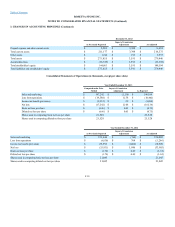

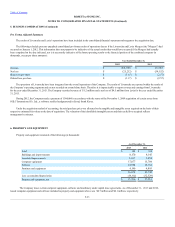

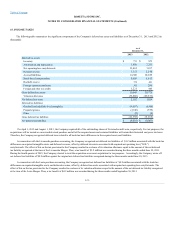

Intangible assets consisted of the following items as of the dates indicated (in thousands):

Trade name/ trademark

$11,807

$ (158)

$11,649

$ 10,607

$ —

$ 10,607

Core technology

9,954

(3,207)

6,747

2,453

(2,453)

—

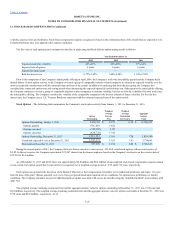

Customer relationships

22,152

(11,720)

10,432

10,850

(10,850)

—

Website

12

(12)

—

12

(12)

—

Patents

300

(122)

178

300

(82)

218

Total

$ 44,225

$(15,219)

$29,006

$ 24,222

$(13,397)

$10,825

The Company recorded intangible assets of $23.8 million, associated with the acquisition of Rosetta Stone Ltd. in January 2006, including our

indefinite-live Rosetta Stone trade name.

The Company recorded intangible assets of $5.5 million with the acquisition of Livemocha in April 2013, consisting of an online community,

enterprise relationships, technology platform and the Livemocha trade name. The estimated useful lives of these intangible assets range from two to five years.