Rosetta Stone 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

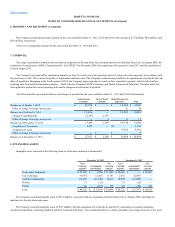

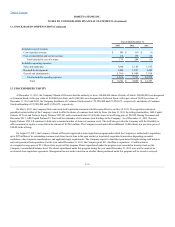

December 31, 2013, options that were vested and exercisable totaled 817,870 shares of common stock with a weighted average exercise price per share of

$13.94.

The weighted average grant-date fair value per share of stock options granted was $8.88 and $5.94 for the years ended December 31, 2013 and 2012,

respectively.

The aggregate intrinsic value disclosed above represents the total intrinsic value (the difference between the fair market value of the Company's common

stock as of December 31, 2013, and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders

had all option holders exercised their options on December 31, 2013. This amount is subject to change based on changes to the fair market value of the

Company's common stock.

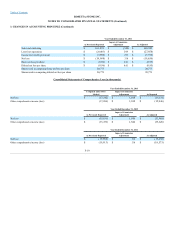

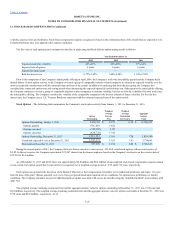

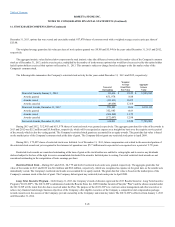

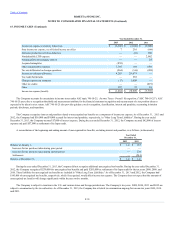

The following table summarizes the Company's restricted stock activity for the years ended December 31, 2013 and 2012, respectively:

Nonvested Awards, January 1, 2012

323,010

$ 18.22

$5,885,242

Awards granted

651,978

8.88

Awards vested

(133,831)

16.85

Awards canceled

(83,054)

12.68

Nonvested Awards, December 31, 2012

758,103

11.00

8,339,133

Awards granted

352,985

14.83

Awards vested

(304,560)

11.72

Awards canceled

(172,497)

12.88

Nonvested Awards, December 31, 2013

634,031

12.28

7,785,901

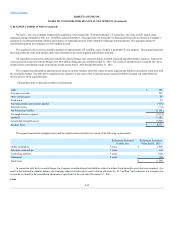

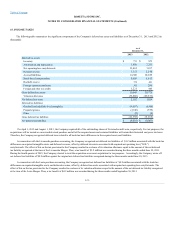

During 2013 and 2012, 352,985 and 651,978 shares of restricted stock were granted, respectively. The aggregate grant date fair value of the awards in

2013 and 2012 was $5.2 million and $5.8 million, respectively, which will be recognized as expense on a straight-line basis over the requisite service period

of the awards, which is also the vesting period. The Company's restricted stock grants are accounted for as equity awards. The grant date fair value is based

on the market price of the Company's common stock at the date of grant. The Company did not grant any restricted stock prior to April 2009.

During 2013, 172,497 shares of restricted stock were forfeited. As of December 31, 2013, future compensation cost related to the nonvested portion of

the restricted stock awards not yet recognized in the statement of operations was $5.7 million and is expected to be recognized over a period of 2.78 years.

Restricted stock awards are considered outstanding at the time of grant as the stock holders are entitled to voting rights and to receive any dividends

declared subject to the loss of the right to receive accumulated dividends if the award is forfeited prior to vesting. Unvested restricted stock awards are not

considered outstanding in the computation of basic earnings per share.

Restricted Stock Units—During 2013 and 2012, 24,779 and 44,241 restricted stock units were granted, respectively. The aggregate grant date fair

value of the awards in 2013 and 2012 was $0.4 million and $0.6 million, respectively, which was recognized as expense on the grant date, as the awards were

immediately vested. The Company's restricted stock units are accounted for as equity awards. The grant date fair value is based on the market price of the

Company's common stock at the date of grant. The Company did not grant any restricted stock units prior to April 2009.

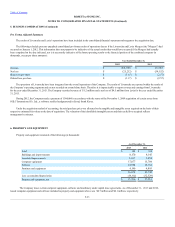

Long Term Incentive Program—On February 21, 2013, the Company’s board of directors approved the 2013 Rosetta Stone Inc. Long Term Incentive

Program (“2013 LTIP”). The 2013 LTIP is administered under the Rosetta Stone Inc. 2009 Omnibus Incentive Plan (the “Plan”) and the shares awarded under

the 2013 LTIP will be taken from the shares reserved under the Plan. The purpose of the 2013 LTIP is to: motivate senior management and other executives to

achieve key financial and strategic business objectives of the Company; offer eligible executives of the Company a competitive total compensation package;

reward executives in the success of the Company; provide ownership in the Company; and retain key talent. The 2013 LTIP is effective from January 1, 2013

until December 31, 2014.

F-28