Rosetta Stone 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

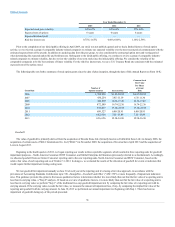

Revenue by Product Revenue and Subscription and Service Revenue

We categorize and report our revenue in two categories—product revenue and subscription and service revenue. Product revenue includes revenues

allocated to our software products, revenues from the sale of audio practice products and mobile applications. Subscription and service revenue includes

revenues allocated to time-based subscription licenses of our web-based services, as well as revenues from training and professional services.

We bundle time-based subscription licenses of our web-based services with product licenses of our language-learning solutions. As a result, we

typically defer 10%-35% of the revenue of each of these bundled sales. We recognize the deferred revenue over the term of the subscription license in accordance

with Accounting Standards Codification subtopic 985-605, In the fourth quarter in 2013, we reduced the stand alone prices

of renewals of our services. Accordingly, the amount we defer related to each bundled sale has decreased.

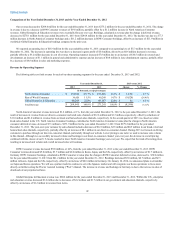

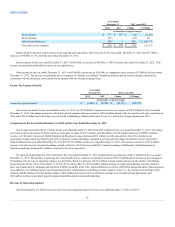

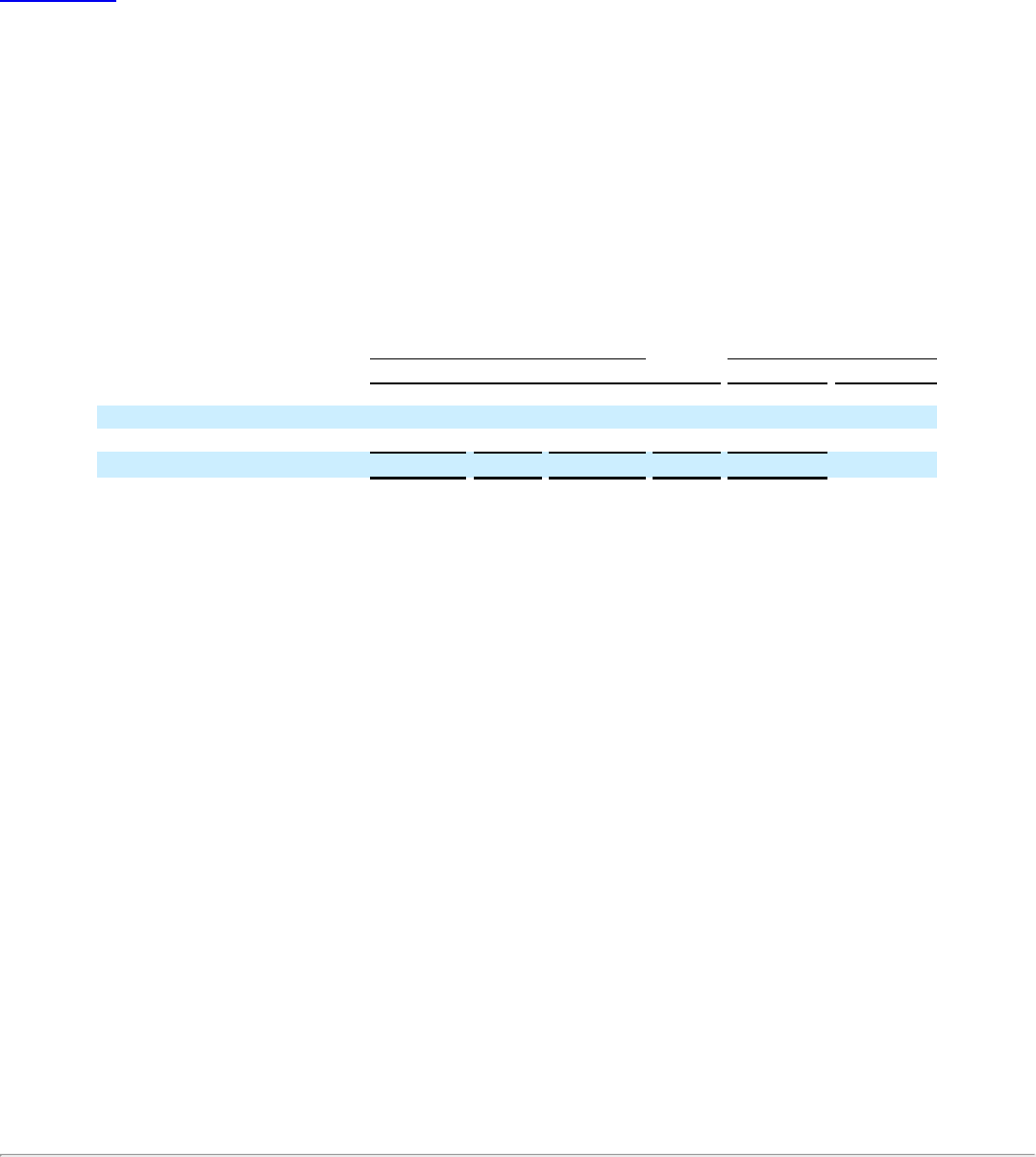

The following table sets forth revenue for products and subscription and services for the years ended December 31, 2013 and 2012:

Product revenue

$156,792

59.2%

$180,919

66.2%

$(24,127)

(13.3)%

Subscription and service revenue

107,853

40.8%

92,322

33.8%

15,531

16.8 %

Total revenue

$264,645

100.0%

$273,241

100.0%

$(8,596)

(3.1)%

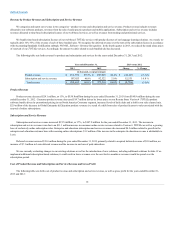

Product Revenue

Product revenue decreased $24.1 million, or 13%, to $156.8 million during the year ended December 31, 2013 from $180.9 million during the year

ended December 31, 2012. Consumer product revenue decreased $19.7 million driven by lower prices on our Rosetta Stone Version 4 product

software bundle driven by promotional pricing in our North America Consumer segment, increased levels of daily deals and a shift in our sales channel mix.

$2.9 million of the decrease in Global Enterprise & Education product revenues is a result of a shift from sales of product licenses to sales associated with the

renewal of online subscriptions.

Subscription and Service Revenue

Subscription and service revenue increased $15.5 million, or 17%, to $107.9 million for the year ended December 31, 2013. The increase in

subscription and service revenues was due to an $11.1 million increase in consumer online service revenue related to Version 4 as well as a growing

base of exclusively online subscription sales. Enterprise and education subscription and service revenues also increased $4.5 million related to growth in the

enterprise and education customer base with renewing online subscriptions. $1.2 million of the increase in the enterprise & education revenue is attributable to

Lexia.

Deferred revenue increased $15.4 million during the year ended December 31, 2013, primarily related to acquired deferred revenue of $2.0 million, an

increase of $7.1 million in Lexia deferred revenue and the increase in our base of paid subscribers.

We are currently evaluating changes to our existing solutions as well as the introduction of new solutions, including additional solutions for kids. If we

implement additional subscription-based solutions, it could result in lower revenues over the next twelve months as revenues would be spread over the

subscription period.

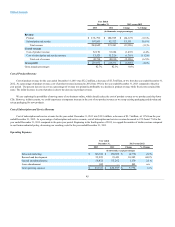

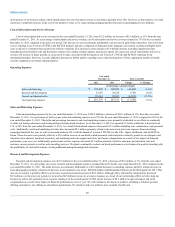

The following table sets forth cost of product revenue and subscription and service revenue, as well as gross profit for the years ended December 31,

2013 and 2012:

44