Rosetta Stone 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

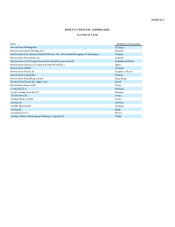

Table of Contents

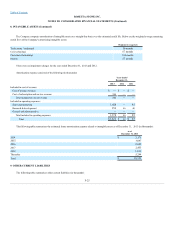

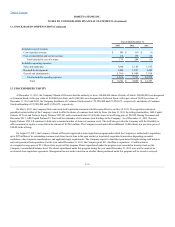

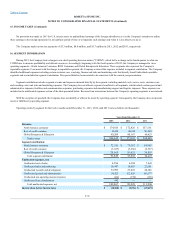

Income tax expense at statutory federal rate

$ (6,306)

$(2,024)

$ (9,600)

State income tax expense, net of federal income tax effect

7

216

(844)

Domestic production activities deduction

—

(81)

580

Nondeductible LTIP expense

—

—

2,062

Nondeductible intercompany interest

—

—

29

Acquired intangibles

(859)

—

—

Other nondeductible expenses

1,105

504

698

Tax rate differential on foreign operations

(264)

(346)

(209)

Increase in valuation allowance

4,263

28,679

—

Tax Audit Settlements

—

281

—

Change in prior year estimates

(17)

1,608

—

Other tax credits

—

—

(619)

Other

187

72

134

Income tax expense (benefit)

$(1,884)

$28,909

$(7,769)

The Company accounts for uncertainty in income taxes under ASC topic 740-10-25, ("ASC 740-10-25"). ASC

740-10-25 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. ASC 740-10-25 also provides guidance on de-recognition, classification, interest and penalties, accounting in interim

periods, disclosure, and transition.

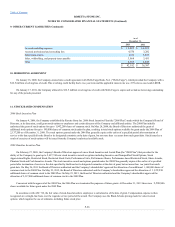

The Company recognizes interest and penalties related to unrecognized tax benefits as a component of income tax expense. As of December 31, 2013 and

2012, the Company had $16,000 and $9,000 accrued for interest and penalties, respectively, in "Other Long Term Liabilities". During the year ended

December 31, 2013, the Company accrued $7,000 of interest expense. During the year ended December 31, 2012, the Company accrued $42,000 of interest

expense and paid $57,000 as settlement of its Japan audit.

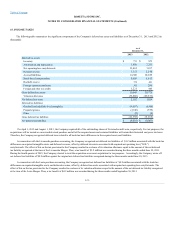

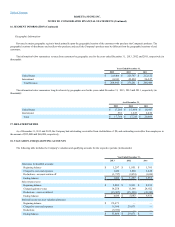

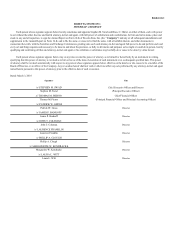

A reconciliation of the beginning and ending amount of unrecognized tax benefits, excluding interest and penalties, is as follows (in thousands):

Balance at January 1,

$143

$165

Increases for tax positions taken during prior period

—

—

Increases for tax positions taken during current period

—

239

Settlements

—

(261)

Balance at December 31,

$143

$143

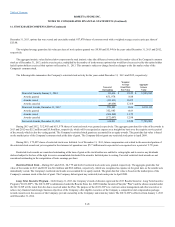

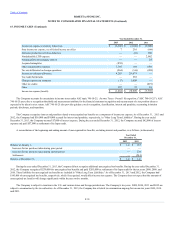

During the year ended December 31, 2013, the Company did not recognize additional unrecognized tax benefits. During the year ended December 31,

2012, the Company recognized $239,000 for unrecognized tax benefits and paid $261,000 as settlement of its Japan audit for the tax years 2008, 2009, and

2010. These liabilities for unrecognized tax benefits are included in "Other Long Term Liabilities." As of December 31, 2013 and 2012, the Company had

$143,000 of unrecognized tax benefits, respectively, which if recognized, would affect income tax expense. The Company does not expect that the amounts of

unrecognized tax benefits will change significantly within the next twelve months.

The Company is subject to taxation in the U.S. and various states and foreign jurisdictions. The Company's tax years 2009, 2010, 2011 and 2012 are

subject to examination by the tax authorities. As of December 31, 2013, the Company has a federal tax examination ongoing for income tax years 2009, 2010

and 2011.

F-35