Rosetta Stone 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

cumulative losses, forecasts of future profitability, the duration of statutory carryforward periods, our experience with operating loss and tax credit

carryforwards not expiring unused, and tax planning alternatives. Significant judgment is required to determine whether a valuation allowance is necessary

and the amount of such valuation allowance, if appropriate. The valuation allowance is reviewed quarterly and is maintained until sufficient positive evidence

exists to support a reversal.

In assessing the recoverability of our deferred tax assets, we consider all available evidence, including:

•the nature, frequency, and severity of cumulative financial reporting losses in recent years;

•the carryforward periods for the net operating loss, capital loss, and foreign tax credit carryforwards;

•predictability of future operating profitability of the character necessary to realize the asset;

•prudent and feasible tax planning strategies that would be implemented, if necessary, to protect against the loss of the deferred tax assets; and

•the effect of reversing taxable temporary differences.

The evaluation of the recoverability of the deferred tax assets requires that we weigh all positive and negative evidence to reach a conclusion that it is

more likely than not that all or some portion of the deferred tax assets will not be realized. The weight given to the evidence is commensurate with the extent to

which it can be objectively verified. The more negative evidence that exists, the more positive evidence is necessary and the more difficult it is to support a

conclusion that a valuation allowance is not needed.

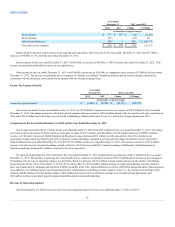

As of December 31, 2012, we performed an analysis on the need for a valuation allowance on our deferred tax assets in various jurisdictions. Our

analysis considered a number of factors, including our cumulative loss over the last three years, our expectation of future taxable income and the time frame

over which our net operating losses expire. This analysis resulted in the need for valuation allowances in the U.S., Korea, Japan and Brazil. We have

maintained a valuation allowance against our deferred tax assets in the U.S., Korea, Japan and Brazil through December 31, 2013. All four jurisdictions have

cumulative losses and pre-tax losses for the most recent year ended December 31, 2013. The establishment of a valuation allowance has no effect on the ability

to use the deferred tax assets in the future to reduce cash tax payments. We will continue to assess the likelihood that the deferred tax assets will be realizable at

each reporting period and the valuation allowance will be adjusted accordingly, which could materially affect our financial position and results of operations.

As of December 31, 2013 and 2012 , our net deferred tax liability was $9.6 million and $8.1 million, respectively.

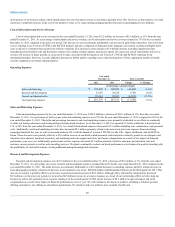

In the third quarter of 2013, we voluntarily changed our accounting policy for sales commissions related to non-cancellable Software-as-a-Service

(“SaaS”) contracts, from recording an expense when incurred, to deferral of the sales commission in proportion to the consideration allocated to each of the

elements in the arrangement and in, or over, the same period the revenue is recognized for each of the elements in the arrangement (i.e. over the non-cancellable

term of the contract for the SaaS deliverable). We anticipate a significant increase in contracts with multi-year subscriptions and a corresponding increase in

sales commissions due, among other reasons, to our acquisition of Lexia. Lexia provides its services using a SaaS model and has historically had longer-term

arrangements, with material sales commissions paid to its network of resellers and has applied a sales commission deferral and amortization policy.

We believe the deferral method described above is preferable primarily because (i) the sales commission charges are so closely related to obtaining the

revenue from the non-cancellable contracts that they should be deferred and charged to expense over the same period that the related revenue is recognized; and

(ii) it provides a single accounting policy, consistent with that used by Lexia, that makes it easier for financial statement users to understand. Furthermore, the

adoption of this accounting policy enhances the comparability of our consolidated financial statements by changing to a method that is widely utilized in our

industry. Deferred commission amounts are recoverable through the future revenue streams under the non-cancellable arrangements. Short-term deferred

commissions are included in prepaid expenses and other current assets, while long-term deferred commissions are included in other assets in the

accompanying consolidated balance sheets. The amortization of deferred commissions is included in sales and marketing expense in the accompanying

consolidated statements of operations.

40