Rosetta Stone 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

moving more of our business online, which should reduce the cost of product revenue as we produce and ship fewer CDs. However, in that scenario, we could

experience a temporary increase in the cost of our product revenue as we scrap existing packaging and develop and set up packaging for new products.

Cost of Subscription and Service Revenue

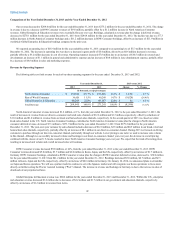

Cost of subscription and service revenue for the year ended December 31, 2012 was $15.2 million, an increase of $2.6 million, or 21% from the year

ended December 31, 2011. As a percentage of subscription and service revenue, cost of subscription and service revenue remained at 17% for the year ended

December 31, 2012 compared to the prior year period. The increase in cost was primarily attributable to an increase in paid online subscribers. Our web-based

service offerings in our Version 4 and products include a component of dedicated online language conversation coaching and higher direct

costs to deliver to customers than our previous software solutions. This increase in costs includes a $1.8 million increase in product support activities

including personnel-related costs and third-party expenses for coaches, product support, and success agents. We expect our cost of subscription and service

revenue will increase in future periods, as a percent of revenue, associated with the launch of our Version 4 and solutions in our

international markets. However, we took additional measures to further address coaching costs in the fourth quarter of 2012, capping the number of studio

sessions compared to our former unlimited policy.

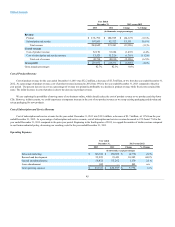

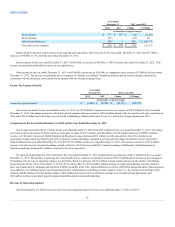

Sales and marketing

$150,882

$160,942

$(10,060)

(6.3)%

Research and development

23,453

24,218

(765)

(3.2)%

General and administrative

55,262

62,031

(6,769)

(10.9)%

Total operating expenses

$229,597

$247,191

$(17,594)

(7.1)%

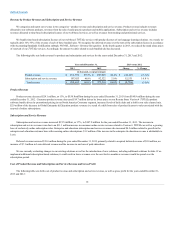

Sales and Marketing Expenses

Sales and marketing expenses for the year ended December 31, 2012 were $150.9 million, a decrease of $10.1 million, or 6%, from the year ended

December 31, 2011. As a percentage of total revenue, sales and marketing expenses were 55% for the year ended December 31, 2012, compared to 60% for the

year ended December 31, 2011. The dollar and percentage decreases in sales and marketing expenses were primarily attributable to our efforts to continually

evaluate our kiosk performance and closing underperforming kiosk locations. As of December 31, 2012 we operated 87 kiosks worldwide, a decrease from

174, or 50% from the year ended December 31, 2011. As a result, kiosk-related expenses decreased $12.3 million including rent, commissions, and personnel

costs. Additionally, media and marketing activities have decreased $8.3 million primarily related to the increase in prior year expenses from advertising

campaigns launched last year, as well as increased media in 2011 with the launch of Version 4 in the U.K., Japan, and Korea, and in

Korea. These decreases were partially offset by a $3.8 million increase in non-kiosk related personnel-related expenses related to growth in our enterprise and

education sales channel, non-kiosk consumer, and marketing and sales support activities, and bonus compensation as a result of our improved financial

performance year over year. Additionally, professional services expenses increased $4.7 million primarily related to enterprise and education sales and

customer success projects as well as web consulting services. We plan to continually evaluate our kiosk performance as we balance the positive branding with

the profitability of our kiosk locations, closing additional underperforming kiosk locations.

Research and Development Expenses

Research and development expenses were $23.5 million for the year ended December 31, 2012, a decrease of $0.8 million, or 3%, from the year ended

December 31, 2011. As a percentage of revenue, research and development expenses remained flat at 9% for the year ended December 31, 2012 compared to the

year ended December 31, 2011. The dollar decrease was primarily attributable to a $0.9 million decrease in consulting expenses and $0.1 million decrease in

stock photography primarily related to the decrease in development costs of our product which launched in Korea in the third quarter of 2011. This

decrease in expense is partially offset by an increase in personnel-related expenses of $0.3 million. Although salary and benefits compensation decreased

$0.9 million over the prior year period, we incurred an $0.8 million increase in severance expenses as a result of our restructuring efforts to better align our

business as well as the separation of an executive employee in the second quarter of 2012 and an increase of $0.3 million in sign-on bonuses and stock

compensation as a result of our improved financial performance year over year. We will continue to develop new products, including a children's product

offering, and improve our offering to educational organizations. We intend to make our products more modular, flexible and

50