Rosetta Stone 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

On August 1, 2013, the Company completed its acquisition of Lexia (the “Lexia Merger”). Lexia is one of the most trusted and established companies in

the reading technology market. The transaction marks the Company’s first extension beyond language learning and takes the Company deeper into the EdTech

industry. The aggregate amount of consideration paid by the Company was $21.1 million in cash, net of working capital and deferred revenue adjustments,

including a holdback of $3.4 million with 50% of such holdback to be paid within 30 days of the Company filing its Form 10-K for the year ended December

31, 2013 and 50% of such holdback to be paid on the 18 month anniversary of the acquisition.

The acquisition of Lexia resulted in goodwill of approximately $9.9 million, none of which is deductible for tax purposes. This amount represents the

residual amount of the total purchase price after allocation to the assets acquired and liabilities assumed.

All expenditures incurred in connection with the Lexia Merger were expensed and are included in general and administrative expenses. Transaction costs

incurred in connection with the Lexia Merger were $0.1 million during the year ended December 31, 2013. The results of operations for Lexia have been

included in the consolidated results of operations for the period August 1, 2013 through December 31, 2013.

The Company has preliminarily allocated the purchase price based on current estimates of the fair values of assets acquired and liabilities assumed in

connection with the Lexia acquisition. The table below summarizes the preliminary estimates of fair value of the Lexia assets acquired, liabilities assumed and

related deferred income taxes as of the acquisition date. Any changes to the initial estimates of the fair value of the assets and liabilities will be recorded as

adjustments to those assets and liabilities and residual amounts will be allocated to goodwill. The Company has substantially completed the purchase price

allocations for the 2013 acquisitions. However, if additional information is obtained about these assets and liabilities within the measurement period (not to

exceed one year from the date of acquisition), including finalization of asset appraisals, the Company will refine its estimates of fair value to allocate the

purchase price more accurately; however, any such revisions are not expected to be significant.

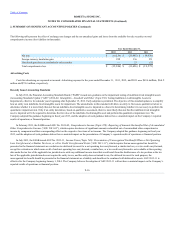

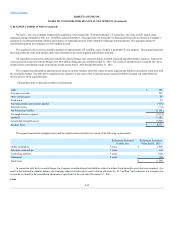

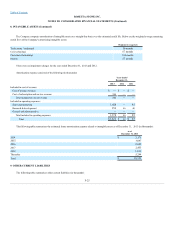

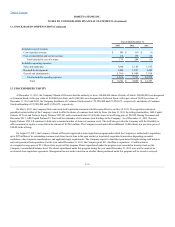

The preliminary purchase price is allocated as follows (in thousands):

Cash

$ 263

Accounts receivable

2,404

Other current assets

105

Fixed assets

255

Accounts payable and accrued expenses

(899)

Deferred revenue

(1,223)

Net deferred tax liability

(4,210)

Net tangible assets acquired

(3,305)

Goodwill

9,938

Amortizable intangible assets

14,500

Preliminary purchase price

$21,133

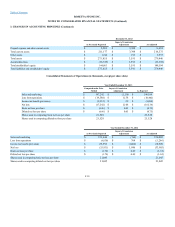

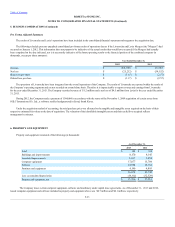

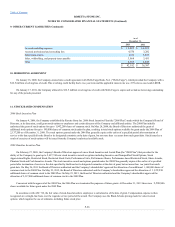

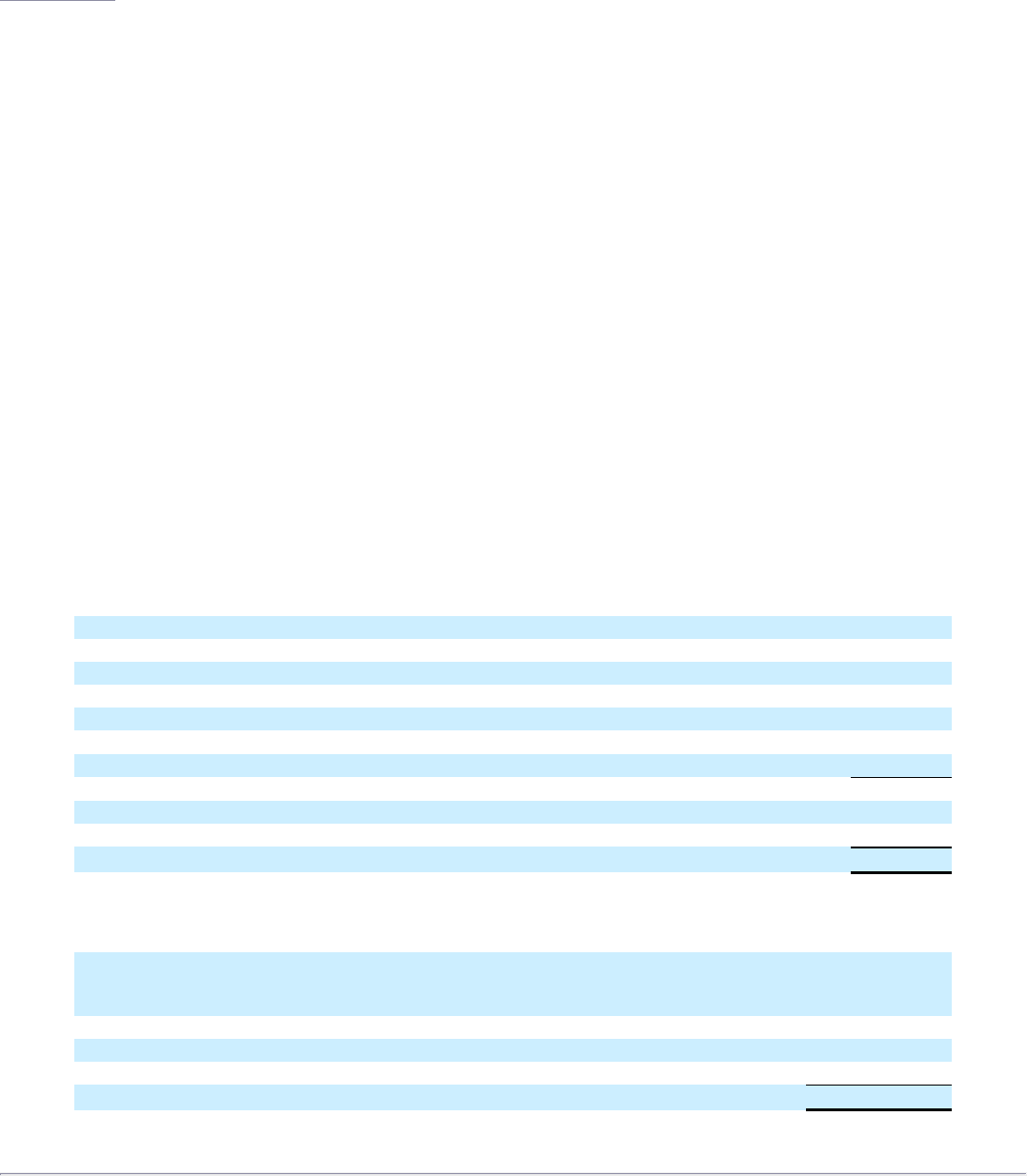

The acquired amortizable intangible assets and the related estimated useful lives consist of the following (in thousands):

Preliminary

Estimated Useful

Lives

Preliminary

Estimated Value

August 1, 2013

Enterprise relationships

10 years

$9,400

Technology platform

7 years

4,100

Tradename

5 years

1,000

Total assets

$14,500

F-22