Rosetta Stone 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

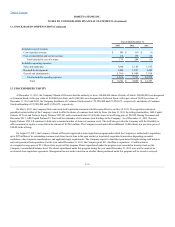

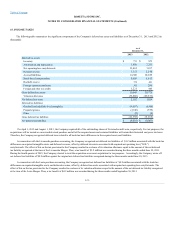

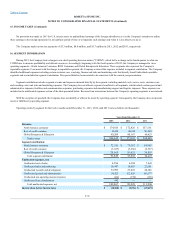

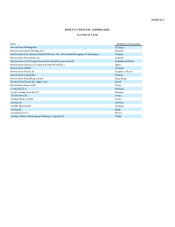

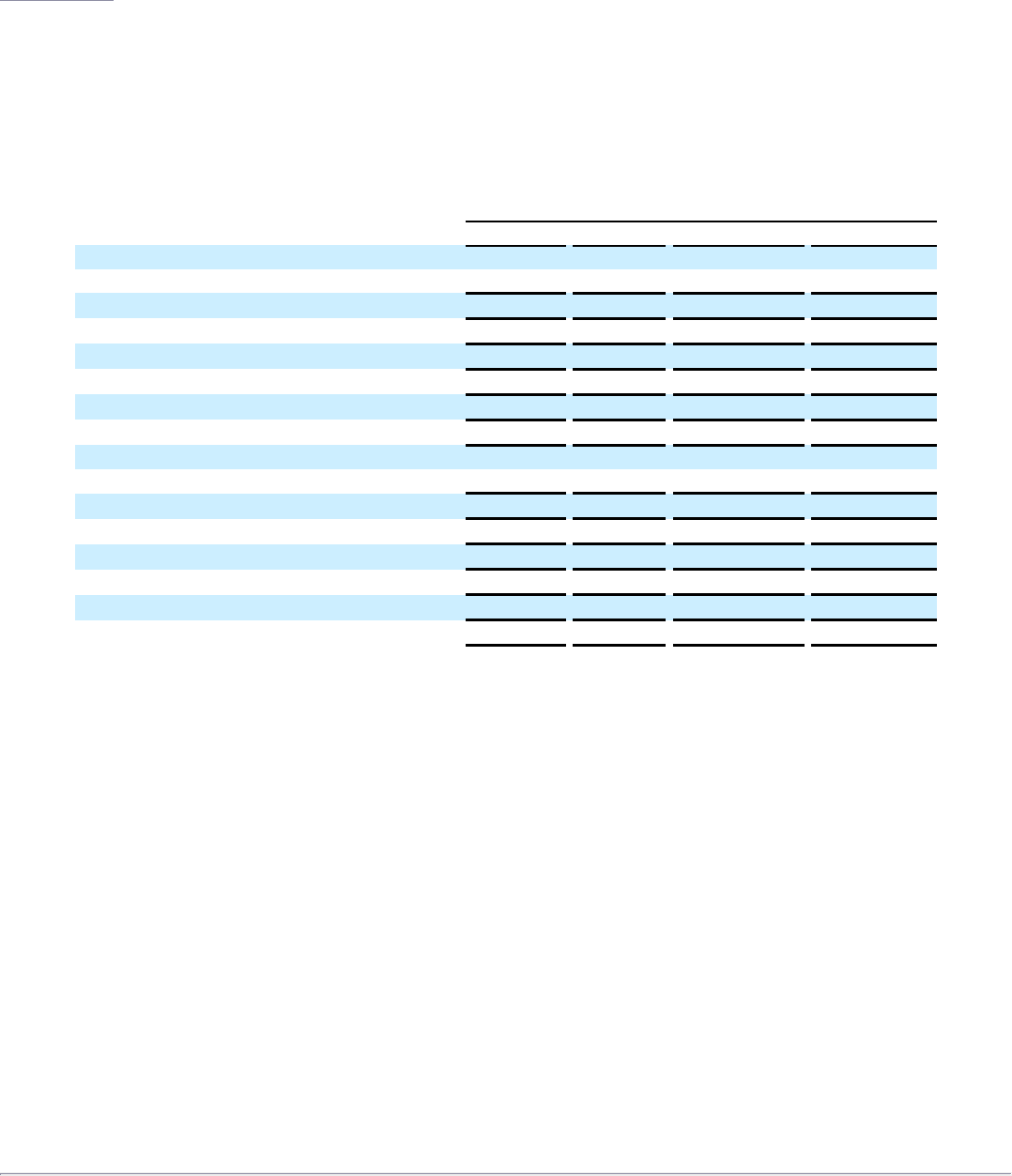

Summarized quarterly supplemental consolidated financial information for 2013 and 2012 are as follows (in thousands, except per share amounts):

2013

Revenue

$63,924

$62,139

$60,872

$ 77,710

Gross profit

$53,660

$51,915

$50,128

$63,228

Net loss

$(4,904)

$(3,213)

$(4,169)

$(3,848)

Basic loss per share

$(0.23)

$(0.15)

$(0.19)

$(0.18)

Shares used in basic per share computation

21,360

21,569

21,827

21,353

Diluted loss per share

$(0.23)

$(0.15)

$(0.19)

$(0.18)

Shares used in diluted per share computation

21,360

21,569

21,827

21,353

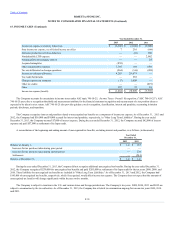

2012

Revenue

$69,449

$60,812

$64,279

$ 78,701

Gross profit

$55,975

$49,492

$ 53,094

$65,770

Net income (loss)

$(2,003)

$ (4,554)

$(32,063)

$4,635

Basic loss per share

$(0.10)

$(0.22)

$ (1.52)

$0.22

Shares used in basic per share computation

20,942

20,995

21,073

21,166

Diluted loss per share

$(0.10)

$(0.22)

$ (1.52)

$0.21

Shares used in diluted per share computation

20,942

20,995

21,073

21,828

The summarized quarterly supplemental financial information above has been adjusted for the retrospective change in accounting principle for sales

commissions, as disclosed in the Company's financial statements for the quarter ended September 30, 2013.

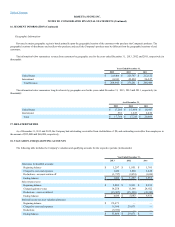

On December 19, 2013, the Company executed a Share Purchase Agreement (the “Agreement”) pursuant to which Rosetta Stone Canada Inc., a wholly-

owned, indirect subsidiary of the Company, agreed to purchase all of the outstanding shares of Vivity Labs Inc., a company organized under the laws of

Canada, from its shareholders for $12.0 million in cash. The Agreement contains customary representations, warranties, covenants, indemnification

obligations and closing conditions. The acquisition of Vivity Labs Inc. was completed on January 2, 2014. Based upon the timing of the acquisition

subsequent to the end of the year, the initial accounting for the acquisition is incomplete at this time as the Company is in the process of determining the fair

values of the net assets acquired and goodwill resulting from the acquisition.

On December 11, 2013, Rosetta Stone Inc. the Company executed a Stock Purchase Agreement (the “Agreement”) pursuant to which Rosetta Stone Ltd.,

a wholly-owned subsidiary of the Company, agreed to purchase all of the outstanding shares of Tell Me More S.A., a company organized under the laws of

France, from its shareholders for approximately €20.75 million ($28.0 million), including assumed net debt. The Agreement contains customary

representations, warranties, covenants, indemnification obligations and closing conditions. The acquisition of Tell Me More S.A. was completed on January

8, 2014. Based upon the timing of the acquisition subsequent to the end of the year, the initial accounting for the acquisition is incomplete at this time as the

Company is in the process of determining the fair values of the net assets acquired and goodwill resulting from the acquisition.

On January 10, 2014, Rosetta Stone announced the restructuring of its Asian operations. During the first quarter of 2014, the Company will close its

office in Japan and streamline its operations in South Korea. As a result of these restructuring efforts, Rosetta Stone will reduce its work force by

approximately 70 employees. The Company will maintain its web-based presence in both countries and focus its efforts in South Korea more directly on

further scaling the Proctor Assisted Learning

F-38