Rosetta Stone 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

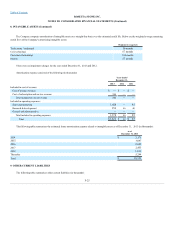

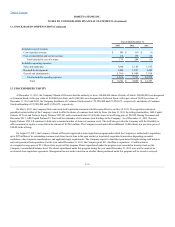

Pro Forma Adjusted Summary

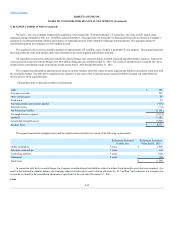

The results of Livemocha and Lexia’s operations have been included in the consolidated financial statements subsequent to the acquisition date.

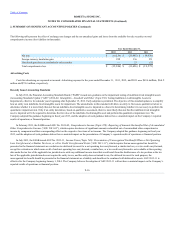

The following schedule presents unaudited consolidated pro forma results of operations data as if the Livemocha and Lexia Mergers (the "Mergers”) had

occurred on January 1, 2012. This information does not purport to be indicative of the actual results that would have occurred if the Mergers had actually

been completed on the date indicated, nor is it necessarily indicative of the future operating results or the financial position of the combined company (in

thousands, except per share amounts):

Revenue

$266,998

$277,033

Net loss

$(25,212)

$(54,152)

Basic loss per share

$(1.17)

$ (2.57)

Diluted loss per share

$(1.17)

$ (2.57)

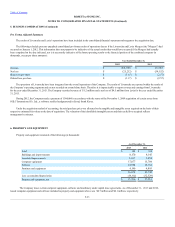

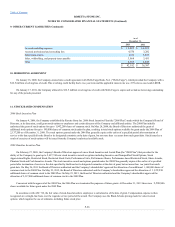

The operations of Livemocha have been integrated into the overall operations of the Company. The results of Livemocha are reported within the results of

the Company’s operating segments and are not recorded on a stand-alone basis. Therefore it is impracticable to report revenue and earnings from Livemocha

for the year ended December 31, 2013. The Company recorded revenue of $1.2 million and a net loss of $4.5 million from Lexia for the year ended December

31, 2013.

During 2012, the Company made a payment of $300,000 in accordance with the terms of the November 1, 2009 acquisition of certain assets from

SGLC International Co. Ltd., a software reseller headquartered in Seoul, South Korea.

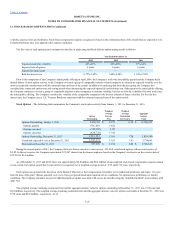

Under the acquisition method of accounting, the total purchase price was allocated to the tangible and intangible assets acquired on the basis of their

respective estimated fair values at the date of acquisition. The valuation of the identifiable intangible assets and their useful lives acquired reflects

management's estimates.

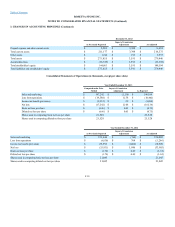

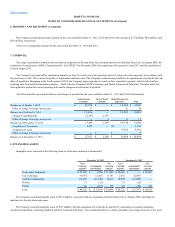

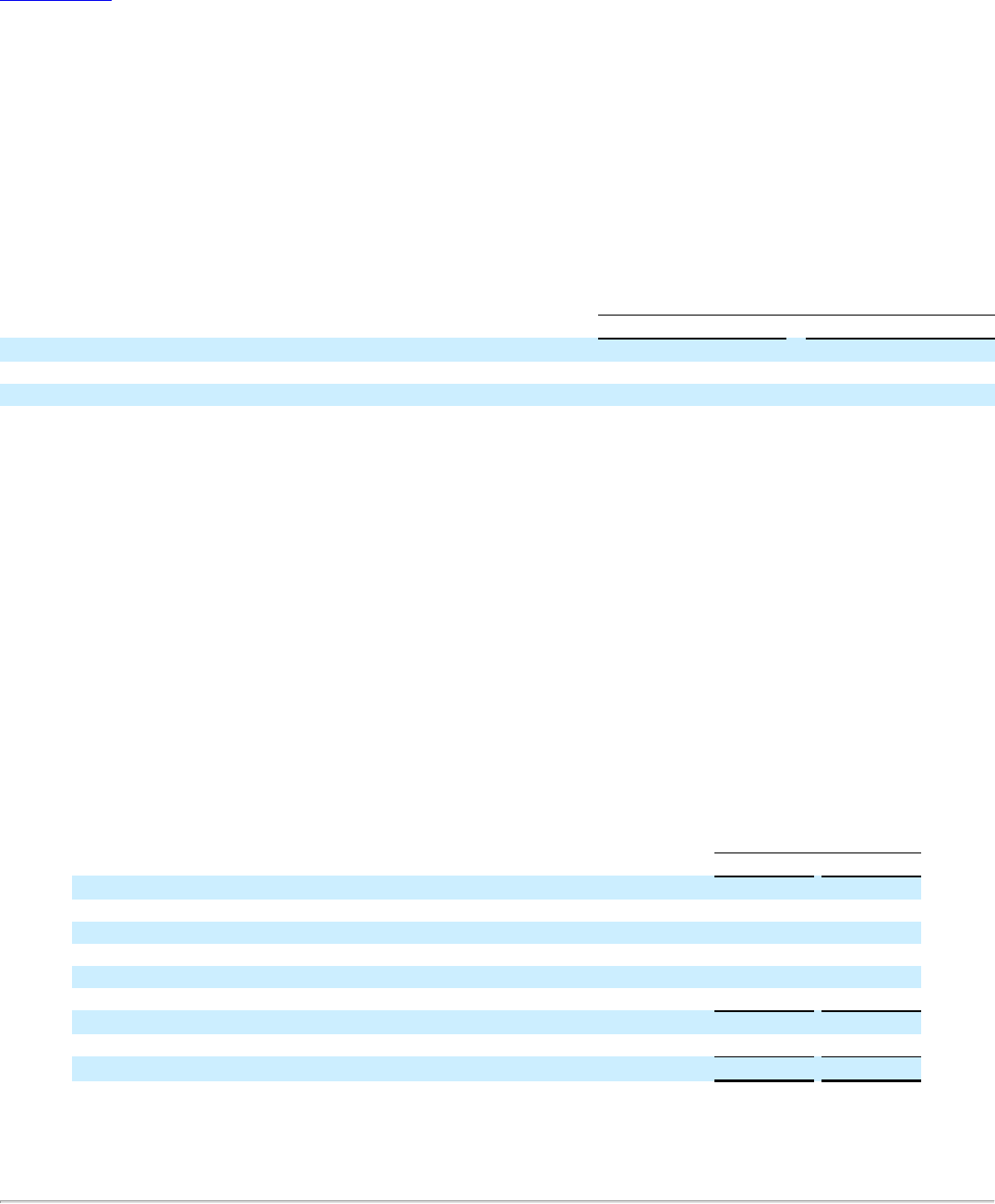

Property and equipment consisted of the following (in thousands):

Land

$390

$390

Buildings and improvements

8,170

8,145

Leasehold improvements

1,657

1,854

Computer equipment

17,077

15,704

Software

24,594

18,754

Furniture and equipment

4,190

4,895

56,078

49,742

Less: accumulated depreciation

(38,312)

(32,529)

Property and equipment, net

$17,766

$ 17,213

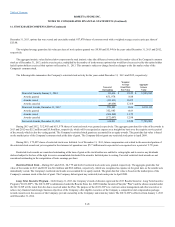

The Company leases certain computer equipment, software and machinery under capital lease agreements. As of December 31, 2013 and 2012,

leased computer equipment and software included in property and equipment above was $0.7 million and $0.1 million, respectively.

F-23