Quest Diagnostics 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

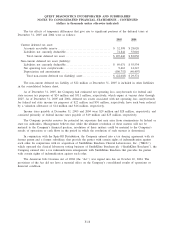

In conjunction with the debt refinancings, the Company recorded a $2.9 million charge to earnings in the

second quarter of 2004 representing the write-off of deferred financing costs associated with the debt that was

refinanced. The $2.9 million charge was included in interest expense, net within the consolidated statements of

operations for the year ended December 31, 2004.

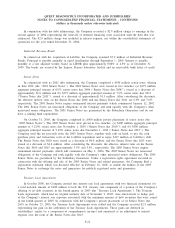

Industrial Revenue Bonds

In connection with the acquisition of LabOne, the Company assumed $7.2 million of Industrial Revenue

Bonds. Principal is payable annually in equal installments through September 1, 2009. Interest is payable

monthly at a rate adjusted weekly based on LIBOR plus approximately 0.08% or 4.5% as of December 31,

2005. The bonds are secured by the Lenexa, Kansas laboratory facility and an irrevocable bank letter of credit.

Senior Notes

In conjunction with its 2001 debt refinancing, the Company completed a $550 million senior notes offering

in June 2001 (the “2001 Senior Notes’’). The 2001 Senior Notes were issued in two tranches: (a) $275 million

aggregate principal amount of 6

3

⁄

4

% senior notes due 2006 (“Senior Notes due 2006’’), issued at a discount of

approximately $1.6 million and (b) $275 million aggregate principal amount of 7

1

⁄

2

% senior notes due 2011

(“Senior Notes due 2011’’), issued at a discount of approximately $1.1 million. After considering the discounts,

the effective interest rates on the Senior Notes due 2006 and the Senior Notes due 2011 are 6.9% and 7.6%,

respectively. The 2001 Senior Notes require semiannual interest payments which commenced January 12, 2002.

The 2001 Senior Notes are unsecured obligations of the Company and rank equally with the Company’s other

unsecured senior obligations. The 2001 Senior Notes are guaranteed by the Subsidiary Guarantors and do not

have a sinking fund requirement.

On October 31, 2005, the Company completed its $900 million private placement of senior notes (the

“2005 Senior Notes’’). The 2005 Senior Notes were priced in two tranches: (a) $400 million aggregate principal

amount of 5.125% senior notes due November 1, 2010 (“Senior Notes due 2010’’); and (b) $500 million

aggregate principal amount of 5.45% senior notes due November 1, 2015 (“Senior Notes due 2015’’). The

Company used the net proceeds from the 2005 Senior Notes, together with cash on hand, to pay the cash

purchase price and transaction costs of the LabOne acquisition and to repay $127 million of LabOne’s debt.

The Senior Notes due 2010 were issued at a discount of $0.8 million, and the Senior Notes due 2015 were

issued at a discount of $1.6 million. After considering the discounts, the effective interest rates on the Senior

Notes due 2010 and 2015 are approximately 5.3% and 5.6%, respectively. The 2005 Senior Notes require

semiannual interest payments, which will commence on May 1, 2006. The 2005 Senior Notes are unsecured

obligations of the Company and rank equally with the Company’s other unsecured senior obligations. The 2005

Senior Notes are guaranteed by the Subsidiary Guarantors. Under a registration rights agreement executed in

connection with the offering and sale of the 2005 Senior Notes and related guarantees, the Company filed a

registration statement which was declared effective on February 16, 2006, to enable the holders of the 2005

Senior Notes to exchange the notes and guarantees for publicly registered notes and guarantees.

Treasury Lock Agreements

In October 2005, the Company entered into interest rate lock agreements with two financial institutions for

a total notional amount of $300 million to lock the U.S. treasury rate component of a portion of the Company’s

offering of its debt securities in the fourth quarter of 2005 (the “Treasury Lock Agreements’’). The Treasury

Lock Agreements, which had an original maturity date of November 9, 2005, were entered into to hedge part

of the Company’s interest rate exposure associated with the minimum amount of debt securities that were issued

in the fourth quarter of 2005. In connection with the Company’s private placement of its Senior Notes due

2015 on October 25, 2005, the Treasury Lock Agreements were settled and the Company received $2.5 million,

representing the gain on the settlement of the Treasury Lock Agreements. These gains are deferred in

stockholders’ equity (as a component of comprehensive income) and amortized as an adjustment to interest

expense over the term of the Senior Notes due 2015.

F-22