Quest Diagnostics 2005 Annual Report Download - page 92

Download and view the complete annual report

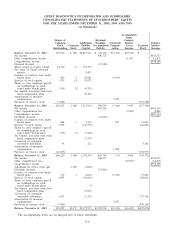

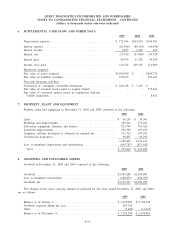

Please find page 92 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

amortization. Of the $680 million allocated to goodwill, approximately $47 million is expected to be deductible

for tax purposes.

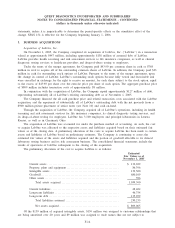

Acquisition of Unilab Corporation

On February 28, 2003, the Company completed the acquisition of Unilab Corporation (“Unilab’’), the

leading commercial clinical laboratory in California. In connection with the acquisition, the Company paid $297

million in cash and issued 14.1 million shares of Quest Diagnostics common stock to acquire all of the

outstanding capital stock of Unilab. In addition, the Company reserved approximately 0.6 million shares of

Quest Diagnostics common stock for outstanding stock options of Unilab which were converted upon the

completion of the acquisition into options to acquire shares of Quest Diagnostics common stock (the “converted

options’’).

The aggregate purchase price of $698 million included the cash portion of the purchase price of $297

million and transaction costs of approximately $20 million, with the remaining portion of the purchase price

paid through the issuance of 14.1 million shares of Quest Diagnostics common stock (valued at $372 million or

$26.40 per share, based on the average closing stock price of Quest Diagnostics common stock for the five

trading days ended March 4, 2003) and the issuance of approximately 0.6 million converted options (valued at

approximately $9 million, based on the Black Scholes option-pricing model).

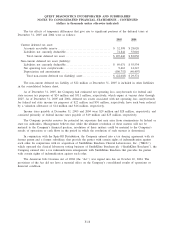

In conjunction with the acquisition of Unilab, the Company repaid $220 million of debt, representing

substantially all of Unilab’s then existing outstanding debt, and related accrued interest. Of the $220 million,

$124 million represents payments related to the Company’s cash tender offer, which was completed on March 7,

2003, for all of the outstanding $101 million principal amount and related accrued interest of Unilab’s 12

3

⁄

4

%

Senior Subordinated Notes due 2009 and $23 million of related tender premium and associated tender offer

costs.

The Company financed the cash portion of the purchase price and related transaction costs, and the

repayment of substantially all of Unilab’s outstanding debt and related accrued interest, with the proceeds from

a new $450 million amortizing term loan due June 2007 and cash on-hand. During 2003, the Company repaid

$145 million of principal outstanding under the term loan due June 2007. During 2004, the Company refinanced

the remaining $305 million of principal outstanding under the term loan due June 2007 with $100 million of

borrowings under the Company’s senior unsecured revolving credit facility, $130 million of borrowings under

the Company’s secured receivables credit facility and $75 million of borrowings under the Company’s term loan

due December 2008.

As part of the Unilab acquisition, Quest Diagnostics acquired all of Unilab’s operations, including its

primary testing facilities in Los Angeles, San Jose and Sacramento, California, and approximately 365 patient

service centers and 35 rapid response laboratories and approximately 4,100 employees. As the leading

commercial clinical laboratory in California, the acquisition of Unilab further solidified the Company’s leading

position within the clinical laboratory testing industry, and further enhanced its national network and access to

its comprehensive range of services for physicians, hospitals, patients and healthcare insurers.

In connection with the acquisition of Unilab, as part of a settlement agreement with the United States

Federal Trade Commission, the Company entered into an agreement to sell to Laboratory Corporation of

America Holdings, Inc., (“LabCorp’’), certain assets in northern California for $4.5 million, including the

assignment of agreements with four independent physician associations (“IPA’’) and leases for 46 patient service

centers (five of which also serve as rapid response laboratories) (the “Divestiture’’). Approximately $27 million

in annual net revenues were generated by capitated fees under the IPA agreements and associated fee-for-service

testing for physicians whose patients use these patient service centers, as well as from specimens received

directly from the IPA physicians. The Company completed the transfer of assets and assignment of the IPA

agreements to LabCorp and recorded a $1.5 million gain in the third quarter of 2003 in connection with the

Divestiture, which is included in “other operating expense (income), net’’ within the consolidated statements of

operations.

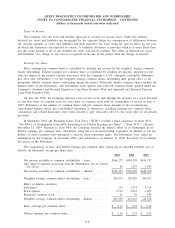

Pro Forma Combined Financial Information

The following unaudited pro forma combined financial information for the years ended December 31, 2005

and 2004 assumes that the LabOne acquisition was completed on January 1, 2004. The unaudited pro forma

F-15