Quest Diagnostics 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

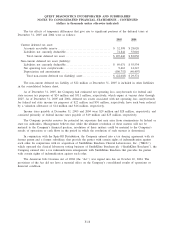

For the year ended December 31, 2005, the Company recorded a $7.5 million charge which is included in

other operating expense (income), net in the consolidated statement of operations, to write-off all of the

goodwill associated with its test kit manufacturing subsidiary, NID. See Note 15 for further details. For the year

ended December 31, 2004, the reduction in goodwill was primarily related to an increase in pre-acquisition tax

net operating losses and credit carryforwards associated with businesses acquired.

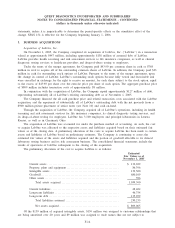

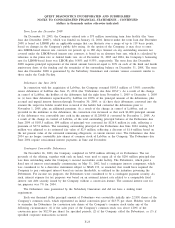

Amortizing intangible assets at December 31, 2005 and 2004 consisted of the following:

Weighted

Average

Amortization

Period December 31, 2005 December 31, 2004

Accumulated Accumulated

Cost Amortization Net Cost Amortization Net

Amortizing

intangible assets:

Customer-related

intangibles ....... 20 years $172,522 $(39,297) $133,225 $42,225 $(37,197) $ 5,028

Non-compete

agreements ....... 5 years 45,707 (44,221) 1,486 44,942 (42,348) 2,594

Other .............. 6 years 7,044 (3,772) 3,272 6,850 (3,010) 3,840

Total ............ 20 years $225,273 $(87,290) $137,983 $94,017 $(82,555) $11,462

Amortization expense related to intangible assets was $4,730, $6,703 and $8,201 for the years ended

December 31, 2005, 2004 and 2003, respectively.

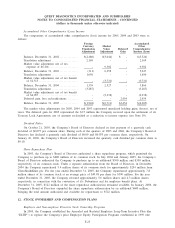

The estimated amortization expense related to amortizable intangible assets for each of the five succeeding

fiscal years and thereafter as of December 31, 2005 is as follows:

Fiscal Year Ending

December 31,

2006 ............................................................ $ 9,374

2007 ............................................................ 7,983

2008 ............................................................ 7,790

2009 ............................................................ 7,375

2010 ............................................................ 7,128

Thereafter ....................................................... 98,333

Total .......................................................... $137,983

Intangible assets not subject to amortization at December 31, 2005 consisted of $9.4 million of tradenames

resulting from the acquisition of LabOne on November 1, 2005 (see Note 3).

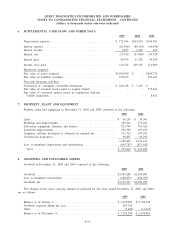

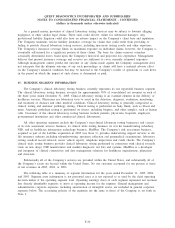

9. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses at December 31, 2005 and 2004 consisted of the following:

2005 2004

Accrued wages and benefits ................................................. $275,709 $265,126

Accrued expenses ........................................................... 266,716 247,134

Trade accounts payable ...................................................... 193,385 128,488

Income taxes payable ....................................................... 28,643 28,239

Total ..................................................................... $764,453 $668,987

F-20