Quest Diagnostics 2005 Annual Report Download - page 109

Download and view the complete annual report

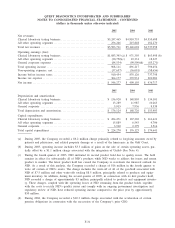

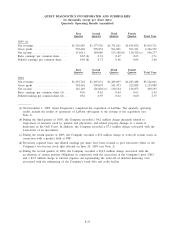

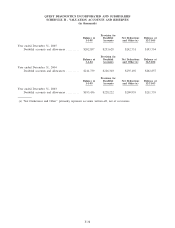

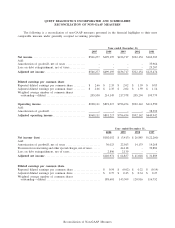

Please find page 109 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

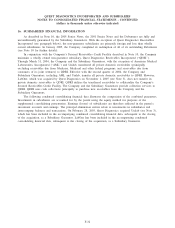

16. SUMMARIZED FINANCIAL INFORMATION

As described in Note 10, the 2005 Senior Notes, the 2001 Senior Notes and the Debentures are fully and

unconditionally guaranteed by the Subsidiary Guarantors. With the exception of Quest Diagnostics Receivables

Incorporated (see paragraph below), the non-guarantor subsidiaries are primarily foreign and less than wholly

owned subsidiaries. In January 2005, the Company completed its redemption of all of its outstanding Debentures

(see Note 10 for further details).

In conjunction with the Company’s Secured Receivables Credit Facility described in Note 10, the Company

maintains a wholly owned non-guarantor subsidiary, Quest Diagnostics Receivables Incorporated (“QDRI’’).

Through March 31, 2004, the Company and the Subsidiary Guarantors, with the exception of American Medical

Laboratories, Incorporated (“AML’’) and Unilab, transferred all private domestic receivables (principally

excluding receivables due from Medicare, Medicaid and other federal programs, and receivables due from

customers of its joint ventures) to QDRI. Effective with the second quarter of 2004, the Company and

Subsidiary Guarantors, including AML and Unilab, transfer all private domestic receivables to QDRI. However,

LabOne, which was acquired by Quest Diagnostics on November 1, 2005 (see Note 3), does not transfer its

private domestic receivables to QDRI. QDRI utilizes the transferred receivables to collateralize the Company’s

Secured Receivables Credit Facility. The Company and the Subsidiary Guarantors provide collection services to

QDRI. QDRI uses cash collections principally to purchase new receivables from the Company and the

Subsidiary Guarantors.

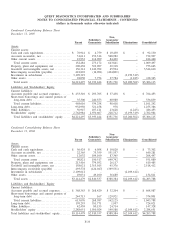

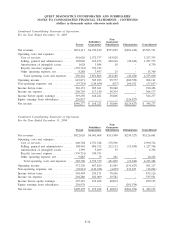

The following condensed consolidating financial data illustrates the composition of the combined guarantors.

Investments in subsidiaries are accounted for by the parent using the equity method for purposes of the

supplemental consolidating presentation. Earnings (losses) of subsidiaries are therefore reflected in the parent’s

investment accounts and earnings. The principal elimination entries relate to investments in subsidiaries and

intercompany balances and transactions. On February 28, 2003, Quest Diagnostics acquired Unilab (see Note 3),

which has been included in the accompanying condensed consolidating financial data, subsequent to the closing

of the acquisition, as a Subsidiary Guarantor. LabOne has been included in the accompanying condensed

consolidating financial data, subsequent to the closing of the acquisition, as a Subsidiary Guarantor.

F-32