Quest Diagnostics 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

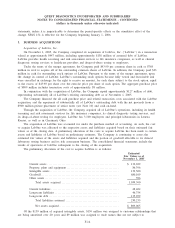

10. DEBT

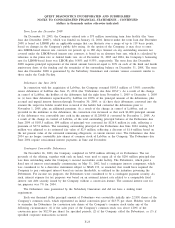

Short-term borrowings and current portion of long-term debt at December 31, 2005 and 2004 consisted of

the following:

2005 2004

Borrowings under Secured Receivables Credit Facility ......................... $ 60,000 $129,921

Senior Notes due July 2006 ................................................. 274,844 -

Contingent Convertible Debentures called for redemption in December 2004 .... - 244,660

Current portion of long-term debt ............................................ 1,995 220

Total short-term borrowings and current portion of long-term debt ........... $336,839 $374,801

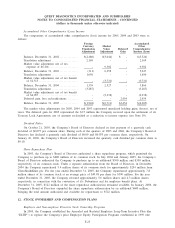

Long-term debt at December 31, 2005 and 2004 consisted of the following:

2005 2004

Industrial Revenue Bonds due September 2009 .............................. $ 7,200 $ -

Borrowings under Credit Facility ........................................... - 100,000

Term loan due December 2008 ............................................. 75,000 75,000

Senior Notes due July 2006 ................................................ - 274,531

Senior Notes due November 2010 .......................................... 399,273 -

Senior Notes due July 2011 ................................................ 274,392 274,281

Senior Notes due November 2015 .......................................... 498,427 -

Debentures due June 2034 ................................................. 2,858 -

Other ..................................................................... 231 429

Total ................................................................... 1,257,381 724,241

Less: current portion ...................................................... 1,995 220

Total long-term debt ..................................................... $1,255,386 $724,021

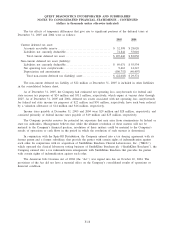

2004 Debt Refinancings

On April 20, 2004, the Company entered into a new $500 million senior unsecured revolving credit facility

which replaced a $325 million unsecured revolving credit facility. Under the new $500 million senior unsecured

revolving credit facility (the “Credit Facility’’), which matures in April 2009, interest is based on certain

published rates plus an applicable margin that will vary over an approximate range of 90 basis points based on

changes in the Company’s public debt rating. At the option of the Company, it may elect to enter into

LIBOR-based interest rate contracts for periods up to 180 days. Interest on any outstanding amounts not

covered under the LIBOR-based interest rate contracts is based on an alternate base rate, which is calculated by

reference to the prime rate or federal funds rate. As of December 31, 2005 and 2004, the Company’s borrowing

rate for LIBOR-based loans was LIBOR plus 0.50% and 0.625%, respectively. The Credit Facility is guaranteed

by the Company’s wholly owned subsidiaries that operate clinical laboratories in the United States (the

“Subsidiary Guarantors’’). The Credit Facility contains various covenants, including the maintenance of certain

financial ratios, which could impact the Company’s ability to, among other things, incur additional indebtedness.

In addition, on April 20, 2004, the Company entered into a new $300 million receivables securitization

facility which replaced a $250 million receivables securitization facility that matured in April 2004. The new

$300 million receivables securitization facility (the “Secured Receivables Credit Facility’’) matures in April 2007.

Interest on the Secured Receivables Credit Facility is based on rates that are intended to approximate

commercial paper rates for highly rated issuers. At December 31, 2005 and 2004, the Company’s borrowing

rate under the Secured Receivables Credit Facility was 4.7% and 2.7%, respectively. The Secured Receivables

Credit Facility is supported by one-year back-up facilities provided by two banks on a committed basis.

Borrowings outstanding under the Secured Receivables Credit Facility, if any, are classified as a current liability

on the Company’s consolidated balance sheet since the lenders fund the borrowings through the issuance of

commercial paper which matures at various dates within one year from the date of issuance and the term of the

one-year back-up facilities described above.

F-21