Quest Diagnostics 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

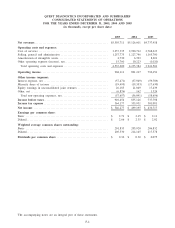

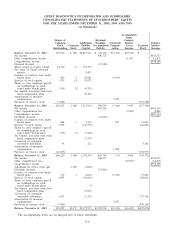

The following securities were not included in the diluted earnings per share calculation due to their

antidilutive effect (in thousands):

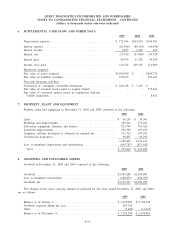

2005 2004 2003

Stock options ........................................... 337 603 4,018

Stock-Based Compensation

Statement of Financial Accounting Standards (“SFAS’’) No. 123, “Accounting for Stock-Based

Compensation’’ (“SFAS 123’’), as amended by SFAS No. 148, “Accounting for Stock-Based Compensation –

Transition and Disclosure – an amendment of FASB Statement No. 123’’ (“SFAS 148’’) encourages, but does

not require, companies to record compensation cost for stock-based compensation plans at fair value. In

addition, SFAS 148 provides alternative methods of transition for a voluntary change to the fair value based

method of accounting for stock-based employee compensation, and amends the disclosure requirements of

SFAS 123 to require prominent disclosures in both annual and interim financial statements about the method of

accounting for stock-based employee compensation and the effect of the method used on reported results.

The Company has chosen to adopt the disclosure only provisions of SFAS 148 and continue to account for

stock-based compensation using the intrinsic value method prescribed in Accounting Principles Board (“APB’’)

Opinion No. 25, “Accounting for Stock Issued to Employees’’ (“APB 25’’), and related interpretations. Under

this approach, the cost of restricted stock awards is expensed over their vesting period, while the imputed cost

of stock option grants and discounts offered under the Company’s Employee Stock Purchase Plan (“ESPP’’) is

disclosed, based on the vesting provisions of the individual grants, but not charged to expense. Stock-based

compensation expense recorded in accordance with APB 25, relating to restricted stock awards, was $2.0

million, $1.4 million and $5.3 million in 2005, 2004 and 2003, respectively.

The Company has several stock ownership and compensation plans, which are described more fully in

Note 12. The following table presents net income and basic and diluted earnings per common share, had the

Company elected to recognize compensation cost based on the fair value at the grant dates for stock option

awards and discounts granted for stock purchases under the Company’s ESPP, consistent with the method

prescribed by SFAS 123, as amended by SFAS 148 (in thousands, except per share data):

2005 2004 2003

Net income, as reported ................................. $546,277 $499,195 $436,717

Add: Stock-based compensation under APB 25 ........... 2,037 1,384 5,297

Deduct: Total stock-based compensation expense

determined under fair value method for all awards, net

of related tax effects .................................. (32,623) (43,710) (52,351)

Pro forma net income ................................... $515,691 $456,869 $389,663

Earnings per common share:

Basic – as reported ..................................... $ 2.71 $ 2.45 $ 2.11

Basic – pro forma ...................................... $ 2.56 $ 2.23 $ 1.88

Diluted – as reported .................................... $ 2.66 $ 2.35 $ 2.02

Diluted – pro forma ..................................... $ 2.50 $ 2.13 $ 1.82

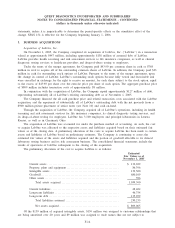

The fair value of each option granted prior to January 1, 2005 was estimated on the date of grant using

the Black-Scholes option-pricing model. The fair value of each stock option award granted subsequent to

January 1, 2005 was estimated on the date of grant using a lattice-based option valuation model. Management

believes a lattice-based option valuation model provides a more accurate measure of fair value. The expected

volatility in connection with the Black-Scholes option-pricing model was based on the historical volatility of the

Company’s stock, while the expected volatility under the lattice-based option valuation model was based on the

current and the historical implied volatilities from traded options of the Company’s stock. The weighted average

assumptions used in valuing options granted in the periods presented are:

F-9