Quest Diagnostics 2005 Annual Report Download - page 90

Download and view the complete annual report

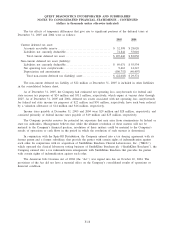

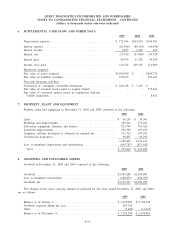

Please find page 90 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

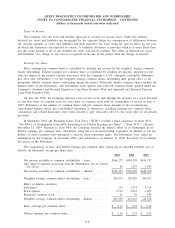

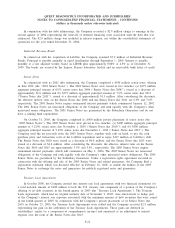

Financial Instruments

The Company’s policy for managing exposure to market risks may include the use of financial instruments,

including derivatives. The Company has established policies and procedures for risk assessment and the

approval, reporting and monitoring of derivative financial instrument activities. These policies prohibit holding or

issuing derivative financial instruments for trading purposes.

SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities’’ (“SFAS 133’’), as

amended, requires that all derivative instruments be recorded on the balance sheet at their fair value. Changes in

the fair value of derivatives are recorded each period in current earnings or other comprehensive income,

depending on whether a derivative is designated as part of a hedge transaction and, if it is, the type of hedge

transaction.

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, accounts receivable and accounts payable and accrued

expenses approximate fair value based on the short maturity of these instruments. At December 31, 2005 and

2004, the fair value of the Company’s debt was estimated at $1.6 billion and $1.2 billion, respectively, using

quoted market prices and yields for the same or similar types of borrowings, taking into account the underlying

terms of the debt instruments. At December 31, 2005 and 2004, the estimated fair value exceeded the carrying

value of the debt by $39 million and $84 million, respectively.

The Company’s Debentures had a contingent interest component that would have required the Company to

pay contingent interest based on certain thresholds, as outlined in the indenture governing such notes. The

contingent interest component, which is more fully described in Note 10, was considered to be a derivative

instrument subject to SFAS 133, as amended. The Debentures were called for redemption by the Company in

December 2004, and redeemed as of January 18, 2005. At December 31, 2004 the derivative was recorded at

its fair value in the consolidated balance sheet and was not material.

Comprehensive (Loss) Income

Comprehensive (loss) income encompasses all changes in stockholders’ equity (except those arising from

transactions with stockholders) and includes net income, net unrealized capital gains or losses on available-for-

sale securities, foreign currency translation adjustments and deferred gains related to the settlement of certain

treasury lock agreements (see Note 10).

New Accounting Standards

In December 2004, the FASB issued SFAS No. 123, revised 2004, “Share-Based Payment’’

(“SFAS 123R’’). SFAS 123R requires that companies recognize compensation cost relating to share-based

payment transactions based on the fair value of the equity or liability instruments issued. SFAS 123R is

effective for annual periods beginning after January 1, 2006. The Company adopted SFAS 123R effective

January 1, 2006 using the modified prospective approach. Under this approach, awards that are granted,

modified or settled after January 1, 2006 will be measured and accounted for in accordance with SFAS 123R.

Unvested awards that were granted prior to January 1, 2006 will continue to be accounted for in accordance

with SFAS 123 except that compensation costs will be recognized in the Company’s results of operations. The

Company expects the estimated impact of SFAS 123R to (i) reduce diluted earnings per common share by

approximately $0.20, (ii) reduce operating income as a percentage of revenues by approximately 1%, and

(iii) require the tax benefits associated with the exercise of stock options be included in cash flows from

financing activities. In 2005, tax benefits from the exercise of stock options increased cash from operations by

$33.8 million.

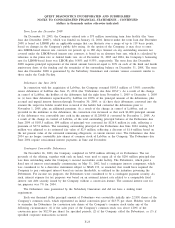

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections’’

(“SFAS 154’’), which replaces APB No. 20 “Accounting Changes’’, and SFAS No. 3 “Reporting Accounting

Changes in Interim Financial Statements’’. SFAS 154 changes the requirements for the accounting for and

reporting of a change in accounting principle, and applies to all voluntary changes in accounting principles, as

well as changes required by an accounting pronouncement in the unusual instance it does not include specific

transition provisions. Specifically, SFAS 154 requires retrospective application to prior periods’ financial

F-13