Quest Diagnostics 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

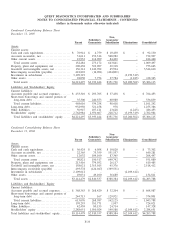

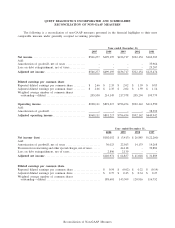

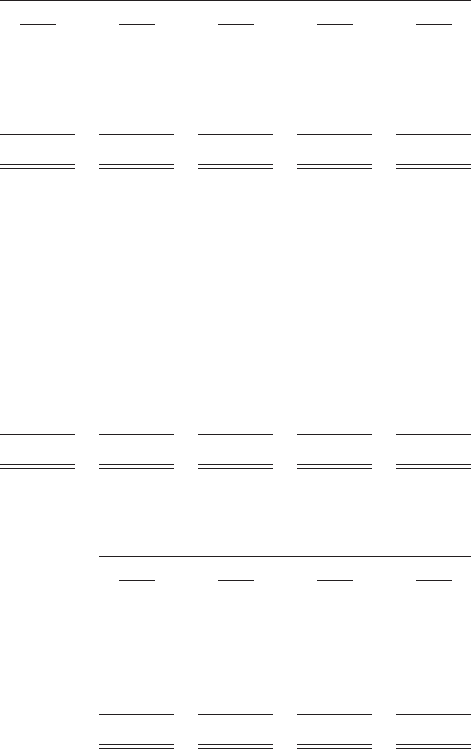

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES

The following is a reconciliation of non-GAAP measures presented in the financial highlights to their most

comparable measure under generally accepted accounting principles.

Year ended December 31,

2005 2004 2003 2002 2001

Net income ........................................ $546,277 $499,195 $436,717 $322,154 $162,303

Add:

Amortization of goodwill, net of taxes ............... ----35,964

Loss on debt extinguishment, net of taxes ............ ----25,207

Adjusted net income ............................... $546,277 $499,195 $436,717 $322,154 $223,474

Diluted earnings per common share

Reported diluted earnings per common share ......... $ 2.66 $ 2.35 $ 2.02 $ 1.59 $ 0.83

Adjusted diluted earnings per common share ......... $ 2.66 $ 2.35 $ 2.02 $ 1.59 $ 1.14

Weighted average number of common shares

outstanding—diluted .............................. 205,530 214,145 217,578 205,294 195,779

Operating income .................................. $968,111 $891,217 $796,454 $592,142 $411,550

Add:

Amortization of goodwill ............................ ----38,392

Adjusted operating income ......................... $968,111 $891,217 $796,454 $592,142 $449,942

Year ended December 31,

2000 1999 1998 1997

Net income (loss) ............................................. $102,052 $ (3,413) $ 26,885 $ (22,260)

Add:

Amortization of goodwill, net of taxes .......................... 36,023 22,013 14,133 14,268

Provision for restructuring and other special charges, net of taxes ...... - 44,118 - 39,881

Loss on debt extinguishment, net of taxes ....................... 2,896 2,139 - -

Adjusted net income .......................................... $140,971 $ 64,857 $ 41,018 $ 31,889

Diluted earnings per common share

Reported diluted earnings per common share .................... $ 0.54 $ (0.02) $ 0.22 $ (0.19)

Adjusted diluted earnings per common share .................... $ 0.75 $ 0.45 $ 0.34 $ 0.27

Weighted average number of common shares

outstanding—diluted ......................................... 188,601 143,309 120,916 116,752

Reconciliation of Non-GAAP Measures