Quest Diagnostics 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

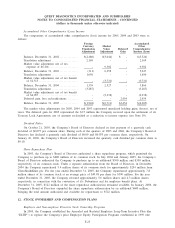

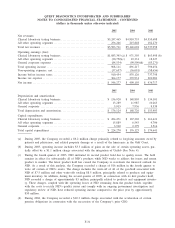

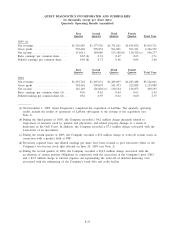

2005 2004 2003

Net revenues:

Clinical laboratory testing business ................................. $5,247,465 $4,910,753 $4,555,688

All other operating segments ....................................... 256,246 215,848 182,270

Total net revenues ................................................. $5,503,711 $5,126,601 $4,737,958

Operating earnings (loss):

Clinical laboratory testing business ................................. $1,083,395 (a) $ 971,395 $ 863,498 (b)

All other operating segments ....................................... (30,750)(c) 19,331 18,227

General corporate expenses ........................................ (84,534) (99,509)(d) (85,271)

Total operating income ............................................ 968,111 891,217 796,454

Non-operating expenses, net........................................ (57,657) (56,091) (58,656)

Income before income taxes ....................................... 910,454 835,126 737,798

Income tax expense ............................................... 364,177 335,931 301,081

Net income ....................................................... $ 546,277 $ 499,195 $ 436,717

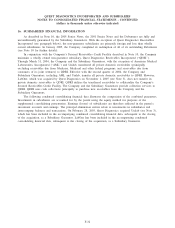

2005 2004 2003

Depreciation and amortization:

Clinical laboratory testing business ................................. $ 156,920 $ 148,803 $ 134,101

All other operating segments ....................................... 13,289 11,987 10,263

General corporate ................................................. 5,915 7,936 9,539

Total depreciation and amortization ................................. $ 176,124 $ 168,726 $ 153,903

Capital expenditures:

Clinical laboratory testing business ................................. $ 204,471 $ 167,203 $ 161,421

All other operating segments ....................................... 15,889 6,543 9,706

General corporate ................................................. 3,910 2,379 3,514

Total capital expenditures .......................................... $ 224,270 $ 176,125 $ 174,641

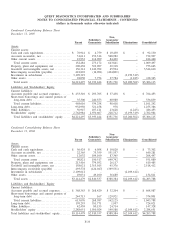

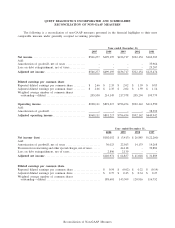

(a) During 2005, the Company recorded a $6.2 million charge primarily related to forgiving amounts owed by

patients and physicians, and related property damage as a result of the hurricanes in the Gulf Coast.

(b) During 2003, operating income includes $3.3 million of gains on the sale of certain operating assets, par-

tially offset by a $1.1 million charge associated with the integration of Unilab (See Note 4).

(c) During the fourth quarter of 2005, NID instituted its second product hold due to quality issues. The hold

remains in effect for substantially all of NID’s products while NID works to address the issues and return

product to market. The latest product hold has caused the Company to reevaluate the financial outlook for

NID. As a result of this analysis, the Company recorded a charge of $16 million in the fourth quarter to

write off certain of NID’s assets. The charge includes the write-off of all of the goodwill associated with

NID of $7.5 million and other write-offs totaling $8.5 million, principally related to products and equip-

ment inventory. In addition, during the second quarter of 2005, in connection with its first product hold,

NID recorded a charge of approximately $3 million, principally related to products and equipment invento-

ry. These charges, coupled with the operating losses at NID stemming from the product holds, together

with the costs to rectify NID’s quality issues and comply with an ongoing government investigation and

regulatory review of NID, have reduced operating income compared to the prior year by approximately

$50 million.

(d) During 2004, the Company recorded a $10.3 million charge associated with the acceleration of certain

pension obligations in connection with the succession of the Company’s prior CEO.

F-31