Quest Diagnostics 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

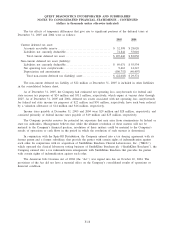

In December 2004, the Company called for redemption all of its outstanding Debentures. Under the terms

of the Debentures, the holders of the Debentures had an option to submit their Debentures for redemption at

par plus accrued and unpaid interest or convert their Debentures into shares of the Company’s common stock at

a conversion price of $43.75 per share. Through December 31, 2004, $3.2 million of principal of the

Debentures were converted into less than 0.1 million shares of the Company’s common stock. The outstanding

principal of the Debentures at December 31, 2004 was classified as a current liability within short-term

borrowings and current portion of long-term debt on the Company’s consolidated balance sheet. As of January

18, 2005, the redemption was completed and $0.4 million of principal was redeemed for cash and $249.6

million of principal was converted into approximately 5.7 million shares of the Company’s common stock.

Letter of Credit Lines

The Company has two lines of credit with two financial institutions totaling $85 million for the issuance of

letters of credit (the “letter of credit lines’’). The letter of credit lines mature in December 2006 and are

guaranteed by the Subsidiary Guarantors. As of December 31, 2005, there are $69 million of outstanding letters

of credit under the letter of credit lines.

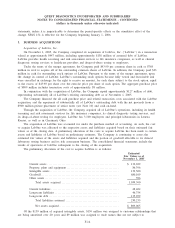

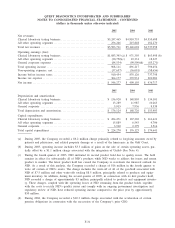

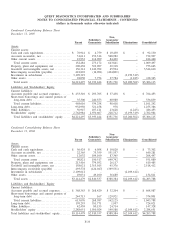

As of December 31, 2005 long-term debt, including capital leases, maturing in each of the years

subsequent to December 31, 2006, is as follows:

Year ending December 31,

2007........................................................................ $ 16,829

2008........................................................................ 61,806

2009........................................................................ 1,800

2010........................................................................ 399,273

2011........................................................................ 274,392

Thereafter ................................................................... 501,286

Total long-term debt ....................................................... $1,255,386

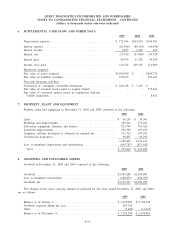

11. PREFERRED STOCK AND COMMON STOCKHOLDERS’ EQUITY

Series Preferred Stock

Quest Diagnostics is authorized to issue up to 10 million shares of Series Preferred Stock, par value $1.00

per share. The Company’s Board of Directors has the authority to issue such shares without stockholder

approval and to determine the designations, preferences, rights and restrictions of such shares. Of the authorized

shares, 1,300,000 shares have been designated Series A Preferred Stock and 1,000 shares have been designated

Voting Cumulative Preferred Stock. No shares are currently outstanding.

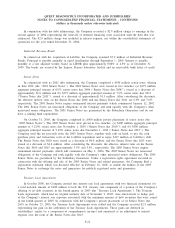

Preferred Share Purchase Rights

Each share of Quest Diagnostics common stock trades with a preferred share purchase right, which entitles

stockholders to purchase one-hundredth of a share of Series A Preferred Stock upon the occurrence of certain

events. In conjunction with the SBCL acquisition, the Board of Directors of the Company approved an

amendment to the preferred share purchase rights. The amended rights entitle stockholders to purchase shares of

Series A Preferred Stock at a predefined price in the event a person or group (other than SmithKline Beecham)

acquires 20% or more of the Company’s outstanding common stock. The preferred share purchase rights expire

December 31, 2006.

F-24