Quest Diagnostics 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividend Policy

During each of the quarters of 2005 and 2004, our Board of Directors has declared a quarterly cash

dividend of $0.09 and $0.075 per common share, respectively. On January 26, 2006, our Board of Directors

declared a quarterly cash dividend per common share of $0.10, payable on April 19, 2006, to shareholders of

record on April 5, 2006. We expect to fund future dividend payments with cash flows from operations, and do

not expect the dividend to have a material impact on our ability to finance future growth.

Share Repurchase Plan

For the year ended December 31, 2005, we repurchased approximately 7.8 million shares of our common

stock at an average price of $49.98 per share for $390 million. Through December 31, 2005, we have

repurchased approximately 32.4 million shares of our common stock at an average price of $42.61 for $1.4

billion under our share repurchase program. At December 31, 2005, the total available for repurchases under the

remaining authorizations was $122 million. In January 2006, our Board of Directors expanded the share

repurchase authorization by an additional $600 million, bringing the total amount authorized and available for

repurchases to $722 million.

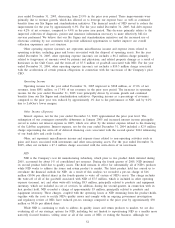

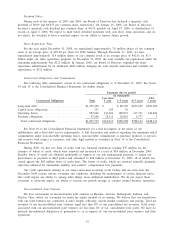

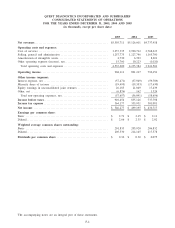

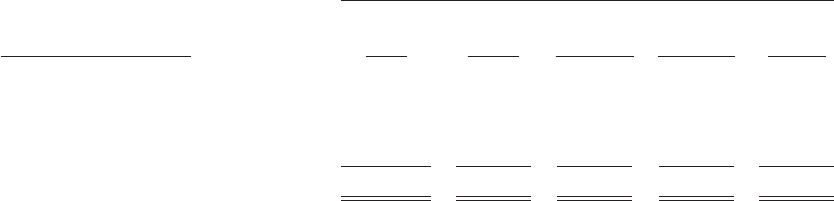

Contractual Obligations and Commitments

The following table summarizes certain of our contractual obligations as of December 31, 2005. See Notes

10 and 14 to the Consolidated Financial Statements for further details.

Payments due by period

(in thousands)

Less than After

Contractual Obligations Total 1 year 1–3 years 4–5 years 5 years

Long-term debt ................................... $1,255,350 $ - $ 80,399 $673,665 $501,286

Capital lease obligations .......................... 231 195 36 - -

Operating leases .................................. 587,026 134,406 188,057 117,721 146,842

Purchase obligations .............................. 55,108 28,312 20,016 6,777 3

Total contractual obligations ..................... $1,897,715 $162,913 $288,508 $798,163 $648,131

See Note 10 to the Consolidated Financial Statements for a full description of the terms of our

indebtedness and related debt service requirements. A full discussion and analysis regarding our minimum rental

commitments under noncancelable operating leases, noncancelable commitments to purchase products or services,

and reserves with respect to insurance and other legal matters is contained in Note 14 to the Consolidated

Financial Statements.

During 2005, we had two lines of credit with two financial institutions totaling $75 million for the

issuance of letters of credit, which were renewed and increased to a total of $85 million in December 2005.

Standby letters of credit are obtained, principally in support of our risk management program, to ensure our

performance or payment to third parties and amounted to $69 million at December 31, 2005, all of which was

issued against the $85 million letter of credit lines. The letters of credit, which are renewed annually, primarily

represent collateral for automobile liability and workers’ compensation loss payments.

Our credit agreements relating to our senior unsecured revolving credit facility and our term loan due

December 2008 contain various covenants and conditions, including the maintenance of certain financial ratios,

that could impact our ability to, among other things, incur additional indebtedness. We do not expect these

covenants to adversely impact our ability to execute our growth strategy or conduct normal business operations.

Unconsolidated Joint Ventures

We have investments in unconsolidated joint ventures in Phoenix, Arizona; Indianapolis, Indiana; and

Dayton, Ohio, which are accounted for under the equity method of accounting. We believe that our transactions

with our joint ventures are conducted at arm’s length, reflecting current market conditions and pricing. Total net

revenues of our unconsolidated joint ventures equal less than 6% of our consolidated net revenues. Total assets

associated with our unconsolidated joint ventures are less than 2% of our consolidated total assets. We have no

material unconditional obligations or guarantees to, or in support of, our unconsolidated joint ventures and their

operations.

57