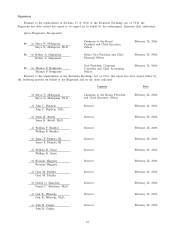

Quest Diagnostics 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.year ended December 31, 2005, decreasing from 23.9% in the prior year period. These improvements were

primarily due to revenue growth, which has allowed us to leverage our expense base, as well as continued

benefits from our Six Sigma and standardization initiatives. The financial results of NID served to reduce the

improvement for the year by approximately 0.3%. For the year ended December 31, 2005, bad debt expense

was 4.2% of net revenues, compared to 4.4% in the prior year period. This decrease primarily relates to the

improved collection of diagnosis, patient and insurance information necessary to more effectively bill for

services performed. We believe that our Six Sigma and standardization initiatives and the increased use of

electronic ordering by our customers will provide additional opportunities to further improve our overall

collection experience and cost structure.

Other operating expense (income), net represents miscellaneous income and expense items related to

operating activities, including gains and losses associated with the disposal of operating assets. For the year

ended December 31, 2005, other operating expense (income), net includes a $6.2 million charge primarily

related to forgiveness of amounts owed by patients and physicians, and related property damage as a result of

hurricanes in the Gulf Coast, and the write-off of $7.5 million of goodwill associated with NID. For the year

ended December 31, 2004, other operating expense (income), net includes a $10.3 million charge associated

with the acceleration of certain pension obligations in connection with the succession of the Company’s prior

CEO.

Operating Income

Operating income for the year ended December 31, 2005 improved to $968 million, or 17.6% of net

revenues, from $891 million, or 17.4% of net revenues, in the prior year period. The increases in operating

income for the year ended December 31, 2005 were principally driven by revenue growth and continued

benefits from our Six Sigma and standardization initiatives. Operating income as a percentage of revenues

compared to the prior year was reduced by approximately 1% due to the performance at NID, and by 0.2%

due to LabOne’s lower margins.

Other Income (Expense)

Interest expense, net for the year ended December 31, 2005 approximated the prior year level. The

redemption of our contingent convertible debentures in January 2005 and increased interest income principally

served to reduce net interest expense in 2005, which was offset by the interest expense related to the financing

of the LabOne acquisition. Interest expense, net for the year ended December 31, 2004 included a $2.9 million

charge representing the write-off of deferred financing costs associated with the second quarter 2004 refinancing

of our bank debt and credit facility.

Other, net represents miscellaneous income and expense items related to non-operating activities such as

gains and losses associated with investments and other non-operating assets. For the year ended December 31,

2005, other, net includes a $7.1 million charge associated with the write-down of an investment.

NID

NID is the Company’s test kit manufacturing subsidiary, which prior to two product holds initiated during

2005, accounted for about 1% of consolidated net revenues. During the fourth quarter of 2005, NID instituted

its second product hold due to quality issues. The hold remains in effect for substantially all of NID’s products

while NID works to address the issues and return product to market. The latest product hold has caused us to

reevaluate the financial outlook for NID. As a result of this analysis we recorded a pre-tax charge of $16

million ($0.06 per diluted share) in the fourth quarter to write off certain of NID’s assets. The charge includes

the write-off of all of the goodwill associated with NID of $7.5 million, which is included in other operating

expense (income), net, and other write-offs totaling $8.5 million, principally related to products and equipment

inventory, which are included in cost of services. In addition, during the second quarter, in connection with its

first product hold, NID recorded a charge of approximately $3 million, principally related to products and

equipment inventory. These charges, coupled with the operating losses at NID stemming from the product holds,

together with the costs to rectify NID’s quality issues and comply with an ongoing government investigation

and regulatory review of NID, have reduced pre-tax earnings compared to the prior year by approximately $50

million or $0.16 per diluted share.

While NID is continuing to work to address its quality issues and return products to market, we are also

evaluating all of our strategic options for NID, including but not limited to repositioning NID as a smaller more

narrowly focused business, selling some or all of the assets of NID, or exiting the business. Although we

52