Quest Diagnostics 2005 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

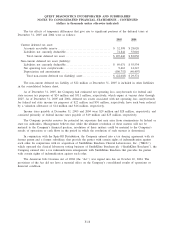

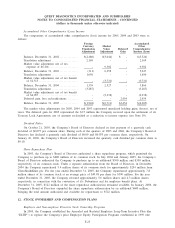

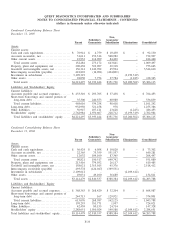

The following relates to options outstanding at December 31, 2005:

Options Outstanding Options Exercisable

Weighted Average

Remaining Weighted Weighted

Range of Shares Contractual Life Average Shares Average

Exercise Price (in thousands) (in years) Exercise Price (in thousands) Exercise Price

$ 3.97 - $ 5.10 ..... 86 2.5 $ 4.36 86 $ 4.36

$ 6.46 - $ 9.58 ..... 842 3.7 6.84 842 6.84

$15.03 - $22.38 ..... 245 4.4 15.26 245 15.26

$23.27 - $34.79 ..... 5,457 6.6 26.35 4,320 26.42

$35.01 - $52.50 ..... 7,895 7.2 42.45 3,160 39.59

$52.62 - $53.27 ..... 523 6.4 53.25 7 52.84

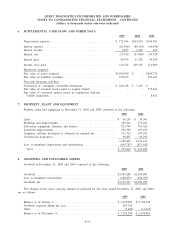

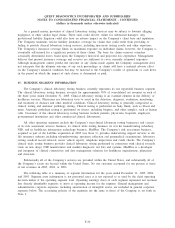

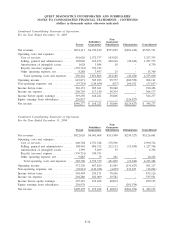

The following summarizes the activity relative to incentive stock awards granted in 2005, 2004 and 2003

(shares in thousands):

2005 2004 2003

Incentive shares, beginning of year ....................................... - 576 1,470

Incentive shares granted ................................................. 113 - 204

Incentive shares vested .................................................. (1) (538) (1,066)

Incentive shares forfeited and canceled ................................... (5) (38) (32)

Incentive shares, end of year ............................................ 107 - 576

Weighted average fair value of incentive shares at grant date .............. $49.71 $ - $ 24.94

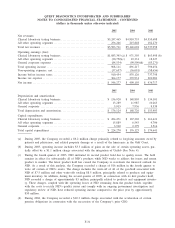

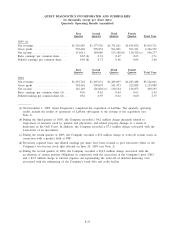

Employee Stock Purchase Plan

Under the Company’s Employee Stock Purchase Plan (“ESPP’’), substantially all employees can elect to

have up to 10% of their annual wages withheld to purchase Quest Diagnostics common stock. The purchase

price of the stock is 85% of the lower of its beginning-of-quarter or end-of-quarter market price. In 2005, the

Company’s ESPP was amended such that effective July 1, 2005, the purchase price of the stock will be 85% of

the market price of the Company’s common stock on the last business day of each calendar month. Under the

ESPP, the maximum number of shares of Quest Diagnostics common stock which may be purchased by eligible

employees is 8 million. The ESPP will terminate effective December 31, 2006. The Company plans to submit

for approval by the shareholders at its 2006 Annual Meeting of Shareholders an extension of the plan.

Approximately 409, 460 and 544 thousand shares of common stock were purchased by eligible employees in

2005, 2004 and 2003, respectively.

Defined Contribution Plan

The Company maintains a qualified defined contribution plan covering substantially all of its employees,

and matches employee contributions up to a maximum of 6%. The Company’s expense for contributions to its

defined contribution plan aggregated $64 million, $62 million and $54 million for 2005, 2004 and 2003,

respectively.

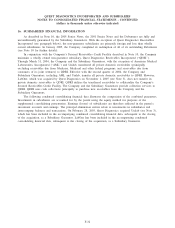

Supplemental Deferred Compensation Plan

The Company’s supplemental deferred compensation plan is an unfunded, non-qualified plan that provides

for certain management and highly compensated employees to defer up to 50% of their eligible compensation in

excess of their defined contribution plan limits. In addition, certain members of senior management have an

additional opportunity to defer up to 95% of their variable incentive compensation. The compensation deferred

under this plan, together with Company matching amounts, are credited with earnings or losses measured by the

mirrored rate of return on investments elected by plan participants. Each plan participant is fully vested in all

deferred compensation, Company match and earnings credited to their account. Although the Company is

currently contributing all participant deferrals and matching amounts to a trust, the funds in the trust, totaling

$25.7 million and $20.9 million at December 31, 2005 and 2004, respectively, are general assets of the

F-27