Quest Diagnostics 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.by physicians. The OIG issued a proposed “safe harbor’’ exception from the federal anti-kickback laws for

certain electronic e-prescribing arrangements and CMS issued a virtually identical proposed exception to the

federal self-referral prohibition laws with regard to these same types of e-prescribing arrangements. In addition,

CMS issued proposed exceptions to the federal self-referral prohibition laws with regard to certain Electronic

Health Record (EHR) arrangements. If these regulations are adopted as proposed, certain providers other than

clinical laboratories would be able to provide broader packages of HIT items or services than laboratories which

could create incentives for some customers to choose such providers. We are commenting on the proposed rules

through our industry trade association, ACLA, reflecting our position that if any providers are permitted to be

donors of e-prescribing or EHR items or services, then all providers should be entitled to the same protections

afforded by the proposed safe harbor and self-referral prohibition exceptions.

Integrating our operations with LabOne may be difficult and, if unsuccessfully executed, may have a

material adverse effect on our business.

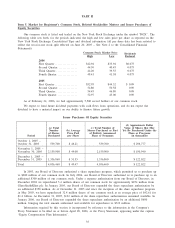

On November 1, 2005, we completed the acquisition of LabOne in a transaction valued at approximately

$947 million, including approximately $138 million of assumed debt of LabOne. LabOne reported revenues of

$468 million for the year ended December 31, 2004. The acquisition involves the integration of a separate

company that previously operated independently and has different systems, processes and cultures. The process

of combining LabOne with our operations may be disruptive to both of our businesses and may cause an

interruption of, or a loss of momentum in, such businesses as a result of the following difficulties, among

others:

•loss of key customers or employees;

•failure to maintain the quality of services that our company has historically provided;

•diversion of management’s attention from the day-to-day business of our company as a result of the need

to deal with the foregoing disruptions and difficulties; and

•the added costs of dealing with such disruptions.

In addition, because most of our clinical laboratory testing is performed under arrangements that are

terminable at will or on short notice, any such interruption of or deterioration in our services may result in a

customer’s decision to stop using us for clinical laboratory testing. We cannot assure you that we will be able

to retain key technical and management personnel or that we will realize the anticipated benefits of the LabOne

acquisition, either at all or in a timely manner. Additionally, as part of our growth strategy, we may in the

future acquire additional clinical laboratories or other healthcare-related businesses, which could have integration

risks.

The acquisition of LabOne may not produce the anticipated benefits.

Even if we are able to successfully complete the integration of the operations of LabOne, we may not be

able to realize all or any of the benefits that we expect to result from such integration. We expect the

acquisition to generate annual synergies of approximately $30 million upon the completion of integration, which

is expected to occur within two years of closing. However, there can be no assurance that such synergies will

be realized.

Failure to timely or accurately bill for our services could have a material adverse effect on our net

revenues and bad debt expense.

Billing for laboratory services is extremely complicated. We provide testing services to a broad range of

healthcare providers. We consider a “payer’’ to be the party that pays for the test and a “customer’’ to be the

party who refers the test to us. Depending on the billing arrangement and applicable law, we must bill various

payers, such as patients, insurance companies, Medicare, Medicaid, physicians and employer groups, all of

which have different billing requirements. Additionally, auditing for compliance with applicable laws and

regulations as well as internal compliance policies and procedures adds further complexity to the billing process.

Among many other factors complicating billing are:

•differences between our fee schedules and the reimbursement rates of the payers;

•disparity in coverage and information requirements among various carriers;

25