Quest Diagnostics 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

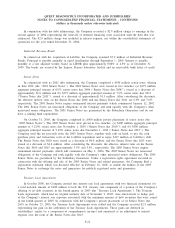

Company believes that the leasehold improvements on the leased properties are significantly more valuable than

the related lease obligations. Based on the circumstances above, no liability has been recorded for any potential

contingent obligations related to the land leases. The Company has certain noncancelable commitments to

purchase products or services from various suppliers, mainly for telecommunications and standing orders to

purchase reagents and other laboratory supplies. At December 31, 2005, the approximate total future purchase

commitments are $55 million, of which $28 million are expected to be incurred in 2006.

In support of its risk management program, the Company has standby letters of credit issued under its

letter of credit lines to ensure its performance or payment to third parties, which amounted to $69 million at

December 31, 2005. The letters of credit, which are renewed annually, primarily represent collateral for current

and future automobile liability and workers’ compensation loss payments.

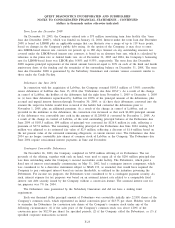

The Company has entered into several settlement agreements with various government and private payers

during recent years relating to industry-wide billing and marketing practices that had been substantially

discontinued by the mid-1990s. The federal or state governments may bring additional claims based on new

theories as to the Company’s practices which management believes to be in compliance with law. In addition,

certain federal and state statues, including the qui tam provisions of the federal False Claims Act, allow private

individuals to bring lawsuits against healthcare companies on behalf of government or private payers alleging

inappropriate billing practices. The Company is aware of certain pending lawsuits related to billing practices

filed under the qui tam provisions of the False Claims Act and other federal and state statutes. These lawsuits

include class action and individual claims by patients arising out of the Company’s billing practices. In addition,

the Company is involved in various legal proceedings arising in the ordinary course of business. Some of the

proceedings against the Company involve claims that are substantial in amount.

During the fourth quarter of 2004, the Company and its test kit manufacturing subsidiary, NID, each

received a subpoena from the United States Attorney’s Office for the Eastern District of New York. The

Company and NID have been cooperating with the United States Attorney’s Office. In connection with such

cooperation, the Company has been providing information and producing various business records of NID and

the Company, including documents related to testing and test kits manufactured by NID. This investigation by

the United States Attorney’s Office could lead to civil and criminal damages, fines and penalties and additional

liabilities from third party claims. In the second and third quarters of 2005, the U.S. Food and Drug

Administration (“FDA’’) conducted an inspection of NID and issued a Form 483 listing the observations made

by the FDA during the course of the inspection. NID is cooperating with the FDA and has filed its responses

to the Form 483. Noncompliance with the FDA regulatory requirements or failure to take adequate and timely

corrective action could lead to regulatory or enforcement action against NID and/or the Company, including, but

not limited to, a warning letter, injunction, suspension of production and/or distribution, seizure or recall of

products, fines or penalties, denial of pre-market clearance for new or changed products, recommendation

against award of government contracts and criminal prosecution.

During the second quarter of 2005, the Company received a subpoena from the United States Attorney’s

Office for the District of New Jersey. The subpoena seeks the production of business and financial records

regarding capitation and risk sharing arrangements with government and private payers for the years 1993

through 1999. Also, during the third quarter of 2005, the Company received a subpoena from the U.S.

Department of Health and Human Services, Office of the Inspector General. The subpoena seeks the production

of various business records including records regarding our relationship with health maintenance organizations,

independent physician associations, group purchasing organizations, and preferred provider organizations from

1995 to the present. The Company is cooperating with the United States Attorney’s Office and the Office of the

Inspector General.

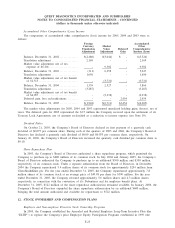

Management has established reserves in accordance with generally accepted accounting principles for the

matters discussed above. Although management cannot predict the outcome of such matters, management does

not anticipate that the ultimate outcome of such matters will have a material adverse effect on the Company’s

financial condition but may be material to the Company’s results of operations or cash flows in the period in

which the impact of such matters is determined or paid. However, the Company understands that there may be

pending qui tam claims brought by former employees or other “whistle blowers’’, or other pending claims as to

which the Company has not been provided with a copy of the complaint and accordingly cannot determine the

extent of any potential liability.

F-29