Quest Diagnostics 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

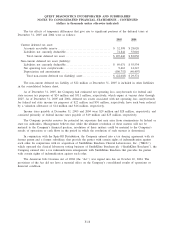

the collection and testing of specimens, as well as administrative and other support functions. Of the $9 million

in costs, $7.9 million was recorded in the fourth quarter of 2003 and related to actions that impact the

employees and operations of Unilab, was accounted for as a cost of the Unilab acquisition and included in

goodwill. Of the $7.9 million, $6.8 million related to employee severance benefits for approximately 150

employees, with the remainder primarily related to contractual obligations. In addition, $1.1 million of

integration costs, related to actions that impact Quest Diagnostics’ employees and operations and comprised

principally of employee severance benefits for approximately 30 employees, were accounted for as a charge to

earnings in the third quarter of 2003 and included in “other operating expense (income), net’’ within the

consolidated statements of operations. As of December 31, 2004, accruals related to the Unilab integration plan

totaled $3.0 million. The actions associated with the Unilab integration plan, including those related to severed

employees, were completed in 2005. The remaining accruals associated with the Unilab integration were not

material at December 31, 2005.

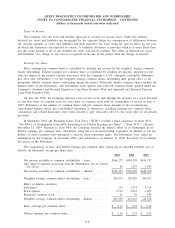

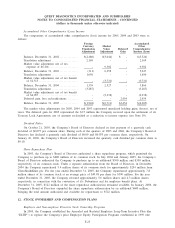

5. TAXES ON INCOME

The Company’s pretax income consisted of $904 million, $826 million and $736 million from U.S.

operations and approximately $6.0 million, $9.1 million and $1.4 million from foreign operations for the years

ended December 31, 2005, 2004 and 2003, respectively.

The components of income tax expense (benefit) for 2005, 2004 and 2003 were as follows:

2005 2004 2003

Current:

Federal ............................................................ $298,991 $233,635 $214,729

State and local ..................................................... 62,232 50,527 51,771

Foreign ............................................................ 2,293 (682) 728

Deferred:

Federal ............................................................ (2,320) 41,316 29,271

State and local ..................................................... 2,981 11,135 4,582

Total ............................................................ $364,177 $335,931 $301,081

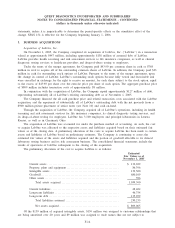

A reconciliation of the federal statutory rate to the Company’s effective tax rate for 2005, 2004 and 2003

was as follows:

2005 2004 2003

Tax provision at statutory rate ......................................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit ..................... 4.6 4.6 5.0

Impact of foreign operations .......................................... 0.1 0.1 0.2

Non-deductible meals and entertainment expense ....................... 0.2 0.2 0.3

Other, net ............................................................ 0.1 0.3 0.3

Effective tax rate ................................................... 40.0% 40.2% 40.8%

F-17