Quest Diagnostics 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)

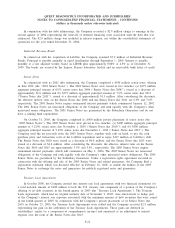

combined financial information for the year ended December 31, 2003 assumes that the Unilab acquisition and

the Divestiture were completed on January 1, 2003 (in thousands, except per share data):

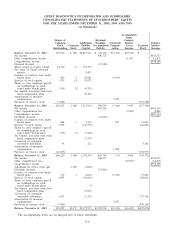

2005 2004 2003

Net revenues .................................................... $5,936,600 $5,610,919 $4,803,875

Net income ..................................................... 547,643 497,758 444,944

Basic earnings per common share:

Net income ..................................................... $ 2.71 $ 2.44 $ 2.13

Weighted average common shares outstanding – basic ............. 201,833 203,920 209,104

Diluted earnings per common share:

Net income ..................................................... $ 2.66 $ 2.34 $ 2.04

Weighted average common shares outstanding – diluted ............ 205,530 214,145 219,872

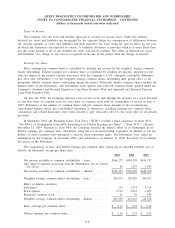

The unaudited pro forma combined financial information presented above reflects certain reclassifications to

the historical financial statements of LabOne and Unilab to conform the acquired companies’ accounting policies

and classification of certain costs and expenses to that of Quest Diagnostics. These adjustments had no impact

on pro forma net income. Pro forma results for the year ended December 31, 2005 exclude $14.3 million of

transaction related costs, which were incurred and expensed by LabOne in conjunction with its acquisition by

Quest Diagnostics. Pro forma results for the year ended December 31, 2003 exclude $14.5 million of

transaction related costs, which were incurred and expensed by Unilab in conjunction with its acquisition by

Quest Diagnostics.

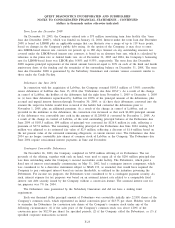

4. INTEGRATION OF ACQUIRED BUSINESSES

In July 2002, the FASB issued SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal

Activities’’ (“SFAS 146’’). SFAS 146, which the Company adopted effective January 1, 2003, requires that a

liability for a cost associated with an exit activity, including those related to employee termination benefits and

contractual obligations, be recognized when the liability is incurred, and not necessarily the date of an entity’s

commitment to an exit plan, as under previous accounting guidance. The provisions of SFAS 146 apply to

integration costs associated with actions that impact the employees and operations of Quest Diagnostics. Costs

associated with actions that impact the employees and operations of an acquired company, such as LabOne or

Unilab, are accounted for as a cost of the acquisition and included in goodwill in accordance with EITF

No. 95-3, “Recognition of Liabilities in Connection with a Purchase Business Combination’’.

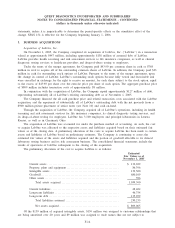

Integration of LabOne, Inc.

The plan and related costs associated with the integration of LabOne’s operations into the Company’s

laboratory network have not been finalized, as such, management has not yet finalized its estimate of integration

costs. Mangement expects a significant portion of these costs will require cash outlays and will primarily relate

to severance and other integration-related costs, including the elimination of excess capacity and workforce

reductions.

Integration of Unilab Corporation

During the fourth quarter of 2003, the Company finalized its plan related to the integration of Unilab into

Quest Diagnostics’ laboratory network. As part of the plan, following the sale of certain assets to LabCorp as

part of the Divestiture, the Company closed its previously owned clinical laboratory in the San Francisco Bay

area and completed the integration of remaining customers in the northern California area into its laboratories in

San Jose and Sacramento. As of December 31, 2005, the Company operated two laboratories in the Los

Angeles metropolitan area. As part of the integration plan, the Company plans to open a new regional

laboratory in the Los Angeles metropolitan area into which it will integrate all of its business in the area. The

Company expects to integrate its business into this new facility during the first quarter of 2006.

During 2003, the Company recorded $9 million of costs associated with executing the Unilab integration

plan. The majority of these integration costs related to employee severance and contractual obligations associated

with leased facilities and equipment. Employee groups affected as a result of this plan include those involved in

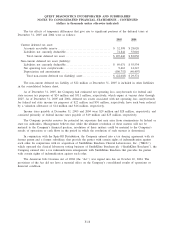

F-16