Quest Diagnostics 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Administration, or FDA, and other international regulatory authorities to assess the safety and efficacy of new

drugs. We have clinical trials testing centers in the United States and in the United Kingdom. We also provide

clinical trials testing in Australia, Singapore and South Africa through arrangements with third parties. Clinical

trials involving new drugs are increasingly being performed both inside and outside the United States.

Approximately 50% of our net revenues from clinical trials testing in 2005 represented testing for

GlaxoSmithKline plc, or GSK. We currently have a long-term contractual relationship with GSK, under which

we are the primary provider of testing to support GSK’s clinical trials testing requirements worldwide.

Other Services and Products

We manufacture and market diagnostic test kits and systems primarily for esoteric testing through our

Nichols Institute Diagnostics subsidiary. These are sold principally to hospitals, clinical laboratories and dialysis

centers, both domestically and internationally.

Our MedPlus subsidiary is a developer and integrator of clinical connectivity and data management

solutions for healthcare organizations, physicians and clinicians primarily through its ChartMaxx威 electronic

medical record system for hospitals and our Care360 suite of products. The Care360 Physician Portal was

developed by MedPlus and enables physicians to order diagnostic tests and review laboratory results from Quest

Diagnostics online. In addition, the Care360 Physician Portal enables physicians to electronically prescribe

medications, view clinical and administrative information from multiple sources, file certain documents into a

patient-centric health record maintained in our repository and share confidential patient information with medical

colleagues in a manner that is consistent with HIPAA privacy and security requirements.

Payers and Customers

We provide testing services to a broad range of healthcare providers. We consider a “payer’’ as the party

that pays for the test and a “customer’’ as the party who refers the test to us. Depending on the billing

arrangement and applicable law, the payer may be (1) the physician or other party (such as a hospital, another

laboratory or an employer) who referred the testing to us, (2) the patient, or (3) a third party who pays the bill

for the patient, such as an insurance company, Medicare or Medicaid. Some states, including New York, New

Jersey and Rhode Island, prohibit us from billing physician clients. During 2005, only three customers

accounted for 5% or more of our net revenues, and no single customer accounted for more than 8% of our net

revenues. We believe that the loss of any one of our customers would not have a material adverse effect on our

financial condition, results of operations or cash flows.

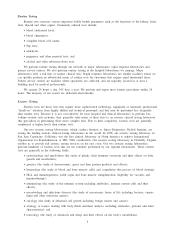

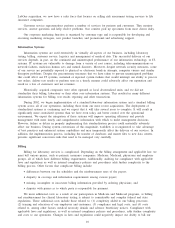

The following table shows current estimates of the breakdown of the percentage of our total volume of

requisitions and net revenues associated with our clinical laboratory testing business during 2005 applicable to

each payer group:

Net Revenues

as % of

Total

Requisition Volume Clinical Laboratory

as % of Testing

Total Volume Net Revenues

Patient ............................................... 2% – 5% 5% – 10%

Medicare and Medicaid ................................ 15% – 20% 15% – 20%

Physicians, Hospitals, Employers and Other

Monthly-Billed Clients .............................. 30% – 35% 20% – 25%

Healthcare Insurers-Fee-for-Service ..................... 30% – 35% 40% – 45%

Healthcare Insurers-Capitated........................... 15% – 20% 5% – 10%

Physicians

Physicians requiring testing for patients are the primary referral source of our clinical laboratory testing

volume. Testing referred by physicians is typically billed to healthcare insurers, government programs such as

Medicare and Medicaid, patients and physicians. Physicians are typically billed on a fee-for-service basis based

on negotiated fee schedules. Fees billed to patients and healthcare insurers are based on the laboratory’s patient

fee schedule, subject to any limitations on fees negotiated with the healthcare insurers or with physicians on

7