Quest Diagnostics 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•missing, incomplete or inaccurate billing information provided by ordering physicians; and

•disputes with payers as to which party is responsible for payment.

We incur additional costs as a result of our participation in Medicare and Medicaid programs, as billing

and reimbursement for clinical laboratory testing is subject to considerable and complex federal and state

regulations. These additional costs include those related to: (1) complexity added to our billing processes;

(2) training and education of our employees and customers; (3) compliance and legal costs; and (4) costs

related to, among other factors, medical necessity denials and advanced beneficiary notices. Compliance with

applicable laws and regulations, as well as internal compliance policies and procedures, adds further complexity

and costs to the billing process. Changes in laws and regulations could negatively impact our ability to bill our

clients. CMS establishes procedures and continuously evaluates and implements changes to the reimbursement

process.

We believe that much of our bad debt expense, which was 4.2% of our net revenues for the year ended

December 31, 2005, is primarily the result of missing or incorrect billing information on requisitions received

from healthcare providers and the failure of patients to pay the portion of the receivable that is their

responsibility, rather than credit related issues. In general, we perform the requested tests and report test results

regardless of whether the billing information is incorrect or missing. We subsequently attempt to contact the

healthcare provider or patient to obtain any missing information and rectify incorrect billing information.

Missing or incorrect information on requisitions adds complexity to and slows the billing process, creates

backlogs of unbilled requisitions, and generally increases the aging of accounts receivable and bad debt expense.

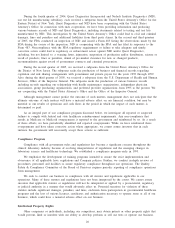

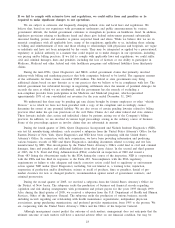

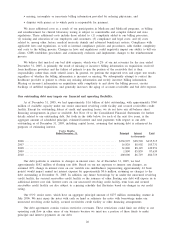

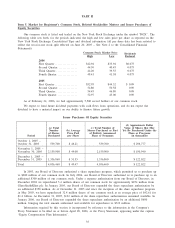

Our outstanding debt may impair our financial and operating flexibility.

As of December 31, 2005, we had approximately $1.6 billion of debt outstanding, with approximately $740

million of available capacity under our senior unsecured revolving credit facility and secured receivables credit

facility. Except for outstanding letters of credit and operating leases, we do not have any off-balance sheet

financing arrangements in place or available. See Note 10 to the Consolidated Financial Statements for further

details related to our outstanding debt. Set forth in the table below, for each of the next five years, is the

aggregate amount of scheduled principal, estimated interest and total payments with respect to our debt

outstanding as of December 31, 2005, including capital leases, assuming that maturing debt is refinanced for

purposes of estimating interest.

Twelve Months

Ended December 31, Principal Interest Total

(in thousands)

2006 ...................................................................... $336,995 $98,520 $435,515

2007 ...................................................................... 16,829 88,902 105,731

2008 ...................................................................... 61,806 88,145 149,951

2009 ...................................................................... 1,800 85,839 87,639

2010 ...................................................................... 400,000 86,719 486,719

Our debt portfolio is sensitive to changes in interest rates. As of December 31, 2005, we had

approximately $142 million of floating rate debt. Based on our net exposure to interest rate changes, an

assumed 10% change in interest rates on our variable rate indebtedness (representing approximately 44 basis

points) would impact annual net interest expense by approximately $0.6 million, assuming no changes to the

debt outstanding at December 31, 2005. In addition, any future borrowings by us under the unsecured revolving

credit facility, the secured receivables credit facility or the issuance of other floating rate debt will expose us to

additional interest rate risk. Interest rates on our unsecured revolving credit facility, term loan and secured

receivables credit facility are also subject to a pricing schedule that fluctuates based on changes in our credit

rating.

Our 6

3

⁄

4

% senior notes, which have an aggregate principal amount of $275 million outstanding, mature in

July 2006. We may repay the notes with cash on hand or refinance the notes with borrowings under our

unsecured revolving credit facility, secured receivables credit facility or other financing arrangements.

Our debt agreements contain various restrictive covenants. These restrictions could limit our ability to use

operating cash flow in other areas of our business because we must use a portion of these funds to make

principal and interest payments on our debt.

26