Pottery Barn 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

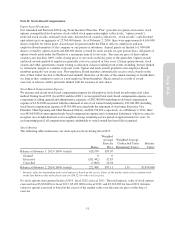

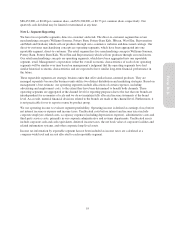

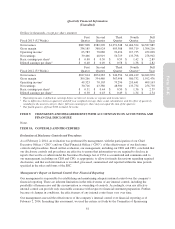

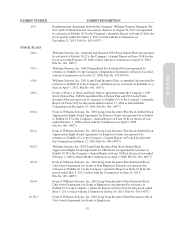

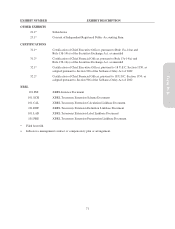

Quarterly Financial Information

(Unaudited)

Dollars in thousands, except per share amounts

Fiscal 2013 (52 Weeks)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Full

Year

Net revenues $887,808 $982,209 $1,051,548 $1,466,324 $4,387,889

Gross margin 334,185 368,924 405,388 595,719 1,704,216

Operating income163,783 78,086 92,494 217,735 452,098

Net earnings 39,466 48,919 56,719 133,798 278,902

Basic earnings per share2$ 0.40 $ 0.50 $ 0.59 $ 1.42 $ 2.89

Diluted earnings per share2$ 0.40 $ 0.49 $ 0.58 $ 1.38 $ 2.82

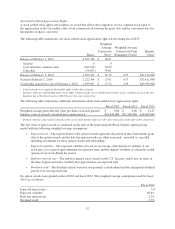

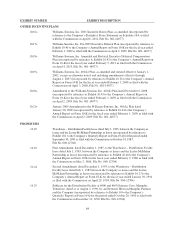

Fiscal 2012 (53 Weeks)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter3

Full

Year

Net revenues $817,614 $874,283 $ 944,554 $1,406,419 $4,042,870

Gross margin 309,266 334,480 367,998 580,732 1,592,476

Operating income149,323 70,103 79,296 210,441 409,163

Net earnings 30,716 43,380 48,900 133,734 256,730

Basic earnings per share2$ 0.31 $ 0.44 $ 0.50 $ 1.36 $ 2.59

Diluted earnings per share2$ 0.30 $ 0.43 $ 0.49 $ 1.34 $ 2.54

1Operating income is defined as earnings before net interest income or expense and income taxes.

2Due to differences between quarterly and full year weighted average share count calculations, and the effect of quarterly

rounding to the nearest cent per share, full year earnings per share may not equal the sum of the quarters.

3Our fourth quarter of fiscal 2012 included 14 weeks.

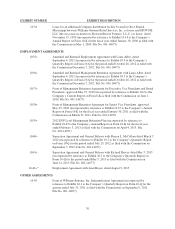

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

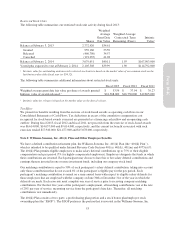

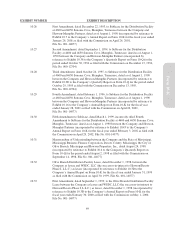

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

As of February 2, 2014, an evaluation was performed by management, with the participation of our Chief

Executive Officer (“CEO”) and our Chief Financial Officer (“CFO”), of the effectiveness of our disclosure

controls and procedures. Based on that evaluation, our management, including our CEO and CFO, concluded that

our disclosure controls and procedures are effective to ensure that information we are required to disclose in

reports that we file or submit under the Securities Exchange Act of 1934 is accumulated and communicated to

our management, including our CEO and CFO, as appropriate, to allow for timely discussions regarding required

disclosures, and that such information is recorded, processed, summarized and reported within the time periods

specified in the rules and forms of the SEC.

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over the company’s

financial reporting. There are inherent limitations in the effectiveness of any internal control, including the

possibility of human error and the circumvention or overriding of controls. Accordingly, even any effective

internal control can provide only reasonable assurance with respect to financial statement preparation. Further,

because of changes in conditions, the effectiveness of any internal control may vary over time.

Our management assessed the effectiveness of the company’s internal control over financial reporting as of

February 2, 2014. In making this assessment, we used the criteria set forth by the Committee of Sponsoring

61

Form 10-K