Pottery Barn 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For purposes of the employment agreement with Ms. Hayes, “cause” is defined as (i) an act of dishonesty made

by her in connection with her responsibilities as an employee, (ii) Ms. Hayes’ conviction of or plea of nolo

contendere to, a felony or any crime involving fraud, embezzlement or any other act of moral turpitude,

(iii) Ms. Hayes’ gross misconduct, (iv) Ms. Hayes’ unauthorized use or disclosure of any proprietary information

or trade secrets of the company or any other party to whom she owes an obligation of nondisclosure as a result of

her relationship with the company, (v) Ms. Hayes’ willful breach of any obligations under any written agreement

or covenant with the company or breach of the company’s Code of Business Conduct and Ethics, or

(vi) Ms. Hayes’ continued failure to perform her employment duties after she has received a written demand of

performance from the chief executive officer which specifically sets forth the factual basis for the chief executive

officers’ belief that she has not substantially performed her duties and has failed to cure such non-performance to

the company’s satisfaction within 30 days after receiving such notice.

For purposes of the employment agreement with Ms. Hayes, “disability” means Ms. Hayes (i) is unable to

engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment

which can be expected to result in death or can be expected to last for a continuous period of not less than

12 months, or (ii) is, by reason of any medically determinable physical or mental impairment which can be

expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a

period of not less than 3 months under an accident and health plan covering company employees.

For purposes of the employment agreement with Ms. Hayes, “good reason” is defined as, without Ms. Hayes’

consent, (i) a reduction in her base salary (except pursuant to a reduction generally applicable to senior

executives of the company), (ii) a material diminution of her authority or responsibilities, (iii) a reduction of

Ms. Hayes’ title, or (iv) Ms. Hayes ceasing to report directly to the chief executive officer. In addition, upon any

such voluntary termination for good reason, Ms. Hayes must provide written notice to the company of the

existence of one or more of the above conditions within 90 days of its initial existence and the company must be

provided with at least 30 days to remedy the condition.

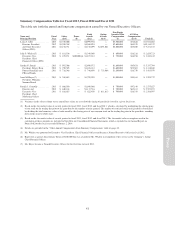

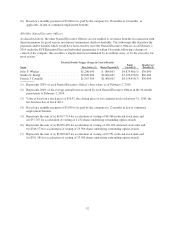

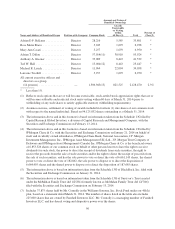

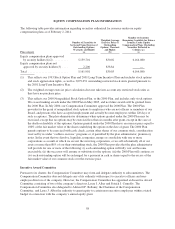

The following table describes the payments and/or benefits which would have been owed by us to Ms. Hayes as

of February 2, 2014 if her employment had been terminated in various situations.

Compensation and Benefits

For Good

Reason

Involuntary

Without Cause

Change-of-

Control Death Disability

Base Salary(1) ................. $ 760,000 $ 760,000 $1,520,000 $ 760,000(2) $ 760,000(2)

Bonus Payment(3) .............. $ 733,333 $ 733,333 $1,466,667 $ 733,333(2) $ 733,333(2)

Equity Awards ................. $4,414,271(4) $4,414,271(4) $7,211,255(5) $4,414,271(4) $4,414,271(4)

Health Care Benefits(6) .......... $ 54,000 $ 54,000 $ 36,000 $ 54,000 $ 54,000

(1) Represents (i) 100%, or 12 months, or (ii) 200%, or 24 months, as applicable, of Ms. Hayes’ base salary as

of February 2, 2014.

(2) Will be reduced by the amount of any payments Ms. Hayes receives through company-paid insurance

policies.

(3) Represents (i) 100%, or 12 months, or (ii) 200%, or 24 months, as applicable, of the average annual bonus

received by Ms. Hayes in the 36-month period prior to February 2, 2014.

(4) Represents the sum of (i) $4,113,916 for acceleration of vesting of 75,457 restricted stock units and

(ii) $300,355 for acceleration of vesting of 22,004 shares underlying outstanding option awards. Value is

based on a stock price of $54.52, the closing price of our common stock on January 31, 2014, the last

business day of fiscal 2013.

(5) Represents the sum of (i) $6,910,900 for acceleration of vesting of 126,759 restricted stock units and

(ii) $300,355 for acceleration of vesting of 22,004 shares underlying outstanding option awards. Value is

based on a stock price of $54.52, the closing price of our common stock on January 31, 2014, the last

business day of fiscal 2013.

51

Proxy