Pottery Barn 2013 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

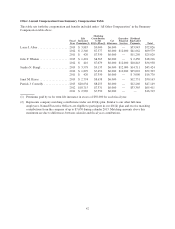

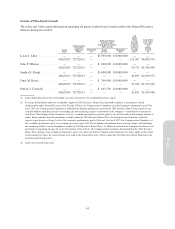

In fiscal 2013, Cook & Co. provided the Compensation Committee with publicly disclosed proxy data related to

Named Executive Officer compensation. The Compensation Committee occasionally requests that Cook & Co.

attend its meetings and receives from Cook & Co., on an annual basis, an in-depth update on general and retail

industry compensation trends and developments.

In addition, in fiscal 2013, the Compensation Committee asked Cook & Co. to evaluate the risk inherent in our

executive and non-executive compensation programs. Their report concluded that, among other things:

• The company’s executive compensation program is designed to encourage behaviors aligned with the long-

term interests of stockholders;

• There is appropriate balance in short-term versus long-term pay, cash versus equity, recognition of corporate

versus business unit performance, financial versus non-financial goals, and use of formulas and discretion; and

• Policies are in place to mitigate compensation risk, such as stock ownership guidelines, insider trading

prohibitions and disclosure requirements, and independent Compensation Committee oversight.

After considering this evaluation, the Compensation Committee concluded that our compensation program does

not encourage executives to take on business and operating risks that are reasonably likely to have a material

adverse effect on the company.

Role of Market Data

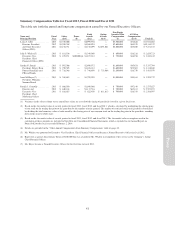

The Compensation Committee, the Chief Executive Officer and management believe that knowledge of general

market practices and the specific compensation practices of our proxy peer group, listed below, is important in

assessing the design and competitiveness of our compensation package. When market data is reviewed, both the

50th percentile (median) and the 75th percentile are considered as reference points, rather than a fixed policy, for

compensation positioning and decision-making. We do not set compensation to meet specific benchmarks or

percentiles. Our executives’ target total direct compensation for fiscal 2013 is above the peer group median and

approaches the 75th percentile. The Compensation Committee determined that setting total direct compensation at

this level is appropriate given the complexity of our multi-channel business model and the comprehensive and

valuable experience of the executive team.

Actual total direct compensation may exceed our target levels relative to our peers’ actual compensation only

when performance goals are exceeded, and may be lower than our target levels when performance goals are not

achieved.

Our Proxy Peer Group

The Compensation Committee uses a peer group composed of public companies in the retail industry to review

competitive compensation data for the company’s executives. The Compensation Committee evaluates this proxy

peer group on an annual basis to ensure that the companies selected remain appropriate. The proxy peer group for

fiscal 2013 was selected by the Compensation Committee based on the guiding criteria described below, with

advice from Cook & Co. Certain proxy peer companies may not meet all selection criteria, but are included

because they are direct competitors of our business, direct competitors for our executive talent, have a

comparable business model, or for other reasons. The proxy peer group guiding criteria for fiscal 2013 are as

follows:

1. Company Classification in the Global Industry Classification Standard in one of the following:

• Home Furnishing Retail;

• Apparel Retail; or

• Department Stores;

2. Revenues between $1.8 billion and $7.3 billion;

3. Market capitalization greater than $800 million and less than $20 billion;

4. Between 14,000 and 56,000 employees; and

33

Proxy