Pottery Barn 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

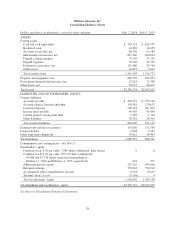

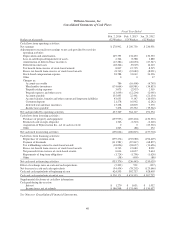

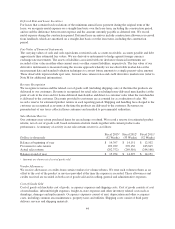

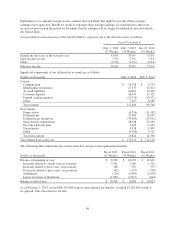

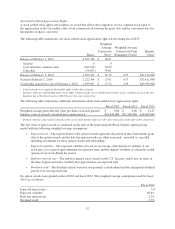

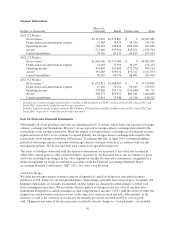

Note B: Property and Equipment

Property and equipment consists of the following:

Dollars in thousands Feb. 2, 2014 Feb. 3, 2013

Leasehold improvements $ 847,351 $ 812,451

Fixtures and equipment 698,275 643,366

Capitalized software 419,432 366,509

Land and buildings 188,498 180,806

Corporate systems projects in progress 172,693 66,839

Construction in progress 25,519 24,971

Total 2,231,768 2,094,942

Accumulated depreciation (1,382,475) (1,282,905)

Property and equipment, net $ 849,293 $ 812,037

1Corporate systems projects in progress as of February 2, 2014 and February 3, 2013 includes approximately $40.1 million

and $39.7 million, respectively, for the portion of our new inventory and order management system currently under

development and not ready for its intended use.

2Construction in progress is primarily comprised of leasehold improvements and furniture and fixtures related to new,

expanded or remodeled retail stores where construction had not been completed as of year-end.

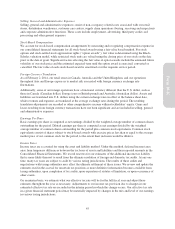

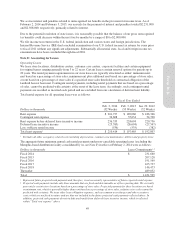

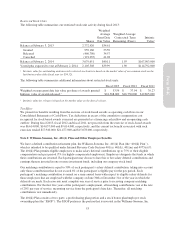

Note C: Borrowing Arrangements

Long-term debt consists of the following:

Dollars in thousands Feb. 2, 2014 Feb. 3, 2013

Memphis-based distribution facilities obligation $ 3,753 $ 5,388

Capital leases 089

Total debt 3,753 5,477

Less current maturities (1,785) (1,724)

Total long-term debt $ 1,968 $ 3,753

Memphis-Based Distribution Facilities Obligation

As of February 2, 2014 and February 3, 2013, total debt of $3,753,000 and $5,388,000, respectively, consists

entirely of bond-related debt pertaining to the consolidation of one of our Memphis-based distribution facilities

due to its related party relationship and our obligation to renew the lease until the bonds are fully repaid (see

Note F).

The aggregate maturities of long-term debt at February 2, 2014 were as follows:

Dollars in thousands

Fiscal 2014 $ 1,785

Fiscal 2015 1,968

Total $ 3,753

Credit Facility

We have a credit facility that provides for a $300,000,000 unsecured revolving line of credit that may be used for

loans or letters of credit. Prior to December 22, 2016, we may, upon notice to the lenders, request an increase in

the credit facility of up to $200,000,000, to provide for a total of $500,000,000 of unsecured revolving credit. As

of February 2, 2014, we were in compliance with our financial covenants under the credit facility and, based on

current projections, we expect to remain in compliance throughout fiscal 2014. The credit facility matures on

June 22, 2017, at which time all outstanding borrowings must be repaid and all outstanding letters of credit must

be cash collateralized.

46