Pottery Barn 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

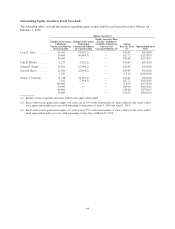

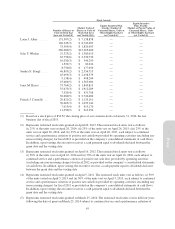

recognized the Chief Executive Officer’s outstanding leadership and achievement against financial objectives –

growing revenues to $4.388 billion, increasing earnings per share to $2.82, and returning over $350 million to

stockholders – as well as significant progress against our long-term strategies: strengthening our brands, laying

the foundation for global expansion and new business development, investing in our supply chain to reduce cost

and improve service, and investing in the technologies and infrastructure underlying all of these initiatives. The

Compensation Committee also reviewed our Chief Executive Officer’s performance against our core values, in

particular noting the Chief Executive Officer’s development of a strong culture and an exceptional leadership

team, and the company’s continued achievements in the areas of corporate responsibility and sustainability.

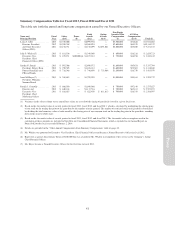

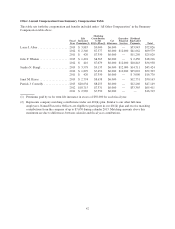

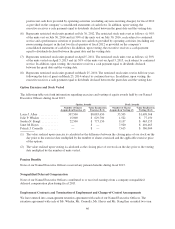

For fiscal 2013, the Compensation Committee approved the following bonus payments under the Bonus Plan for

each Named Executive Officer.

Named Executive Officer

Fiscal 2013

Bonus

Amount*

Fiscal 2013

Actual Bonus

(as a Percentage

of Target)

Laura J. Alber ..................... $3,500,000 179%

Julie P. Whalen .................... $ 850,000 142%

Sandra N. Stangl ................... $1,800,000 180%

Janet M. Hayes .................... $1,000,000 132%

Patrick J. Connolly ................. $ 750,000 117%

* Reflects the Compensation Committee’s exercise of discretion to reduce the maximum amount payable to the

executive under the Bonus Plan for fiscal 2013 from $10,000,000 to the amount shown.

Long-Term Incentives

The third component of the company’s compensation program is long-term equity compensation. The

Compensation Committee believes that equity compensation awards encourage our executives to work toward

the company’s long-term business and strategic objectives and to maximize long-term stockholder returns. In

addition, the Compensation Committee believes that equity awards incentivize executives to remain with the

company.

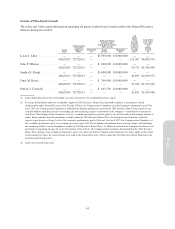

In fiscal 2013, equity was granted to our Named Executive Officers in the form of RSUs with a performance-

based vesting requirement and a time-based vesting schedule of 25% per year over four years. The Compensation

Committee believes that granting equity in the form of RSUs drives strong performance, aligns each executive’s

interests with those of stockholders, and provides an important and powerful retention tool.

The performance criterion for the fiscal 2013 performance-based RSUs required that the company achieve

positive net cash flow provided by operating activities in fiscal 2013 as provided on the company’s consolidated

statements of cash flows. The performance criterion for fiscal 2013 was achieved.

In determining the type and number of equity awards granted to each Named Executive Officer, the

Compensation Committee considered the recommendations of the Chief Executive Officer, which were based on:

• The executive’s performance and contribution to the profitability of the company;

• The type and number of awards previously granted to each executive;

• The executive’s outstanding equity awards;

• The vesting schedule of the executive’s outstanding equity awards;

• The relative value of awards offered by peer companies to executives in comparable positions;

• The appropriate mix between long-term incentive awards and other types of compensation, such as base

salary and bonus; and

37

Proxy