Pottery Barn 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

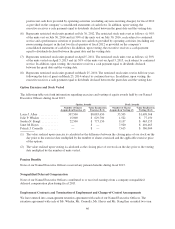

Double-Trigger Change of Control Provisions

Each of our Named Executive Officers is entitled to double-trigger change of control benefits under either a

Management Retention Agreement or our 2012 EVP Level Management Retention Plan, other than our Chief

Executive Officer, who is entitled to such benefits under an individual arrangement. None of our Named

Executive Officers are provided with any type of golden parachute excise tax gross-up. We believe that our

change of control arrangements are competitive compensation practices and meet the company’s objectives of:

• Enhancing our ability to retain these key executives as such arrangements are an important component of

competitive compensation programs;

• Ensuring that our executives remain objective and fully dedicated to the company’s business and strategic

objectives at a critical time; and

• Facilitating a smooth transition should a change in control occur.

The Compensation Committee has considered the total potential cost of the change of control arrangements

provided to our Named Executive Officers and has determined that such cost is reasonable and reflects the

importance of the objectives described above.

Severance Protection for the Chief Executive Officer

As described in the section titled “Employment Contracts and Termination of Employment and Change-of-

Control Arrangements” beginning on page 46, we have entered into a severance arrangement with Ms. Alber

providing for certain severance benefits following a change of control in the event of a termination of her

employment without cause or her voluntary termination for good reason. The Compensation Committee

implemented this arrangement to ensure that she remains focused on the company’s business and strategic

objectives rather than potential personal economic exposure under these particular circumstances. The

Compensation Committee has considered the total potential cost of her severance benefits and determined them

to be reasonable.

Severance Protection for the President, Williams-Sonoma Brand

In March 2013, Ms. Hayes became President of the Williams-Sonoma brand, leaving her role as President of

Pottery Barn Kids and PBteen. As Ms. Hayes moved to this new role, the Compensation Committee believed it in

the best interests of the Company and its stockholders to provide Ms. Hayes with certain employment protections

through May 2015. Details of Ms. Hayes’ employment agreement are described in the section titled “Employment

Contracts and Termination of Employment and Change-of-Control Arrangements” beginning on page 46.

RSU Vesting Provisions Upon Retirement

Grants of RSUs, including the performance-based RSUs granted to our Named Executive Officers, include an

acceleration feature that provides for full vesting upon retirement, which is defined as leaving the company at age

70 or later, with a minimum of 15 years of service.

Clawback Policy Following Financial Restatement

We do not have a formal policy regarding recovery of past payments or awards in the event of a financial

restatement, but in such event, the Compensation Committee will review all performance-based compensation

and consider initiating recovery of any favorably impacted performance-based compensation in appropriate

circumstances. Additional remedial actions could include an executive’s termination of employment. Further, we

intend to implement any recovery policies required by applicable law, including anticipated SEC rulemaking

under the Dodd-Frank Act.

Internal Revenue Code Section 162(m)

Internal Revenue Code Section 162(m) disallows the deduction of compensation paid to certain executives in

excess of $1,000,000 unless it is “qualified performance-based compensation.” The Compensation Committee

39

Proxy