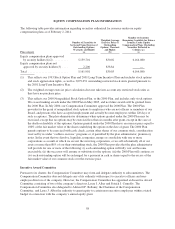

Pottery Barn 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

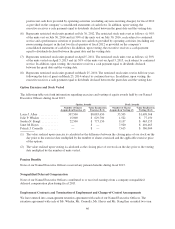

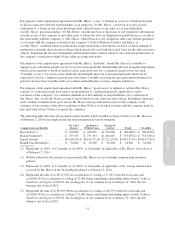

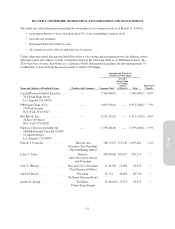

Amount and Nature of

Beneficial Ownership

Name and Address of Beneficial Owner Position with Company Common Stock

Awards

Exercisable

or Vesting

within

60 Days(1) Total

Percent of

Class(2)

Adrian D.P. Bellamy ............ Director 28,216 5,585 33,801 *

Rose Marie Bravo .............. Director 5,245 1,693 6,938 *

Mary Ann Casati ............... Director 5,257 1,693 6,950 *

Adrian T. Dillon ............... Director 57,014(11) 38,910 95,924 *

Anthony A. Greener ............ Director 33,089 8,443 41,532 *

Ted W. Hall ................... Director 15,004(12) 8,443 23,447 *

Michael R. Lynch .............. Director 11,964 22,094 34,058 *

Lorraine Twohill ............... Director 5,257 1,693 6,950 *

All current executive officers and

directors as a group

(14 persons) ................. — 1,306,945(13) 821,525 2,128,470 2.3%

* Less than 1%.

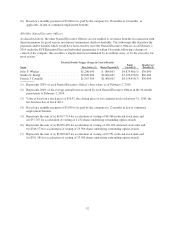

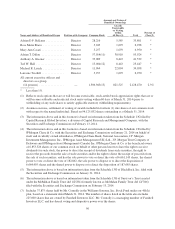

(1) Reflects stock options that are or will become exercisable, stock-settled stock appreciation rights that are or

will become settleable and restricted stock units vesting within 60 days of March 31, 2014 (prior to

withholding of any such shares to satisfy applicable statutory withholding requirements).

(2) Assumes exercise, settlement or vesting of awards included in footnote (1) into shares of our common stock

with respect to the named individual. Based on 94,125,832 shares outstanding as of March 31, 2014.

(3) The information above and in this footnote is based on information taken from the Schedule 13G filed by

Capital Research Global Investors, a division of Capital Research and Management Company, with the

Securities and Exchange Commission on February 13, 2014.

(4) The information above and in this footnote is based on information taken from the Schedule 13G filed by

JPMorgan Chase & Co. with the Securities and Exchange Commission on January 21, 2014 on behalf of

itself and its wholly owned subsidiaries, JPMorgan Chase Bank, National Association, J.P. Morgan

Investment Management, Inc., JPMorgan Asset Management (UK) Ltd., J.P. Morgan Trust Company of

Delaware and JPMorgan Asset Management (Canada) Inc. JPMorgan Chase & Co. is the beneficial owner

of 6,853,526 shares of our common stock on behalf of other persons known to have the right to receive

dividends for such stock, the power to direct the receipt of dividends from such securities, the right to

receive the proceeds from the sale of such securities and/or the right to direct the receipt of proceeds from

the sale of such securities, and has the sole power to vote or direct the vote of 6,661,149 shares, the shared

power to vote or direct the vote of 182,862, the sole power to dispose or to direct the disposition of

6,664,495 shares and the shared power to dispose or to direct the disposition of 187,685 shares.

(5) The information above is based on information taken from the Schedule 13G of BlackRock, Inc. filed with

the Securities and Exchange Commission on January 31, 2014.

(6) The information above is based on information taken from the Schedule 13G of Survivor’s Trust created

under the McMahan Family Trust dtd 1/25/84 (formerly known as McMahan Family Trust dtd 12/7/06)

filed with the Securities and Exchange Commission on February 13, 2014.

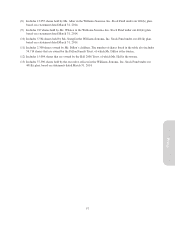

(7) Includes 37,875 shares held by Mr. Connolly in the Williams-Sonoma, Inc. Stock Fund under our 401(k)

plan, based on a statement dated March 31, 2014. The number of shares listed in the table also includes

225,000 shares that are owned by Fanshell Investors LLC. Mr. Connolly is a managing member of Fanshell

Investors LLC, and has shared voting and dispositive power over the shares.

56