Pottery Barn 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

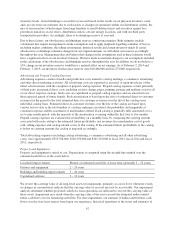

Cash Flows from Investing Activities

For fiscal 2013, net cash used in investing activities was $190,624,000 compared to $206,815,000 for fiscal

2012, and was primarily attributable to purchases of property and equipment. Net cash used compared to fiscal

2012 decreased primarily due to a decrease in purchases of property and equipment.

For fiscal 2012, net cash used in investing activities was $206,815,000 compared to $157,704,000 in fiscal 2011,

and was primarily attributable to purchases of property and equipment. Net cash used compared to fiscal 2011

increased primarily due to an increase in purchases of property and equipment.

Cash Flows from Financing Activities

For fiscal 2013, net cash used in financing activities was $355,376,000 compared to $236,445,000 in fiscal 2012.

For fiscal 2013, net cash used in financing activities was primarily attributable to repurchases of common stock

of $239,274,000 and the payment of dividends of $111,581,000. Net cash used compared to fiscal 2012 increased

primarily due to increases in repurchases of common stock.

For fiscal 2012, net cash used in financing activities was $236,445,000 compared to $259,039,000 in fiscal 2011.

Net cash used in financing activities in fiscal 2012 was primarily attributable to repurchases of common stock of

$155,080,000 and the payment of dividends of $87,847,000. Net cash used in financing activities in fiscal 2012

decreased compared to fiscal 2011 primarily due to a decrease in our repurchase of common stock, partially

offset by an increase in the payment of dividends.

Dividends

See section titled Dividends within Part II, Item 5 of this Annual Report on Form 10-K for further information.

Stock Repurchase Programs

See section titled Stock Repurchase Programs within Part II, Item 5 of this Annual Report on Form 10-K for

further information.

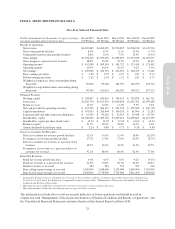

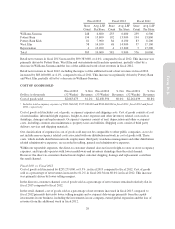

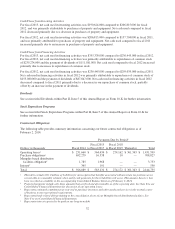

Contractual Obligations

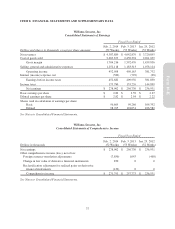

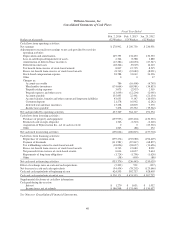

The following table provides summary information concerning our future contractual obligations as of

February 2, 2014:

Payments Due by Period1

Dollars in thousands Fiscal 2014

Fiscal 2015

to Fiscal 2017

Fiscal 2018

to Fiscal 2019 Thereafter Total

Operating leases2$ 231,660 $ 564,434 $ 274,162 $ 361,343 $ 1,431,599

Purchase obligations3692,279 16,538 10 — 708,827

Memphis-based distribution

facilities obligation41,785 1,968 — — 3,753

Interest5365 191 — — 556

Total $ 926,089 $ 583,131 $ 274,172 $ 361,343 $ 2,144,735

1This table excludes $13.0 million of liabilities for unrecognized tax benefits associated with uncertain tax positions as we

are not able to reasonably estimate when and if cash payments for these liabilities will occur. This amount, however, has

been recorded as a liability in the accompanying Consolidated Balance Sheet as of February 2, 2014.

2Projected payments include only those amounts that are fixed and determinable as of the reporting date. See Note E to our

Consolidated Financial Statements for discussion of our operating leases.

3Represents estimated commitments at year-end to purchase inventory and other goods and services in the normal course

of business to meet operational requirements.

4Represents bond-related debt pertaining to the consolidation of one of our Memphis-based distribution facilities. See

Note F to our Consolidated Financial Statements.

5Represents interest expected to be paid on our long-term debt.

32