Pottery Barn 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

upholstered furniture manufacturing operations and our personalization capabilities, and we made

progress in taking over our agent sourcing relationships.

•Technology and infrastructure investment – We continued to invest in technology to support our

multi-channel business. E-commerce represented 44% of our net revenues, and we believe the

investments we are making in technology to redefine the customer experience are allowing us to provide

the best level of service to our customers.

The results demonstrate that our execution and financial discipline allow us to deliver sustainable returns and

increase stockholder value. We have built a portfolio of brands that provide continuing opportunities for growth

and market share gains.

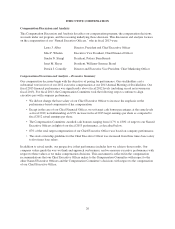

Our Compensation Program Aligns and Advances Executive and Stockholder Interests

Our compensation program is constructed to successfully attract, motivate and retain exceptional executives in

support of our primary objective of creating long-term value for stockholders. Fundamentally, we believe that

earnings per share, or EPS, is the measure most closely aligned with long-term stockholder value and, as such,

each executive’s bonus payout is directly dependent on the company’s achievement of an annual EPS goal.

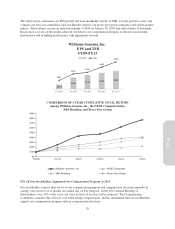

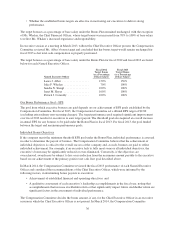

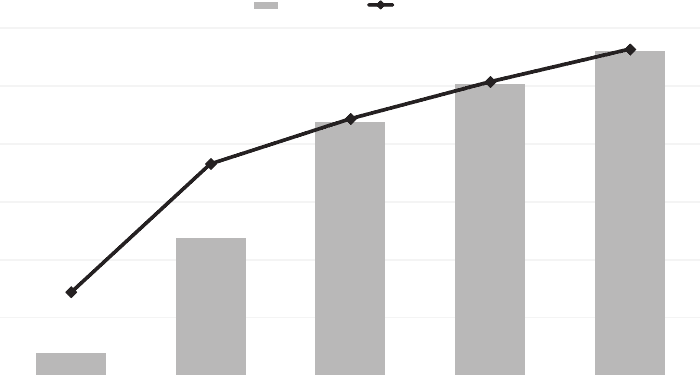

The chart below illustrates the year over year increases of our target performance goals under our 2001 Incentive

Bonus Plan, as well as our EPS. Our performance goals are consistently set higher than the previous year’s EPS.

$0.72

$1.83

$2.22

$2.54

$2.82

$-

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

FY 2009 FY 2010 FY 2011 FY 2012 FY 2013

Annual Bonus - EPS Performance Goals

FY09-FY13

Target EPS

Similarly, our equity compensation and stock ownership guidelines are structured to encourage our executives to

deliver long-term sustained growth in our stock price. We believe this dual approach is the most effective means

of aligning and advancing executive and stockholder interests. Simply stated, when we exceed targeted

performance levels and/or our stock price appreciates, our executives’ compensation opportunity is substantially

increased. When we do not achieve targeted performance levels and/or our stock price does not appreciate, our

executives’ compensation opportunity is substantially reduced.

28