Pottery Barn 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

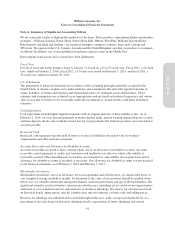

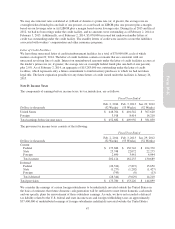

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist of non-occupancy related costs associated with our retail

stores, distribution warehouses, customer care centers, supply chain operations (buying, receiving and inspection)

and corporate administrative functions. These costs include employment, advertising, third party credit card

processing and other general expenses.

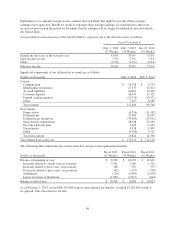

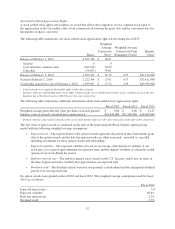

Stock-Based Compensation

We account for stock-based compensation arrangements by measuring and recognizing compensation expense in

our consolidated financial statements for all stock-based awards using a fair value based-method. For stock

options and stock-settled stock appreciation rights (“option awards”), fair value is determined using the Black-

Scholes valuation model, while restricted stock units are valued using the closing price of our stock on the date

prior to the date of grant. Significant factors affecting the fair value of option awards include the estimated future

volatility of our stock price and the estimated expected term until the option award is exercised, converted or

cancelled. The fair value of each stock-based award is amortized over the requisite service period.

Foreign Currency Translation

As of February 2, 2014, our retail stores in Canada, Australia and the United Kingdom, and our operations

throughout Asia and Europe expose us to market risk associated with foreign currency exchange rate

fluctuations.

Additionally, some of our foreign operations have a functional currency different than the U.S. dollar, such as

those in Canada (Canadian dollar), Europe (euro or British pound) and Australia (Australian dollar). Assets and

liabilities are translated into U.S. dollars using the current exchange rates in effect at the balance sheet date,

while revenues and expenses are translated at the average exchange rates during the period. The resulting

translation adjustments are recorded as other comprehensive income within stockholders’ equity. Gains and

losses resulting from foreign currency transactions have not been significant and are included in selling, general

and administrative expenses.

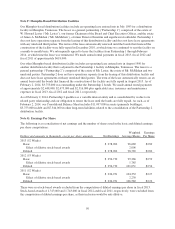

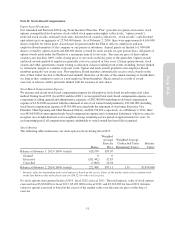

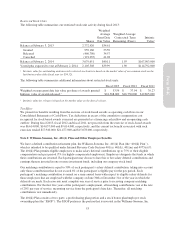

Earnings Per Share

Basic earnings per share is computed as net earnings divided by the weighted average number of common shares

outstanding for the period. Diluted earnings per share is computed as net earnings divided by the weighted

average number of common shares outstanding for the period plus common stock equivalents. Common stock

equivalents consist of shares subject to stock-based awards with exercise prices less than or equal to the average

market price of our common stock for the period, to the extent their inclusion would be dilutive.

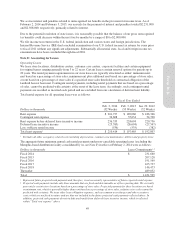

Income Taxes

Income taxes are accounted for using the asset and liability method. Under this method, deferred income taxes

arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the

Consolidated Financial Statements. We record reserves for our estimates of the additional income tax liability

that is more likely than not to result from the ultimate resolution of foreign and domestic tax audits. At any one

time, many tax years are subject to audit by various taxing jurisdictions. The results of these audits and

negotiations with taxing authorities may affect the ultimate settlement of these issues. We review and update the

estimates used in the accrual for uncertain tax positions as more definitive information becomes available from

taxing authorities, upon completion of tax audits, upon expiration of statutes of limitation, or upon occurrence of

other events.

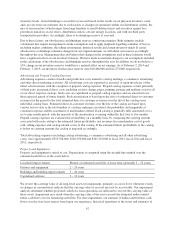

On an interim basis, we estimate what our effective tax rate will be for the full fiscal year and adjust these

estimates throughout the year as necessary. Adjustments to our income tax provision due to changes in our

estimated effective tax rate are recorded in the interim period in which the change occurs. Our effective tax rate

in a given financial statement period may be materially impacted by changes in the mix and level of our earnings

in various taxing jurisdictions.

45

Form 10-K