Pottery Barn 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Additional factors, including increased responsibilities, succession planning and retention strategy.

The Compensation Committee believes that each factor influences the type and number of shares appropriate for

each individual and that no one factor is determinative.

In determining the long-term incentive grant for the Chief Executive Officer, the Compensation Committee took

into account a number of factors, including the company’s performance and the assessment by the Compensation

Committee of the Chief Executive Officer’s performance.

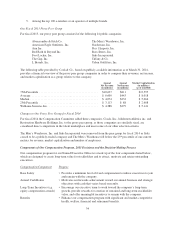

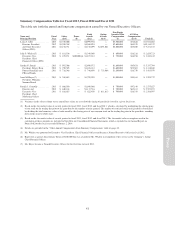

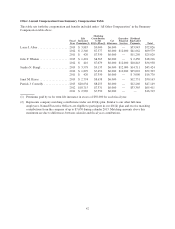

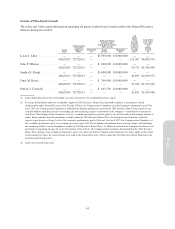

Equity grants approved by the Compensation Committee in April 2013 were as follows.

Named Executive Officer

Number of

Restricted

Stock Units

Laura J. Alber .................................... 131,307

Julie P. Whalen ................................... 25,323

Sandra N. Stangl .................................. 46,895

Janet M. Hayes ................................... 33,764

Patrick J. Connolly ................................ 20,821

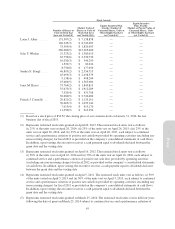

Benefits Provided to Named Executive Officers

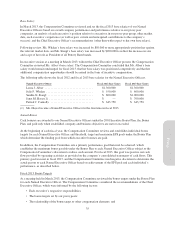

All of the benefits offered to our Named Executive Officers are offered broadly to our full-time associates except

that a limited number of company executives are provided with reimbursement of financial consulting services

up to $12,000 annually. The Compensation Committee believes that providing this assistance is prudent given the

complexity of these executives’ compensation and financial arrangements. The value of the benefits offered to

each of the Named Executive Officers is detailed in the Other Annual Compensation from Summary

Compensation Table on page 42. As noted previously, the company does not provide any income tax gross-ups to

Named Executive Officers on any benefits.

Additional Information

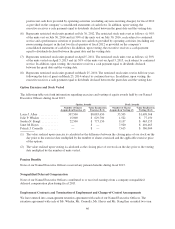

Executive Stock Ownership Guidelines

The Compensation Committee has established stock ownership guidelines for our Named Executive Officers,

among others. Executive stock ownership supports the company’s primary objective of creating long-term value

for stockholders by aligning the executives’ interests directly with those of the company’s stockholders. Each

executive is expected to maintain this minimum ownership while employed with us. The guidelines for stock

ownership are:

President and Chief Executive Officer: Five times Base Salary

Other Named Executive Officers: One times Base Salary

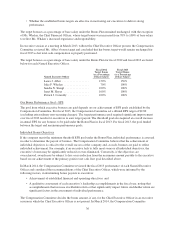

The following equity holdings count toward the stock ownership guidelines: shares directly owned by the

executive or his or her immediate family members; shares held in trust or any similar entity benefiting the

executive or the executive’s immediate family; and shares owned through the Williams-Sonoma, Inc. 401(k)

Plan. Unexercised stock appreciation rights, unexercised stock options, and unvested restricted stock units or

other full-value awards do not count towards the stock ownership guidelines listed above.

Executives covered under the ownership guidelines are required to retain at least 50% of the net after-tax shares

received as a result of the release of restricted stock units until the applicable ownership guideline has been

achieved. All of our Named Executive Officers have met or exceeded the applicable guideline for stock

ownership.

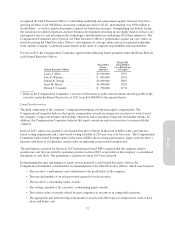

In March 2014, the Compensation Committee increased the guidelines for stock ownership for Named Executive

Officers, other than the President and Chief Executive Officer, from one times to two times base salary, effective

March 2015.

38