Pottery Barn 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5. Among the top 100 e-retailers or an operator of multiple brands.

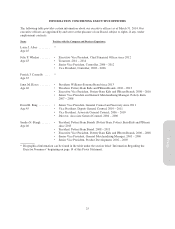

Our Fiscal 2013 Proxy Peer Group

For fiscal 2013, our proxy peer group consisted of the following 14 public companies:

Abercrombie & Fitch Co. The Men’s Wearhouse, Inc.

American Eagle Outfitters, Inc. Nordstrom, Inc.

Ann Inc. Pier 1 Imports, Inc.

Bed Bath & Beyond Inc. Ross Stores, Inc.

Foot Locker, Inc. Saks Incorporated

The Gap, Inc. Tiffany & Co.

L Brands, Inc. Urban Outfitters, Inc.

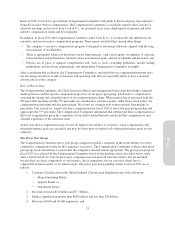

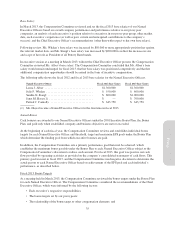

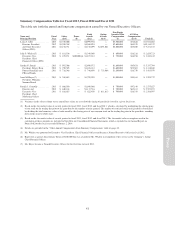

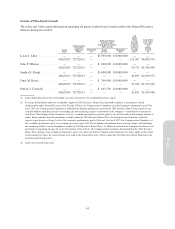

The following table provided by Cook & Co., based on publicly available information as of March 31, 2014,

provides a financial overview of the proxy peer group companies in order to compare their revenues, net income,

and market capitalization as a group relative to the company.

Annual

Net Revenue

(in millions)

Annual

Net Income

(in millions)

Market Capitalization

(in millions)

(as of 2/2/2014)

75th Percentile ........................................ $10,637 $811 $13,595

Average ............................................. $ 6,600 $443 $ 8,018

Median .............................................. $ 4,074 $232 $ 5,664

25th Percentile ........................................ $ 3,113 $ 88 $ 2,608

Williams-Sonoma, Inc. ................................. $ 4,388 $279 $ 5,141

Changes to Our Proxy Peer Group for Fiscal 2014

For fiscal 2014 the Compensation Committee added three companies, Coach, Inc., lululemon athletica inc. and

Restoration Hardware Holdings, Inc. to the proxy peer group, as those companies are similarly sized, are

considered direct competitors in the talent marketplace and meet some of our other selection criteria.

The Men’s Wearhouse, Inc. and Saks Incorporated were removed from the peer group for fiscal 2014 as Saks

ceased to be a publicly-traded company and The Men’s Wearhouse fell below the 25th percentile of our current

metrics for revenue, market capitalization and number of employees.

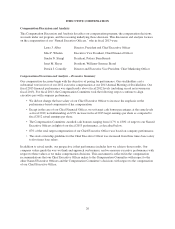

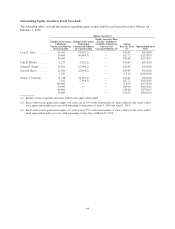

Components of Our Compensation Program, 2013 Decisions and the Decision-Making Process

Our compensation program for our Named Executive Officers is made up of the four components listed below,

which are designed to create long-term value for stockholders and to attract, motivate and retain outstanding

executives.

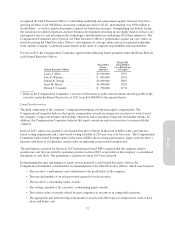

Compensation Component Purpose

Base Salary • Provides a minimum level of fixed compensation to induce executives to join

and remain with the company.

Annual Cash Bonus • Motivates and rewards achievement toward our annual business and strategic

objectives with cash that varies based on results.

Long-Term Incentives (e.g.

equity compensation awards)

• Encourage our executive team to work toward the company’s long-term

growth, provide rewards for creation of sustained and long-term stockholder

value, and offer meaningful incentives to remain with the company.

Benefits • Enhance our compensation program with significant and market-competitive

health, welfare, financial and retirement benefits.

34