Pottery Barn 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

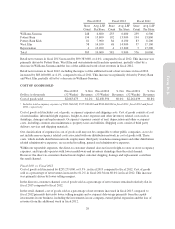

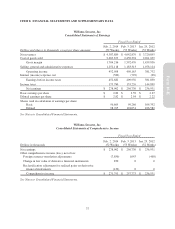

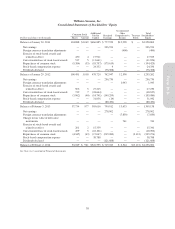

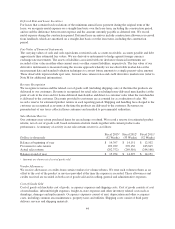

Williams-Sonoma, Inc.

Consolidated Statements of Stockholders’ Equity

Common Stock Additional

Paid-in

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income

Treasury

Stock

Total

Stockholders’

EquityDollars and shares in thousands Shares Amount

Balance at January 30, 2011 104,888 $1,049 $466,885 $ 777,939 $12,990 $ — $1,258,863

Net earnings — — — 236,931 — — 236,931

Foreign currency translation adjustments — — — — (400) — (400)

Exercise of stock-based awards and

related tax effect 430 4 17,921 — — — 17,925

Conversion/release of stock-based awards 517 5 (11,661) — — — (11,656)

Repurchases of common stock (5,384) (53) (18,757) (175,619) — — (194,429)

Stock-based compensation expense — — 24,332 4 — — 24,336

Dividends declared — — — (76,308) — — (76,308)

Balance at January 29, 2012 100,451 1,005 478,720 762,947 12,590 — 1,255,262

Net earnings — — — 256,730 — — 256,730

Foreign currency translation adjustments — — — — 1,043 — 1,043

Exercise of stock-based awards and

related tax effect 506 5 27,225 — — — 27,230

Conversion/release of stock-based awards 739 7 (18,644) — — — (18,637)

Repurchases of common stock (3,962) (40) (14,741) (140,299) — — (155,080)

Stock-based compensation expense — — 31,056 (14) — — 31,042

Dividends declared — — — (88,452) — — (88,452)

Balance at February 3, 2013 97,734 977 503,616 790,912 13,633 — 1,309,138

Net earnings — — — 278,902 — — 278,902

Foreign currency translation adjustments — — — — (7,850) — (7,850)

Change in fair value of derivative

instruments — — — — 741 — 741

Exercise of stock-based awards and

related tax effect 201 2 15,339 — — — 15,341

Conversion/release of stock-based awards 459 5 (18,101) — — — (18,096)

Repurchases of common stock (4,345) (43) (17,047) (219,083) — (3,101) (239,274)

Stock-based compensation expense — — 38,788 — — — 38,788

Dividends declared — — — (121,688) — — (121,688)

Balance at February 2, 2014 94,049 $ 941 $522,595 $ 729,043 $ 6,524 $(3,101) $1,256,002

See Notes to Consolidated Financial Statements.

39

Form 10-K