Pottery Barn 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

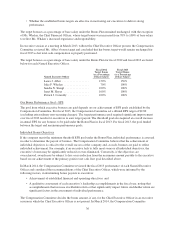

|

|

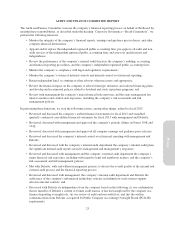

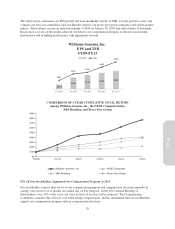

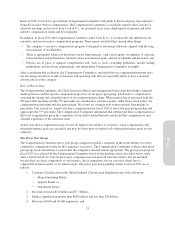

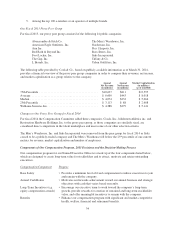

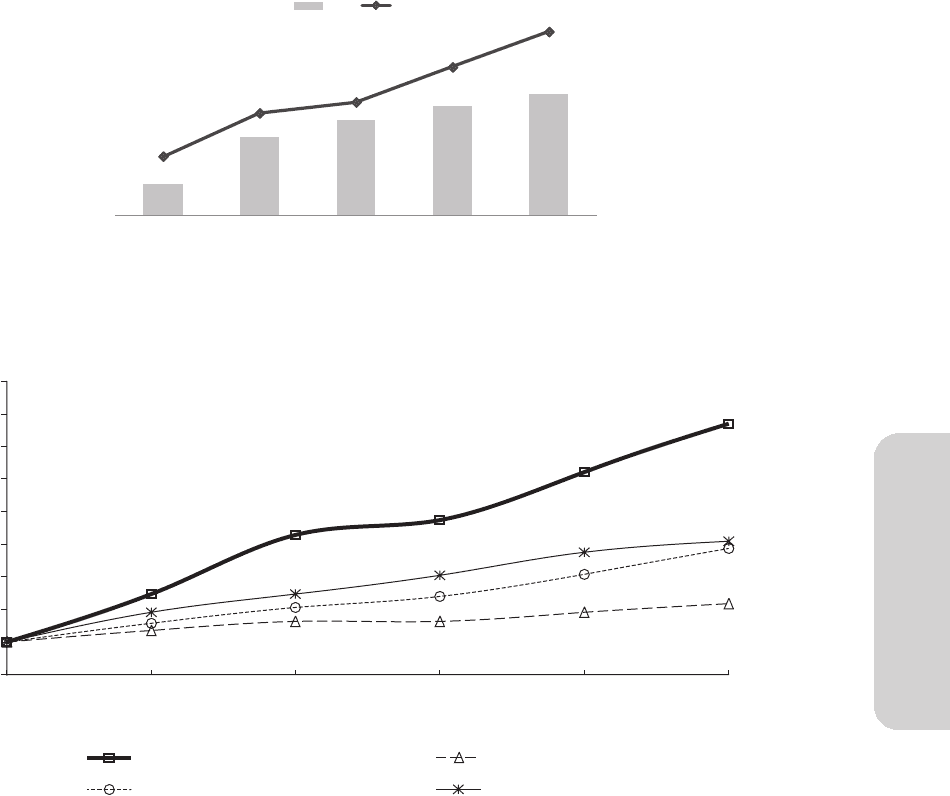

The charts below summarize our EPS growth and total stockholder return, or TSR, over the past five years, and

compare our five-year cumulative total stockholder return to our proxy peer group companies and certain market

indices. These returns assume an initial investment of $100 on January 30, 2009 and reinvestment of dividends.

Based upon a review of the results achieved, we believe our compensation program is effective in incenting

performance and in linking performance with appropriate rewards.

$0.72

$1.83 $2.22 $2.54 $2.82

$247

$429 $474

$622

$770

FY 2009 FY 2010 FY 2011 FY 2012 FY 2013

Williams-Sonoma, Inc.

EPS and TSR

FY09-FY13

EPS TSR

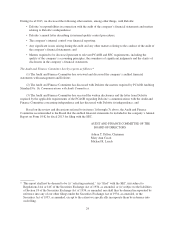

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Williams-Sonoma, Inc., the NYSE Composite Index,

S&P Retailing, and Proxy Peer Group

1/30/09 1/31/10 1/30/11 1/29/12 2/3/13 2/2/14

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

Williams−Sonoma, Inc. NYSE Composite

S&P Retailing Proxy Peer Group

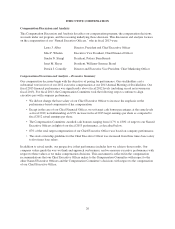

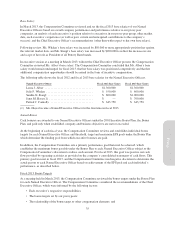

92% Of Our Stockholders Supported Our Compensation Program in 2013

Our stockholders express their views on our compensation program and compensation decisions annually by

casting votes in favor of or against our annual Say on Pay proposal. At the 2013 Annual Meeting of

Stockholders, over 92% of the votes cast were in favor of our Say on Pay proposal. The Compensation

Committee considers this advisory vote when setting compensation, and has determined that our stockholders

support our compensation program and our compensation decisions.

29

Proxy