Pottery Barn 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

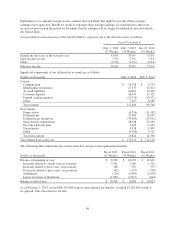

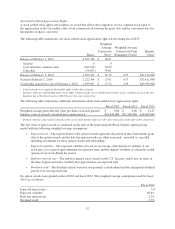

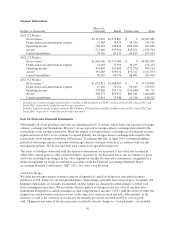

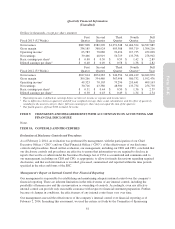

Amounts recorded within accumulated other comprehensive income (“AOCI”) associated with our derivative

instruments were as follows:

Dollars in thousands

Fiscal 2013

(52 Weeks)

AOCI beginning balance amount of gain (loss) $ 0

Amounts recognized in OCI before reclassifications 870

Amounts reclassified from OCI into cost of goods sold (129)

AOCI ending balance amount of gain (loss) $ 741

Note N: Fair Value Measurements

Fair value is the price that would be received from selling an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date.

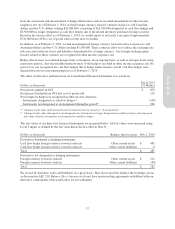

We determine the fair value of financial and non-financial assets and liabilities using the fair value hierarchy

established by ASC 820, Fair Value Measurement, which defines three levels of inputs that may be used to

measure fair value, as follows:

• Level 1 inputs which include quoted prices in active markets for identical assets or liabilities;

• Level 2 inputs which include observable inputs other than Level 1 inputs, such as quoted prices for similar

assets or liabilities; quoted prices for identical or similar assets or liabilities in markets that are not active; or

other inputs that are observable or can be corroborated by observable market data for substantially the full

term of the asset or liability. These inputs either represent quoted prices for similar assets in active markets

or have been derived from observable market data; and

• Level 3 inputs which include unobservable inputs that are supported by little or no market activity and that

are significant to the fair value of the underlying asset or liability.

The fair values of our cash and cash equivalents are based on Level 1 inputs, which include quoted prices in

active markets for identical assets.

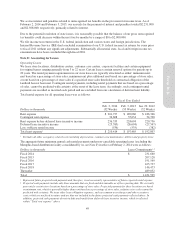

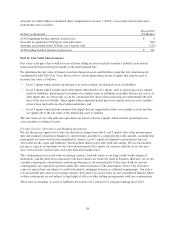

Foreign Currency Derivatives and Hedging Instruments

We use the income approach to value our derivatives using observable Level 2 market data at the measurement

date and standard valuation techniques to convert future amounts to a single present value amount, assuming that

participants are motivated but not compelled to transact. Level 2 inputs are limited to quoted prices that are

observable for the assets and liabilities, which include interest rates and credit risk ratings. We use mid-market

pricing as a practical expedient for fair value measurements. Key inputs for currency derivatives are the spot

rates, forward rates, interest rates and credit derivative market rates.

The counterparties associated with our foreign currency forward contracts are large credit-worthy financial

institutions, and the derivatives transacted with these entities are relatively short in duration, therefore, we do not

consider counterparty concentration and non-performance to be material risks at this time. Both we and our

counterparties are expected to perform under the contractual terms of the instruments. None of the derivative

contracts entered into are subject to credit risk-related contingent features or collateral requirements. Our policy

is to present the fair value of our foreign currency derivatives on a gross basis in our Consolidated Balance Sheet

as these instruments are not subject to legal right of offset or other netting arrangements with our counterparties.

There were no transfers of assets or liabilities between Level 1 and Level 2 categories during fiscal 2013.

58